Key Takeaways:

- Regardless of a 0.61% value dip amidst Trump-era tariff volatility, Bitcoin’s on-chain exercise surged with 6% transaction progress and 15% extra lively wallets, indicating continued consumer adoption regardless of macro uncertainties.

- US spot Bitcoin ETF outflows improved dramatically by 78% to -$794.74M in March (in comparison with February’s outflows of over $3.5 billion), suggesting a possible turnaround in investor sentiment regardless of broader financial issues.

- Bitcoin mining confronted headwinds as issue elevated, whereas transaction charges decreased by 8%, resulting in a slight 1.6% dip in complete mining income.

- Ether’s value skilled a major 18.4% decline alongside a 771% reversal in ETF flows, highlighting its sensitivity to market sentiment and inside financial mannequin debates.

- Nonetheless, regardless of the damaging value motion, new Ethereum wallets surged by 30%, indicating continued consumer curiosity.

- Solana’s 15.7% value drop and 11% lower in transactions mirrored a cooling of speculative meme coin exercise.

Desk of Contents

- In This Article

- Bitcoin Information – March 2025 Highlights

- President Trump Indicators Government Order Creating Strategic Bitcoin Reserve

- Coinbase launched 24/7 Bitcoin perpetual futures for US merchants

- Brazil proposed a brand new laws to permit partial wage funds in Bitcoin

- Ethereum Information – March 2025 Highlights

- The Pectra improve mainnet will launch on Could 7, 2025

- Ethereum Core Builders to Part Out Holesky Testnet by September 2025

- Coinbase Turns into Largest Ethereum Node Operator, Controlling 11.42% of Staked ETH

- Solana Information – March 2025 Highlights

- Solana Neighborhood Rejects SIMD-0228 in Historic Vote as Small Validators Sway End result

- PayPal now permits US customers to purchase, promote, maintain, and switch Solana straight on its platform

- BlackRock Expands BUIDL Fund to Embrace Solana (SOL)

Bitcoin Navigates Trump-Period Volatility Amidst ETF and On-Chain Shifts

Ethereum's Combined March: ETH Value Drops and ETF Flows Reverse Regardless of Technical Positive aspects

Solana Sees On-Chain Metrics Decline as Meme Coin Mania Fades

April's Key Occasions

- In This Article

- Bitcoin Navigates Trump-Period Volatility Amidst ETF and On-Chain Shifts

- Bitcoin Information – March 2025 Highlights

- President Trump Indicators Government Order Creating Strategic Bitcoin Reserve

- Coinbase launched 24/7 Bitcoin perpetual futures for US merchants

- Brazil proposed a brand new laws to permit partial wage funds in Bitcoin

- Ethereum's Combined March: ETH Value Drops and ETF Flows Reverse Regardless of Technical Positive aspects

- Ethereum Information – March 2025 Highlights

- The Pectra improve mainnet will launch on Could 7, 2025

- Ethereum Core Builders to Part Out Holesky Testnet by September 2025

- Coinbase Turns into Largest Ethereum Node Operator, Controlling 11.42% of Staked ETH

- Solana Sees On-Chain Metrics Decline as Meme Coin Mania Fades

- Solana Information – March 2025 Highlights

- Solana Neighborhood Rejects SIMD-0228 in Historic Vote as Small Validators Sway End result

- PayPal now permits US customers to purchase, promote, maintain, and switch Solana straight on its platform

- BlackRock Expands BUIDL Fund to Embrace Solana (SOL)

- April's Key Occasions

Present Full Information

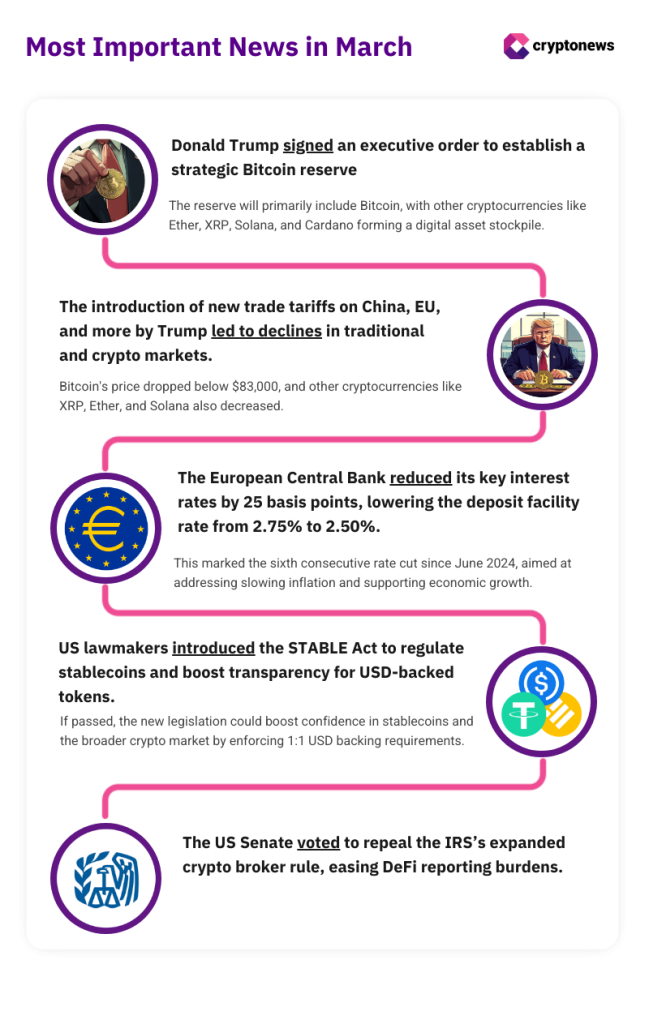

Right here’s a abstract of the important thing occasions that influenced the crypto market in March 2025:

Bitcoin Navigates Trump-Period Volatility Amidst ETF and On-Chain Shifts

March 2025 was a troublesome month for Bitcoin (and crypto as a complete), with market volatility stemming from US President Donald Trump’s new tariff insurance policies.

Whereas Bitcoin (BTC) skilled a slight month-to-month return lower of 0.61%, it navigated a interval of great market fluctuations pushed by geopolitical tensions. After an preliminary drop, Bitcoin rebounded to $88,000 round March 24 earlier than falling again to round $82,800 by April 6.

Regardless of the latest value drop, US spot Bitcoin exchange-traded funds (ETFs) noticed a optimistic shift in investor sentiment. Month-to-month internet outflows decreased considerably to $794.74 million in March, a 78% enchancment in comparison with the substantial $3.56 billion outflow in February.

On-chain information additionally mirrored continued community exercise and adoption. Bitcoin transactions elevated by 6% to 12 million, whereas lively wallets grew by 15%, reaching 23.6 million, and new wallets grew by 14%, reaching 9.8 million. These metrics point out a rising consumer base and sustained utilization of the Bitcoin community, even amidst market uncertainty.

Nonetheless, the Bitcoin mining sector confronted growing challenges. The Bitcoin community issue continued its upward pattern, reaching 112.14 trillion on March 10 and climbing additional to 113.76 trillion on March 23.

The typical Bitcoin hashrate additionally remained excessive at 808.40 EH/s. This rising issue, coupled with declining community transaction charges (which decreased by 8% to $15.11 million in March), put stress on miners, notably these utilizing older {hardware}.

Complete mining income for the month reached $1.22 billion, a slight 1.6% lower in comparison with February’s $1.24 billion. The mixture of upper issue and decrease charges can push some miners into unprofitable territory, probably resulting in {hardware} shutdowns till upgrades or improved community situations happen. The long-term impression of the April 2024 Bitcoin halving, which decreased the block subsidy to three.125 BTC, continued to be felt by the mining business.

On a extra optimistic notice, Bitcoin and cryptocurrency adoption noticed progress on the state legislative stage within the US. Throughout March, 13 US states superior numerous Bitcoin- and crypto-related payments, starting from proposals to ascertain Bitcoin reserves to initiatives targeted on crypto taxation and exploring pension fund investments. This legislative exercise alerts rising recognition and acceptance of Bitcoin throughout the conventional monetary and regulatory panorama.

In case you’re concerned about extra detailed and precious market insights, try Cryptonews’ in-depth price analyses, which supply professional forecasts for Bitcoin and different cash.

Bitcoin Information – March 2025 Highlights

President Trump Indicators Government Order Creating Strategic Bitcoin Reserve

Per a tweet from White Home crypto and AI czar David Sacks, the reserve will initially be capitalized by Bitcoin already owned by the federal authorities, estimated at round 200,000 cash.

Coinbase launched 24/7 Bitcoin perpetual futures for US merchants

The transfer marks the primary time U.S. merchants could have entry to perpetual-style futures contracts with out expiration dates, aligning home markets with international buying and selling norms.

Brazil proposed a brand new laws to permit partial wage funds in Bitcoin

On March 12, 2025, Federal Deputy Luiz Phillipe de Orleans e Bragança launched laws that allows partial wage funds in BTC.

Ethereum’s Combined March: ETH Value Drops and ETF Flows Reverse Regardless of Technical Positive aspects

March 2025 offered a combined image for Ethereum, characterised by a major downturn in its market efficiency alongside notable technical developments.

The worth of Ether (ETH) skilled a considerable 18.4% lower in the course of the month, reflecting broader market sentiment.

This damaging value motion additionally coincided with a dramatic shift in US spot Ether ETF inflows. After a optimistic influx of $60.1 million in February, there was a major outflow of $403.4 million in March, a 771% drop month-on-month.

On-chain information offered additional insights into community exercise. Whereas the variety of transactions on the Ethereum community noticed a modest improve of 4.8% to 37.3 million, the variety of lively wallets skilled a slight decline of 1.4% to 13.9 million. Apparently, the creation of recent wallets surged by 30% to six.9 million, indicating continued curiosity in becoming a member of the Ethereum ecosystem regardless of the prevailing market situations.

Inside the broader Ethereum ecosystem, sure tokens noticed vital value volatility, with FUNToken (FUN) and WhiteRock (WHITE) main the beneficial properties, whereas STP (STPT) and MyShell (SHELL) skilled substantial losses.

Analyzing the income generated by Ethereum block validators, staker income decreased by 16% to $145 million in comparison with February, whereas transaction charges noticed a optimistic improve of 30% to $14.47 million.

Moreover, a February fuel restrict improve eased congestion, resulting in considerably decrease transaction charges.

Nonetheless, Ethereum’s financial mannequin continues to face stress. Customary Chartered revised its 2025 ETH value goal downwards in March, citing structural points associated to charge seize, as Layer-2 options, notably Coinbase’s Base, are diverting worth and substantial transaction charges away from the Layer-1. This dynamic has sparked issues throughout the neighborhood that Ethereum dangers “commoditizing itself” inside its personal scaling structure.

Regardless of financial headwinds in March, Ethereum additionally made technical strides with the upcoming Pectra improve, which introduces options like transaction batching and gasless transactions to enhance usability and safety, with the “Hoodi” testnet launched and mainnet activation anticipated by late April.

Ethereum Information – March 2025 Highlights

The Pectra improve mainnet will launch on Could 7, 2025

The improve was activated at 7:29 am UTC on March 5, attaining a flawless proposal charge, in line with Ethereum core developer Terence.

Ethereum Core Builders to Part Out Holesky Testnet by September 2025

In earlier years, builders retired Kiln, Ropsten, and Rinkeby in 2022, adopted by Goerli in 2023.

Coinbase Turns into Largest Ethereum Node Operator, Controlling 11.42% of Staked ETH

The report states that as of March 3, Coinbase had 3.84 million ETH staked to its validators, valued at roughly $6.8 billion.

In case you’re concerned about extra detailed and precious market insights, try Cryptonews’ in-depth price analyses, which supply professional forecasts for Ether and different cash.

Solana Sees On-Chain Metrics Decline as Meme Coin Mania Fades

March 2025 proved to be a difficult month for the Solana (SOL) blockchain, marked by a notable 15.7% lower in its token worth.

This downturn was largely attributed to a cooling of on-chain exercise because the fervor surrounding speculative buying and selling, notably in meme cash, subsided.

Transaction counts noticed an 11% lower, settling at 2.7 billion for the month. Equally, the variety of lively wallets on the community skilled a modest 3% decline to 97.6 million, whereas the creation of recent wallets remained comparatively steady, with a minor 0.5% lower, totaling 530.3 million new wallets. This implies that whereas current customers might have been much less lively in buying and selling, the Solana ecosystem continued to draw new contributors.

DefilLlama information additionally exhibits a 12% month-to-month decline in Solana’s complete worth locked (TVL) from $7.5 billion to $6.6 billion

Inside the Solana ecosystem, sure tokens skilled vital volatility, with Saros (SAROS), GOHOME (GOHOME), and Alchemist AI (ALCH) rising as high gainers with spectacular proportion will increase, whereas Act I: The AI Prophecy (ACT), Tensor (TNSR), and Staika (STIK) suffered substantial losses.

Past on-chain exercise, in March, Solana‘s neighborhood debated SIMD-0228, a proposal to decrease inflation to ~1% with a dynamic staking correlation, aiming to scale back promote stress. Whereas proponents noticed advantages, issues about smaller validators and unpredictability led to its rejection, although inflation reform discussions and validator cost-reduction concepts persist.

March introduced optimistic information for Solana’s institutional adoption with the launch of CME SOL futures contracts on March 18. This was rapidly adopted by the debut of the primary SOL futures ETF simply two days later. These developments are vital steps, probably resulting in the provision of spot SOL trade traded merchandise (ETPs) within the US.

Moreover, the Securities and Change Fee (SEC) would possibly start hearings relating to SOL’s regulatory classification as early as late spring or early summer time, suggesting growing readability for the digital asset’s future.

Solana Information – March 2025 Highlights

Solana Neighborhood Rejects SIMD-0228 in Historic Vote as Small Validators Sway End result

The rejection of Solana’s SIMD-0228 proposal exhibits tensions between financial effectivity and decentralization.

PayPal now permits US customers to purchase, promote, maintain, and switch Solana straight on its platform

Beforehand, customers may solely entry SOL and LINK by way of third-party providers like MoonPay whereas utilizing PayPal as a cost methodology.

BlackRock Expands BUIDL Fund to Embrace Solana (SOL)

The transfer, introduced by Securitize, introduces a brand new share class of BUIDL on Solana, including to its rising presence throughout a number of blockchain networks.

In case you’re concerned about extra detailed and precious market insights, try Cryptonews’ in-depth price analyses, which supply professional forecasts for Solana and different cash.

April’s Key Occasions

In April 2025, a number of macroeconomic occasions and main conferences may have an effect on the cryptocurrency market.

Macroeconomic Occasions:

- Ongoing US tariff coverage may proceed to affect crypto markets. Following the early April bulletins round new commerce tariffs, continued developments might gas market uncertainty and threat aversion. If commerce tensions escalate, conventional markets may face stress, probably driving extra traders towards cryptocurrencies as various belongings – or, conversely, triggering broader sell-offs that additionally have an effect on digital belongings. The crypto market stays delicate to how these insurance policies evolve within the coming weeks.

- Federal Reserve Assembly Minutes (April 9): Minutes from the Federal Open Market Committee’s earlier assembly can be scrutinized for indications of future financial coverage, providing clues about rate of interest trajectories that may sway crypto market dynamics.

- US Shopper Value Index (CPI) Launch (April 10): Inflation information can be intently monitored, as higher-than-expected inflation may result in tighter financial insurance policies, probably lowering the enchantment of cryptocurrencies as various belongings.

- European Central Financial institution Curiosity Charge Resolution (April 17): The ECB’s choice on rates of interest might affect the euro’s power and investor habits in crypto markets, particularly if coverage shifts differ from these of the Federal Reserve (Fed).

- China’s Q1 GDP Announcement (April 16): China’s financial efficiency can have an effect on international threat sentiment. Stronger progress might improve urge for food for riskier belongings, together with cryptocurrencies, whereas weaker figures may have the alternative impact.

- US Q1 GDP and Core PCE Knowledge (April 30): These financial indicators will present a complete view of the US economic system’s well being, probably influencing Fed insurance policies and, consequently, the cryptocurrency market.

Main Conferences:

- Paris Blockchain Week (April 8-10). This premier occasion focuses on blockchain and Web3 applied sciences, that includes discussions on DeFi, NFTs, AI, and regulatory points.

- Cornell Blockchain Conference (April 25). The upcoming convention brings collectively leaders from blockchain, finance, and academia in New York Metropolis to debate the way forward for the US crypto ecosystem.

- TOKEN2049 Dubai (April 30-Could 1). This main crypto occasion will happen in Dubai, UAE, the place founders and executives of high Web3 corporations will share insights on the business.

Wanting forward from the tendencies noticed in March 2025, a number of developments may considerably affect the cryptocurrency market.

First, state-level legislative progress within the US relating to Bitcoin reserves, crypto taxation, and stablecoin regulation factors to potential broader adoption of digital belongings by authorities entities. Ought to a few of these initiatives prolong to Ether and different altcoins (for instance, for crypto reserves), it may speed up institutional curiosity and normalize cryptocurrency holdings inside conventional monetary programs.

Secondly, the optimistic shift in sentiment in direction of US spot Bitcoin ETFs in March, evidenced by decreased outflows, means that additional altcoin ETF approvals – resembling for Solana, which is seeing rising institutional curiosity, and even XRP – may broaden investor entry and market liquidity within the coming months and years.

Nonetheless, Bitcoin’s growing integration into conventional monetary markets may additionally amplify its vulnerability to broader market downturns, probably difficult its narrative as a steady hedge towards inflation. The interconnectedness with conventional belongings signifies that macroeconomic headwinds may exert larger downward stress on Bitcoin’s value.

Moreover, the commerce tariff insurance policies enacted by Trump, which contributed to market volatility in March, may pose a continued threat to the crypto market, notably impacting Bitcoin’s value resulting from its standing because the main digital asset and its sensitivity to international financial sentiment.

Crypto traders ought to fastidiously contemplate the present financial panorama. For extra detailed info, try Cryptonews value predictions for Bitcoin, Ether, and Solana.

The publish March 2025 Crypto Recap: Bitcoin, Ether, and Solana Navigate US Commerce Tariff Politics and Trump-Period Uncertainty appeared first on Cryptonews.