Key Takeaways:

- Bitcoin stays robust above $100K, however hasn’t damaged out but — June might be pivotal as institutional flows and macro tailwinds align.

- Ethereum stays the highest Layer 1 decide for establishments, due to real-world asset tokenization and rising staking momentum.

- Altcoin rotation could also be across the nook, with Solana displaying bullish technical patterns and analysts eyeing a summer time shift into ETH and SOL.

In Might, many within the crypto neighborhood had been nonetheless hoping that Bitcoin (BTC) and main altcoins like Ethereum (ETH) and Solana (SOL) would proceed the rally that started earlier within the spring. However this time, the market took a unique flip: momentum light, and costs moved sideways.

Nonetheless, analysts consider the basic outlook stays robust. June might mark the start of a brand new transfer. On this report, we take a look at how BTC, ETH, and SOL carried out in Might and what to anticipate within the weeks forward.

Desk of Contents

- In This Article

$118K Might Be the Subsequent Goal for Bitcoin Value Ethereum ‘Nonetheless Feels Undervalued’ Regardless of Secure Inflows Solana Kinds a ‘Cup-and-Deal with’ as Altcoin Rotation Looms Summer time May Belong to Altcoins

- In This Article

- $118K Might Be the Subsequent Goal for Bitcoin Value

- Ethereum ‘Nonetheless Feels Undervalued’ Regardless of Secure Inflows

- Solana Kinds a ‘Cup-and-Deal with’ as Altcoin Rotation Looms

- Summer time May Belong to Altcoins

Present Full Information

$118K Might Be the Subsequent Goal for Bitcoin Value

Regardless of robust expectations, Might didn’t ship a breakout for Bitcoin. The worth held above $100,000 however struggled to beat key resistance ranges. Nonetheless, market confidence in additional development hasn’t light.

24h7d30d1yAll time

Kelghe D’Cruz, CEO of Pairs.xyz, instructed Cryptonews that each technical indicators and macro traits are taking part in in Bitcoin’s favor:

Bitcoin is holding robust above $100K and simply broke via key resistance ranges — many analysts now see $118K as the following goal. What’s behind the optimism? Institutional inflows, robust ETF demand, and Bitcoin’s rising correlation with tech shares.

D’Cruz additionally famous:

June has typically been a sideways month traditionally, however this time feels completely different. With bullish technicals and macro tailwinds in play, we might see Bitcoin check new highs.

Eneko Knörr, CEO and co-founder of Stabolut, additionally sees favorable circumstances forming:

We’re getting into what I’d name a good storm for Bitcoin. Banks, lengthy held again by regulatory uncertainty, are lastly moving into crypto to satisfy rising shopper demand. On the similar time, sovereign entities and main firms are including BTC to their stability sheets, additional cementing Bitcoin’s legitimacy. That is unlocking a brand new wave of curiosity from household places of work and long-term institutional gamers.

Knörr added that the halving impact isn’t over but and that the market could also be at first of a brand new bull cycle:

For my part, the “halving impact” remains to be in movement. The bounce from $60K was only the start — we’re probably getting into a full-blown bull market with Bitcoin on the helm.

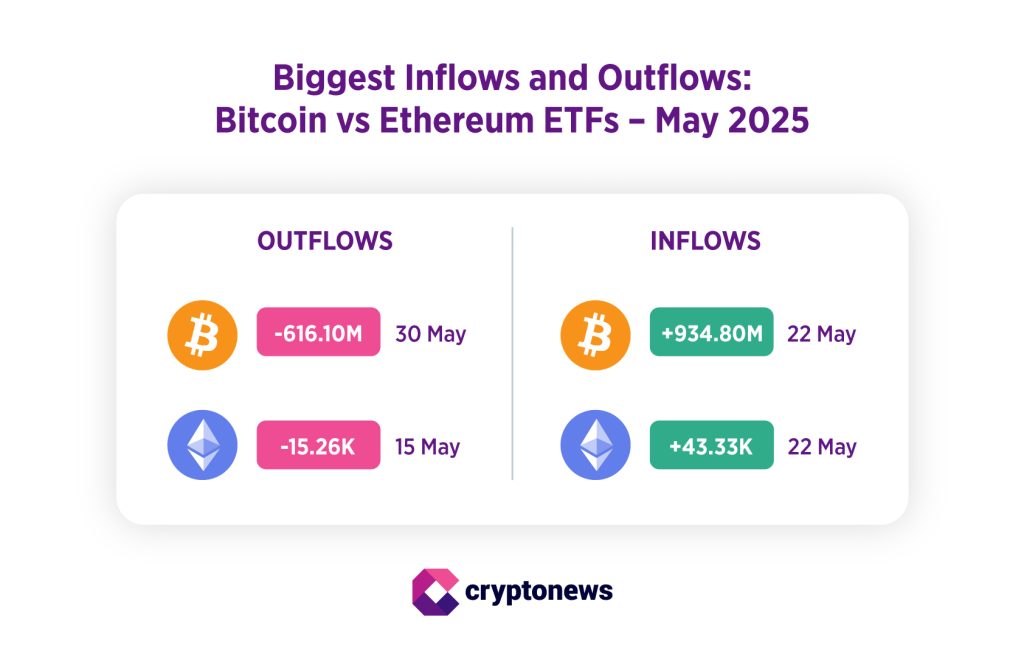

This infographic illustrates the biggest Bitcoin ETF outflow since late February 2025. On Might 22, web outflows totaled round $616 million, the largest single-day drop since Feb. 25, when ETFs noticed a document $1 billion go away the market.

Ethereum ‘Nonetheless Feels Undervalued’ Regardless of Secure Inflows

Whereas Bitcoin ETFs noticed capital exit, Ethereum ETFs held up higher. Inflows had been weak however remained constructive in Might, pointing to continued institutional curiosity.

24h7d30d1yAll time

Eneko Knörr instructed Cryptonews that ETH stays a high decide amongst establishments, particularly with the rise of real-world asset (RWA) tokenization:

Ethereum, regardless of this yr’s positive aspects, nonetheless feels undervalued. It’s the institutional favourite amongst Layer 1s, and because the real-world asset tokenization development accelerates, Ethereum is positioning itself because the core infrastructure of that monetary evolution.

Prabal Banerjee, CEO of Avail, famous that institutional involvement now goes past ETFs and consists of infrastructure:

This summer time does appear to be one for the institutional market. I count on the narrative round institutional adoption to evolve from simply ETFs to additionally embody infrastructure. We’re already seeing early indicators: BlackRock and Citi are experimenting with tokenized funds, whereas main monetary establishments are actively exploring sovereign rollups and high-throughput modular execution layers.

Banerjee emphasised the shift in institutional pondering:

Establishments are not asking if they need to tokenize belongings, however how. From sovereign bonds to cash market funds, there’s now a transparent pipeline of tokenized merchandise being deployed.

D’Cruz additionally expects ETH to achieve momentum if present circumstances maintain:

Ethereum seems to be able to push previous $2,800–$2,900 and doubtlessly escape above $3K, particularly as staking will increase and the liquid provide tightens. If the bullish momentum continues, ETH might have a powerful summer time.

Essentially, Ethereum continues to strengthen its place. In keeping with information, community income in Might rose by 162.5%, far outpacing different blockchains. For comparability, Solana’s income elevated by simply 19.3%, reflecting the slowdown in meme coin exercise that had beforehand fueled its development.

Solana Kinds a ‘Cup-and-Deal with’ as Altcoin Rotation Looms

Not like the start of the yr, Might was quieter for Solana. Meme coin hype light, and development slowed. Nonetheless, technical alerts stay robust, and analysts see room for a continuation.

24h7d30d1yAll time

Kelghe D’Cruz instructed Cryptonews that SOL is displaying a bullish chart sample:

Solana’s chart is much more thrilling — it’s respecting help and shaping up right into a textbook cup-and-handle. Some forecasts are calling for $500 as a mid-range goal this yr, with a possible stretch to $1,000 if circumstances align. The rising buzz round a Solana ETF and continued DeFi traction solely add gas to the hearth.

Eneko Knörr identified that in basic market cycles, Bitcoin rallies first — adopted by altcoins like Solana:

As in each previous cycle, Bitcoin strikes first, after which we see a rotation into altcoins like Ethereum and Solana. When that occurs, Bitcoin dominance will probably drop as ETH and SOL start to outperform.

Summer time May Belong to Altcoins

Analysts agree that even when June brings volatility, the broader image is of market maturity and diversification.

Prabal Banerjee famous {that a} drop in Bitcoin’s market share shouldn’t be seen as weak point:

And Bitcoin, nicely it’s nonetheless essentially the most dominant. So even when there may be some worth fluctuation, it gained’t sign weak point. It might in all probability simply be capital motion with a maturation of the market, kind of a shift towards a extra various set of high-utility belongings and architectures purpose-built for the following period of institutional and client adoption.

Kelghe D’Cruz added that ETH and SOL might entice extra consideration within the months forward:

If this summer time performs out like previous cycles, we’ll probably see Bitcoin lead — however ETH and SOL could steal the present as we see cash rotating into high-utility altcoins.

Whether or not we’re getting into a brand new altcoin season or not, the indicators of rising institutional engagement throughout the board are laborious to disregard. June might be quieter on the floor, however underneath the hood, the market appears to be warming up once more.

The put up June 2025 Crypto Outlook: A ‘Good Storm’ for Bitcoin Value appeared first on Cryptonews.