Metaplanet shareholders authorized all 5 proposals at a unprecedented assembly on Friday, clearing the way in which for 2 new courses of most popular shares designed to fund Bitcoin purchases whereas delivering fastened month-to-month and quarterly dividends to traders.

The Tokyo-listed firm, which holds 30,823 BTC value roughly $2.7 billion, is now positioned to boost capital by dividend-paying securities somewhat than additional diluting frequent stockholders.

Govt Dylan LeClair confirmed the assembly’s end result on social media, as CEO Simon Gerovich additionally thanked attendees in spite of everything agenda objects handed.

5/5 Proposals Authorized on the @Metaplanet Extraordinary Shareholder Assembly

1) Approve shift of capital inventory and capital reserve to capital surplus to extend capability for most popular share dividends & potential share buybacks.

2) Improve the entire variety of approved…— Dylan LeClair (@DylanLeClair) December 22, 2025

The approvals included increasing approved most popular shares to 555 million for each Class A and Class B constructions, amending Class A shares to hold month-to-month floating-rate dividends underneath the MARS (Metaplanet Adjustable Price Safety) system, and authorizing the issuance of Class B most popular shares to abroad institutional traders.

Metaplanet Mirrors Technique’s Dividend-Backed Bitcoin Funding Mannequin

The MARS construction mimics Technique’s STRC most popular inventory, which launched in July and at the moment trades close to $98 with an annualized dividend of about 10.75%.

STRC’s dividend adjusts month-to-month to maintain the inventory close to its $100 goal worth, lowering volatility whereas providing regular revenue to traders searching for Bitcoin publicity with out direct fairness danger.

Technique has used STRC proceeds to fund Bitcoin purchases, with about 21,000 BTC acquired from this system’s preliminary public providing alone.

Metaplanet’s Class A most popular shares can pay adjustable month-to-month dividends designed to ship worth stability, with charges rising when the inventory trades beneath par and falling when it trades above.

Class B shares, branded “Mercury,” pay a quarterly dividend of 4.9% yearly and supply the choice to transform to frequent inventory if Metaplanet’s share worth triples from present ranges.

The Mercury shares raised ¥21.25 billion ($135 million) in November by a third-party allocation to abroad institutional traders, with a conversion worth set effectively above the prevailing market fee to restrict near-term dilution.

Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury technique, saying Technique can stand up to 80-90% drawdowns.#Metaplanet #Bitcoinhttps://t.co/pikptcs4nb

— Cryptonews.com (@cryptonews) November 21, 2025

Again then, Gerovich said the construction goals to “decrease dilution from frequent share issuances whereas persevering with to broaden BTC holdings,” calling it a “new step in scaling” the corporate’s Bitcoin treasury technique.

The corporate additionally authorized shifting capital inventory and capital reserves to capital surplus, growing capability for most popular share dividends and potential share buybacks.

The Class B shares are topic to a 10-year 130% issuer name and embrace an investor put proper, until an preliminary public providing happens inside one 12 months.

U.S. Buying and selling Entry Opens By Sponsored ADR Program

The shareholder approvals adopted Metaplanet’s launch of a Sponsored Stage I American Depositary Receipt program, giving U.S. traders dollar-denominated entry to the corporate’s fairness underneath the ticker MPJPY.

Deutsche Financial institution Belief Firm Americas serves because the depositary, whereas MUFG Financial institution acts because the custodian for the underlying shares in Japan.

Every ADR represents one abnormal Metaplanet share and trades on the U.S. over-the-counter market.

Gerovich mentioned the ADR program “instantly displays suggestions from U.S. retail and institutional traders searching for simpler entry to our fairness.”

U.S. buying and selling of Metaplanet ADRs begins December 19. Ticker: $MPJPY

This instantly displays suggestions from U.S. retail and institutional traders searching for simpler entry to our fairness. One other step towards broader international participation in Metaplanet. pic.twitter.com/XEvfAFw8Z3— Simon Gerovich (@gerovich) December 19, 2025

The construction improves settlement effectivity, lowers transaction prices, and will increase transparency for U.S. traders who face operational and regulatory hurdles when buying and selling foreign-listed shares instantly.

Metaplanet’s shares beforehand traded within the U.S. underneath the image MTPLF, however that association concerned no formal settlement with a depositary financial institution and restricted the corporate’s potential to offer constant disclosures and investor assist.

The ADR launch shouldn’t be designed to boost capital and doesn’t have an effect on the variety of issued frequent or most popular shares.

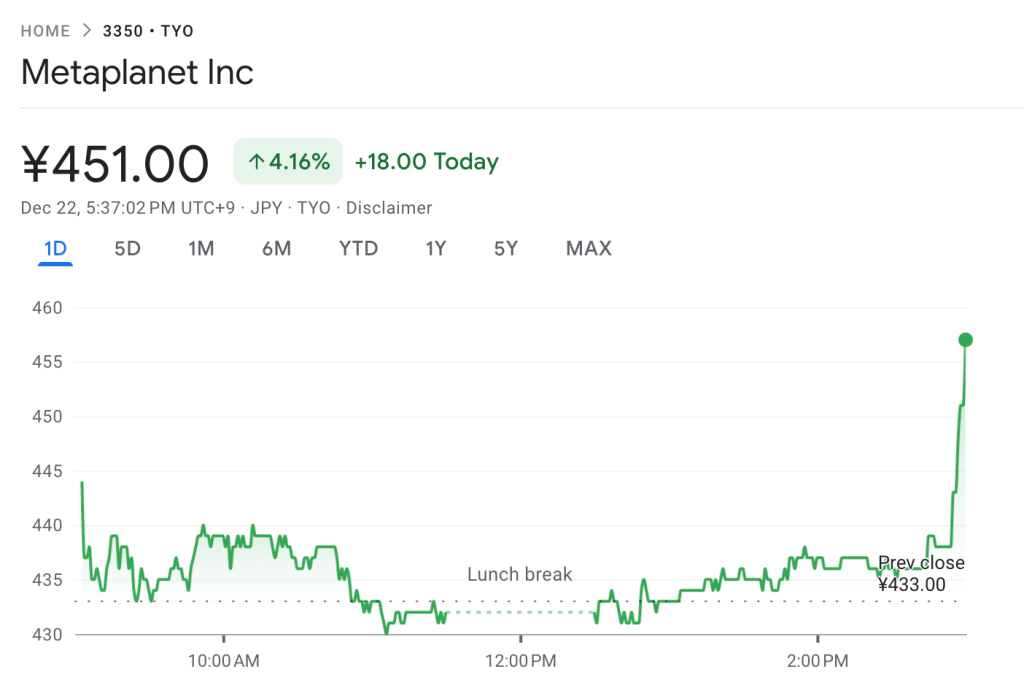

Notably, Metaplanet shares rose 4% immediately following the announcement, closing at 451 yen.

Metaplanet gathered roughly 29,000 BTC in 2025 however paused purchases in late September amid volatility that pressured Bitcoin treasury corporations.

The corporate additionally secured a $130 million mortgage in November backed totally by Bitcoin underneath a $500 million credit score facility, sustaining what it described as a ample collateral buffer even in periods of sturdy worth volatility.

The submit Japan’s Largest Bitcoin Holder Now Providing Dividend Shares to Traders appeared first on Cryptonews.