Japanese vitality consulting agency Remixpoint has raised roughly 31.5 billion yen ($215 million) by way of a financing spherical devoted completely to Bitcoin investments.

The corporate introduced that its short-term goal is to amass 3,000 BTC, though this goal could also be adjusted primarily based on Bitcoin’s market value and Remixpoint’s inventory efficiency (3825.T).

In a July 9 assertion translated from Japanese, Remixpoint defined, “We’ve turn out to be much more satisfied of Bitcoin’s future, and this resolution is the results of intensive discussions to boost company worth from a risk-return perspective, whereas additionally holding future choices open.“

リミックスポイント本日開示

ファイナンスにて約315億円資金調達

資金使途、全額BTC取得

目先『3000BTC保有』を目指す

※BTC価格、株価により変動あり

(初回以降は3日連続取引日の平均株価)

背景

より一層ビットコインの未来に確信を

持ち、議論を重ねた結果となります。…— リミックスポイント公式Xアカウント (@remixpoint_x) July 9, 2025

Japanese Remixpoint Constructing on Current Bitcoin Technique

Remixpoint has been accumulating Bitcoin since September 2024, establishing itself as a big company holder within the cryptocurrency house.

Based on Bitcoin treasuries information, Remixpoint ranks because the thirtieth publicly listed firm by Bitcoin holdings with 1,051 BTC, surpassing corporations like Nano Labs and The Smarter Net Firm on the time of writing.

The corporate’s dedication to Bitcoin was demonstrated earlier this yr when it accredited a ¥1 billion ($7 million) Bitcoin buy following a board decision in Might.

Japan’s Remixpoint approves one other $7M Bitcoin buy, elevating whole crypto holdings to $84M.#Japan #Remixpoint #Bitcoinhttps://t.co/ozpqS3v3QL

— Cryptonews.com (@cryptonews) Might 26, 2025

Past Bitcoin, Remixpoint has expanded its digital asset holdings to incorporate Ethereum (ETH), Solana (SOL), and Avalanche (AVAX).

In September 2024, the agency invested roughly $351,700 to amass 130.1 ETH, 2,260.5 SOL, and 12,269.9 AVAX tokens.

The Japanese agency’s crypto dedication extends to government compensation, with the corporate turning into the primary Tokyo Inventory Alternate-listed entity to pay its CEO and President solely in Bitcoin.

Based on the report, CEO Yoshihiko Takahashi characterised this resolution as a “clear sign” of his dedication to company worth and shareholder-focused governance.

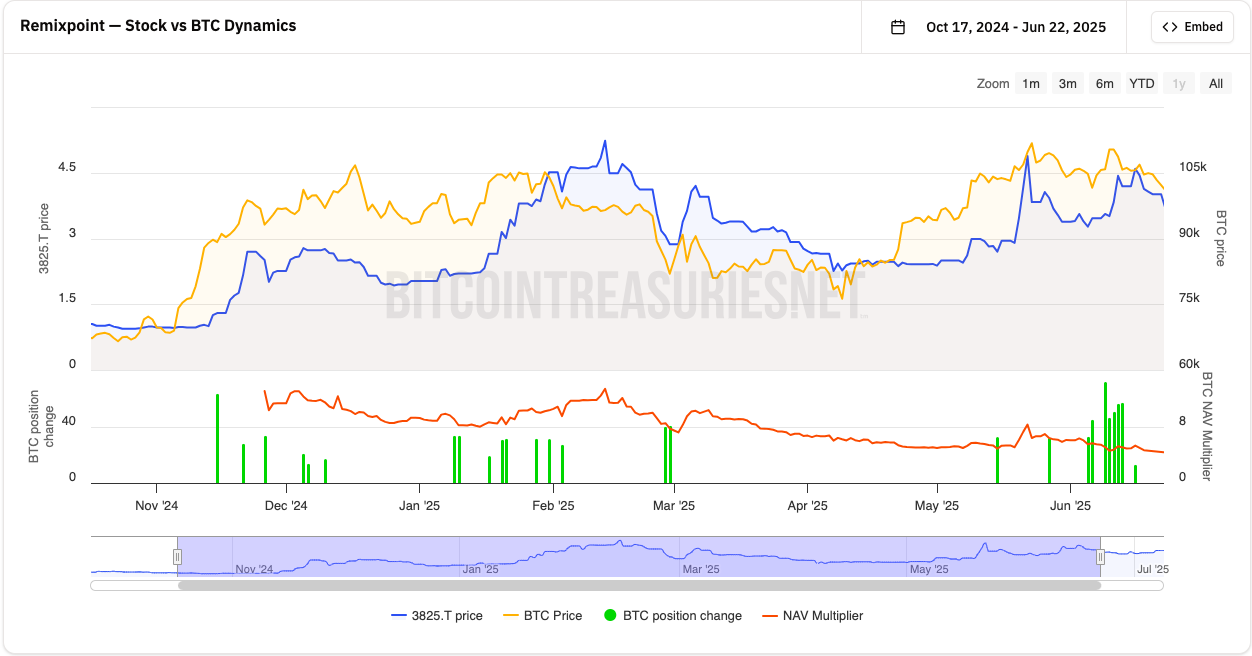

Furthermore, Remixpoint’s inventory value has demonstrated a robust correlation with Bitcoin’s efficiency, benefiting from the cryptocurrency’s success.

When Bitcoin reached its lows of $77,000 in April, 3825.T shares traded at ¥328 ($2.26). As Bitcoin climbed above $109,000 in Might, the inventory value greater than doubled to ¥701 ($4.88).

At press time, Remixpoint shares commerce at 592 yen, reflecting a 3.86% improve within the final 24 hours and over 64% year-to-date features, based on Google Finance.

Rising Japanese Company Bitcoin Adoption

Remixpoint’s technique aligns with an rising development amongst publicly listed firms that incorporate Bitcoin into their stability sheets.

Whereas U.S.-based firms like MicroStrategy have popularized this strategy, Remixpoint joins a rising checklist of Japanese corporations adopting related fashions.

Metaplanet, one other Bitcoin-focused Japanese firm, has constantly expanded its holdings of BTC.

Japanese funding agency @Metaplanet_JP has unveiled an bold new goal to amass 210,000 BTC by the tip of 2027.#Metaplanet #Bitcoinhttps://t.co/jCQ3G0uzPC

— Cryptonews.com (@cryptonews) June 6, 2025

On Monday, Metaplanet bought an extra 2,205 BTC, bringing its whole Bitcoin holdings to fifteen,555 BTC, valued at roughly 225.8 billion yen ($1.7 billion).

In April, NASDAQ-listed Japanese magnificence and beauty surgical procedure clinic operator SBC Medical Group Holdings accomplished a Bitcoin buy value over $418,000.

Furthermore, Japan’s evolving regulatory panorama is supporting the elevated adoption of cryptocurrencies.

The nation is making ready to formally acknowledge crypto belongings as monetary merchandise underneath its Monetary Devices and Alternate Act and is shifting towards approving Bitcoin ETFs.

These developments are anticipated to encourage extra Japanese firms and residents to embrace Bitcoin and cryptocurrency investments.

Authorities officers are additionally contemplating Bitcoin as a reserve asset.

Satoshi Hamada, a member of parliament from the Celebration to Defend the Individuals from NHK, has known as for the institution of a nationwide Bitcoin reserve, just like current proposals from lawmakers in Argentina, Russia, and different nations.

The put up Japanese Agency Remixpoint Secures $215 Million Funding to Buy 3,000 Bitcoins appeared first on Cryptonews.