Three of Japan’s largest banks, Mitsubishi UFJ Financial institution, Sumitomo Mitsui, and Mizuho, are becoming a member of forces to launch stablecoins pegged to the Japanese yen and US greenback, a transfer to problem the dominance of dollar-backed USDT and USDC stablecoins.

Based on an October 17 report from Japanese outlet Nikkei, the yen-backed stablecoin will first be used for settlement by Mitsubishi Company.

The three megabanks, which collectively serve over 300,000 main enterprise companions, have united particularly to drive stablecoin adoption throughout Japan.

Japanese banks will difficulty stablecoins for business utilization quickly. Mitsubishi UFJ, Sumitomo Mitsui and Mizuho Financial institution are set to collectively difficulty stablecoins.

Equally, SBI Holdings will combine Ripple's $RLUSD into companies for Japanese shoppers by Q1 2026.

[Source:Nikkei News] pic.twitter.com/io0Gi5aPRP— ALLINCRYPTO (@RealAllinCrypto) October 17, 2025

“The banks will construct a construction for company shoppers to permit for stablecoins to be transferred between them alongside uniform requirements, initially issuing a yen-pegged coin and doubtlessly a dollar-pegged coin sooner or later,” Nikkei reported.

Progmat Is Constructing Japan’s Stablecoin To Problem USDT And USDC Dominance

CryptoNews coated this initiative again in April when Mitsubishi UFJ Belief and Banking first introduced plans to difficulty the nation’s first fiat-pegged stablecoin.

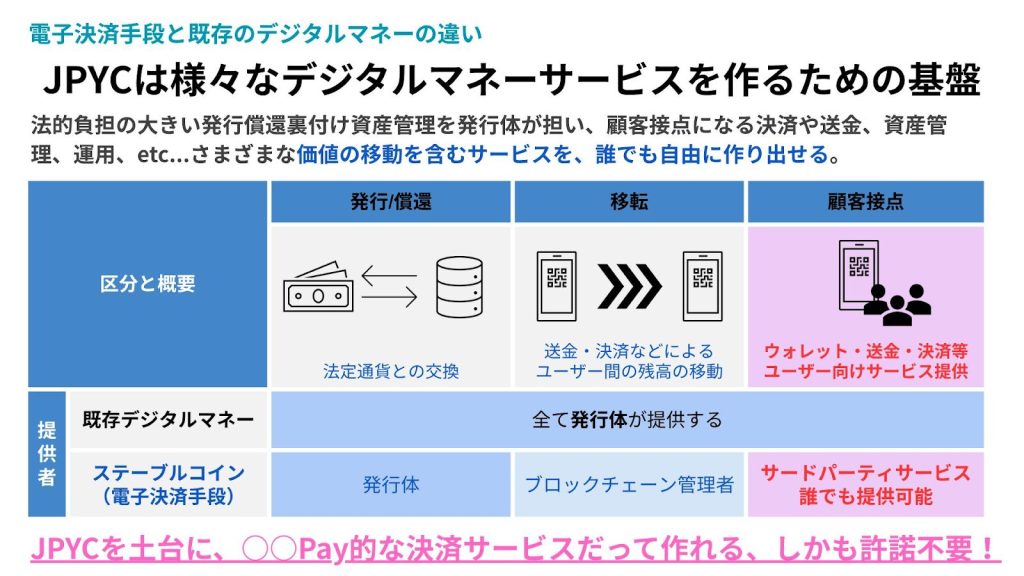

On the core of this growth is Progmat, the blockchain infrastructure firm established by MUFG.

Progmat focuses on constructing digital monetary merchandise that meet regulatory necessities.

The platform will deal with the issuance and governance of the brand new stablecoin, sustaining constant authorized and operational compliance all through.

Past Progmat, the banks have partnered with a number of crypto sector gamers, together with home change Bitbank, blockchain firm Avalabs, and crypto infrastructure supplier Fireblocks.

This follows Nikkei’s earlier report that Japan was getting ready to approve its first yen-denominated stablecoin this autumn.

CryptoNews confirmed then that Tokyo-based fintech firm JPYC would lead the launch.

The stablecoin, additionally named JPYC, will keep its peg to the yen by way of reserves of extremely liquid property, together with deposits and authorities bonds.

Potential purposes for the yen-backed stablecoin embody sending cash to college students overseas, facilitating cross-border company funds, and enabling participation in decentralized finance.

Over the subsequent three years, the banks plan to difficulty 1 trillion yen value of JPYC, equal to roughly $6.64 billion on the present change charge of 150.42 yen to the greenback.

The timing coincides with rising international curiosity in stablecoins, whose complete market capitalization just lately crossed $307 billion, with dollar-backed tokens USDC and USDT holding the lion’s share.

Presently, solely Circle’s USDC has acquired approval as a world greenback stablecoin to be used in Japan.

USDC entered the Japanese market after Circle partnered with monetary conglomerate SBI Group in March to record the token on the SBI VC Commerce crypto change.

Jeremy Allaire, CEO of Circle, acknowledged Japan’s welcoming arms to crypto in an X put up, stating: “We’ve spent 2+ years partaking with Japan’s regulators, main business gamers, strategic companions, banking companions and others to allow USDC for the Japanese market.”

Japan Doubles Down on Crypto Adoption

Japan’s revised authorized framework, efficient since June 2023, signifies the nation’s intent to problem the dominance of dollar-backed stablecoins.

Underneath the brand new guidelines, stablecoins are categorised as “currency-denominated property” and might solely be issued by banks, belief firms, and registered cash switch companies.

These coverage modifications have helped the nation greater than double its crypto adoption over the previous yr, in accordance with crypto analytics agency Chainalysis.

In an unique interview with Cryptonews, Chengyi Ong, Head of Public Coverage, APAC at Chainalysis, reveals how the East is constructing a definite, sustainable path for digital property, difficult Western dominance.#Chainalysis #CryptoAdoption #APACcryptohttps://t.co/lFmzy2l3lc

— Cryptonews.com (@cryptonews) October 13, 2025

Among the many prime 5 markets within the Asia Pacific area, Japan recorded the strongest progress, with its on-chain worth acquired rising 120% year-over-year within the 12 months to June, in accordance with an excerpt from Chainalysis’ 2025 Report launched in September.

Over the 12 months to June 2025, the report confirmed that cryptocurrency purchases utilizing JPY stablecoins have been directed primarily towards XRP, which accounted for $21.7 billion in fiat buying and selling exercise, adopted by BTC ($9.6 billion) and ETH ($4.0 billion).

The dominance of XRP buying and selling is especially notable and means that buyers could also be betting on the real-world utility of XRP following Ripple’s strategic partnership with SBI Holdings.

The put up Japanese Banking Giants Enter Stablecoins, Problem USDT and USDC Dominance appeared first on Cryptonews.