Bitcoin (BTC) has gone down by 1.5% previously 24 hours to face at $81,927. This could be the fourth consecutive day of losses for the highest crypto and its sixth purple session previously seventh.

A complete of $58 million price of BTC lengthy positions have been wiped throughout this era and an identical quantity of Ethereum (ETH) has additionally been flushed out of the system as the value drops close to key ranges.

Analysts see the $80,000 stage as a key help space to observe within the close to time period as these psychological thresholds are inclined to set off a spike in shopping for volumes.

If BTC does bounce off the $80K stage, this might propel the value of cryptocurrencies like XRP whose correlation with Bitcoin is sort of excessive.

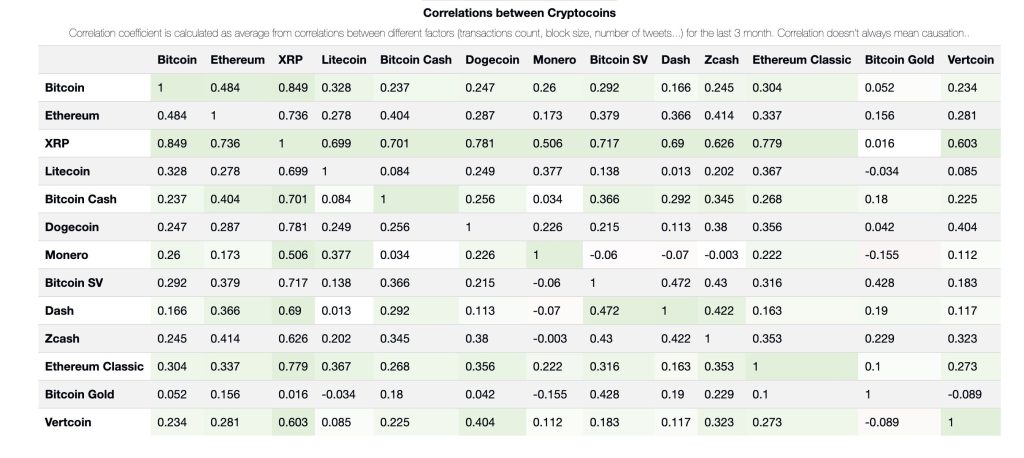

XRP (XRP) has one of many highest correlations with BTC at 0.849 based on knowledge from BitInfoCharts. A worth correlation of 1 signifies that for each 1% that BTC beneficial properties, the dependent asset beneficial properties precisely the identical share. On this case, a 1% improve in BTC worth would end in a 0.85% acquire for XRP.

Bitcoin May Retest its Nearest Key Help if It Breaks Under $80K

From a technical standpoint, bearish momentum has gained traction previously buying and selling classes as BTC appears to have rejected a transfer above a key development line resistance.

Bitcoin’s newest rally seems to be fading, with the every day chart exhibiting a agency rejection on the $89,000 stage final week.

Technical indicators help a bearish near-term outlook. The Relative Energy Index (RSI) has issued a promote sign, and the MACD histogram displays waning bullish momentum.

Including to this, BTC has additionally been pushed again from the 61.8% Fibonacci retracement stage—typically seen as a final main resistance earlier than development reversal.

If BTC breaks beneath the $80,000 threshold, draw back stress may intensify, probably dragging the value to its subsequent help at $76,600.

Nonetheless, most analysts stay bullish on Bitcoin’s long-term trajectory, with expectations of latest all-time highs later this 12 months.

Certainly, analyst Stockmoney Lizards thinks BTC may backside out round $80,000 with a rally following quickly after for alts.

For traders, present weak spot might provide a uncommon alternative to build up earlier than the following breakout.

Within the meantime, a brand new meme coin referred to as BTC Bull Token (BTCBULL) is popping heads—providing holders passive BTC rewards as Bitcoin climbs larger.

BTC Bull Token (BTCBULL) Captures Traders’ Curiosity by Introducing an Revolutionary Rewards Scheme

BTC Bull Token (BTCBULL) is the meme coin constructed for true Bitcoin believers—rewarding holders as BTC climbs to new heights in 2025.

Right here’s the way it works: each time Bitcoin hits a significant milestone, $BTCBULL holders profit. The venture options an aggressive provide burn and airdrop technique, making it one of the bold and rewarding meme cash out there.

Right here’s the reward roadmap:

- BTC $100K – $BTCBULL Launch

- BTC $125K – Token Burn

- BTC $150K – BTC Airdrop

- BTC $175K – Token Burn

- BTC $200K – BTC Airdrop

- BTC $225K – Token Burn

- BTC $250K – Large $BTCBULL Airdrop

As Bitcoin marches towards the $1 million mark, $BTCBULL holders will take pleasure in milestone-based rewards, lowered token provide, and direct BTC incentives alongside the way in which.

To purchase $BTCBULL, merely head to the BTC Bull Token web site and join your pockets (e.g. Greatest Pockets).

You may both swap USDT or ETH for this meme coin or use a financial institution card to finish your funding.

The submit Is $80K Bitcoin the Backside? Analysts Say It May Spark Large Breakouts appeared first on Cryptonews.