Fundstrat’s Chief Funding Officer Tom Lee has cautioned that institutional consumers might disrupt Bitcoin’s conventional four-year cycle, as sustained institutional capital inflows over the previous two years have launched counter-cyclical dynamics to the market.

Throughout a current interview with Mario Nawfal, Lee, who serves as Chairman of Bitmine, defined that Bitcoin’s four-year cryptocurrency cycle originates from its halving mechanism.

Tom Lee: Will the Crypto 4-Yr Worth Cycle Stop to Be Efficient?

In an interview with Mario Nawfal, Tom Lee, Chairman of Bitmine, identified that the origin of the four-year cryptocurrency cycle may be traced again to Bitcoin's halving mechanism. Within the early decentralized… pic.twitter.com/Oil06eXV1y— Wu Blockchain (@WuBlockchain) September 8, 2025

Lee emphasised that the market has moved past retail dominance, noting that 2024 has witnessed company consumers and ETF launches bringing constant capital flows to Bitcoin, shifting away from the four-year cycle’s provide scarcity-driven rallies that beforehand powered your entire crypto market.

Tom Lee: “Fairness Market Liquidity Has Ended Bitcoin’s Conventional 4-Yr Cycle”

In keeping with Lee, the crypto market confronts two essential checks, that are whether or not Bitcoin will keep its conventional downward cycle trajectory subsequent 12 months, or whether or not it should decouple from fairness markets with which it has maintained a powerful correlation.

Ought to each eventualities materialize, cycle-based discussions within the cryptocurrency market might progressively diminish.

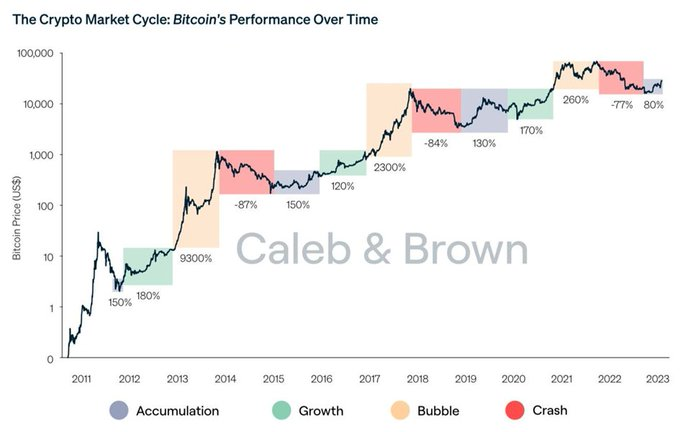

For greater than a decade, Bitcoin’s market patterns appeared extremely predictable.

Each 4 years, the halving occasion, a programmed discount in mining rewards, would provoke a cascading impact.

Costs would surge to recent peaks, then crash into devastating “crypto winters,” earlier than restarting the cycle.

This sample grew to become almost sacred amongst crypto merchants. Nevertheless, a number of the trade’s most outstanding analysts now recommend this period could also be ending.

Supporting Lee’s place, Pierre Rochard, CEO of The Bitcoin Bond Firm, additionally contends the standard cycle has misplaced relevance, as expressed in a current social media submit.

His reasoning addresses a basic shift, with merely 5% of Bitcoin remaining to be mined, the halving’s provide affect is considerably weaker than beforehand.

There may be solely 5,15% of #Bitcoin left to mine.

Give it some thought! pic.twitter.com/GLViwCD0BJ— Rand (@crypto_rand) September 7, 2025

Throughout Bitcoin’s early years, slicing miner rewards created dramatic market stream disruptions.

Presently, the first market catalysts could also be institutional inflows, regulated funding automobiles, and international macroeconomic elements.

Jason Dussault, CEO of Intellistake.ai, equally views the rise of institutional consumers as representing a structural transformation.

“The halving maintains relevance, but it surely’s now not the first driver,” he defined to CryptoNews.

Worth actions are actually equally influenced by international liquidity circumstances, ETF capital flows, and investor sentiment as they’re by on-chain provide mechanisms.

“Bitcoin more and more responds to the identical elements affecting equities, bonds, and commodities,” he added.

In July, Bitwise Chief Funding Officer Matt Hougan prompt the traditionally noticed four-year crypto cycle might now not govern present market conduct.

Throughout a collaborative dialogue with Bitcoin proponent Kyle Chassé and Bloomberg ETF analyst James Seyffart, Hougan contended that the historic framework is deteriorating, doubtlessly giving solution to an prolonged, extra sustainable development interval.

He highlighted the July passage of the GENIUS Act as a pivotal growth, arguing that the laws enabled Wall Road to assemble crypto-focused monetary merchandise.

Glassnode Knowledge Contends that Bitcoin’s Conventional 4-Yr Cycle is Nonetheless Intact

However, not all analysts are ready to pronounce the cycle’s demise.

In dialog with CryptoNews, Connor Howe, CEO of Enso, argued that the halving’s affect has been weakened reasonably than eradicated.

“The halving stays vital for mining economics and long-term shortage narratives, however merchants can now not rely on a strict four-year framework.“

Moreover, current Glassnode analysis suggests Bitcoin’s conventional four-year cycle maintains structural integrity.

The blockchain analytics firm decided that Bitcoin’s present cycle period and long-term holder profit-taking behaviors intently resemble earlier cycles, with all-time highs in each 2015-2018 and 2018-2022 cycles occurring 2-3 months past the current timeline.

This information signifies comparable cycle maturity to historic precedents reasonably than an finish to the basic 4-year construction..

On the 4-hour Chart, Bitcoin declined to weekend lows of $109,977 earlier than recovering towards $112,150 at press time, although investor confidence stays fragile.

This outlook has dampened bullish sentiment, with traders now questioning whether or not BTC can exceed final month’s peak of $124,128.

Latest market polling signifies almost 70% of respondents anticipate a decline to $105,000 earlier than any potential upward motion.

The submit Institutional Consumers Might Break Bitcoin’s Conventional 4-Yr Cycle, Tom Lee Warns appeared first on Cryptonews.