Indonesia’s annual crypto tax income jumped sharply in 2024, marking its highest degree because the authorities launched taxation on digital property in 2022.

Based on officers from the Directorate Common of Taxes, the nation collected 620 billion rupiah (round $38 million) final yr, a 181% rise from the 220 billion rupiah recorded in 2023.

The sharp improve displays a broader surge in native crypto exercise. Officers attributed the expansion to an increase in transaction volumes, which reportedly reached 650 trillion rupiah ($39.67 billion) in 2024.

This aligns with Indonesia’s rising crypto person base, which now stands at over 20 million folks, surpassing the variety of inventory market buyers.

Crypto Tax Income in Indonesia Surged in 2024, however 2025 Off to a Slower Begin

Nonetheless, the momentum could not final. 12 months-to-date figures for 2025 present a steep drop in tax income, with collections sitting at simply 115 billion rupiah ($6.97 million) as of July. Officers level to crypto market volatility as a key issue behind the fluctuations.

“Crypto is a long-term funding. The value can drop,” stated Hestu Yoga Saksama, Director of Tax Rules I on the Directorate Common of Taxes. “It might spike, it might drop—it depends upon what sort of fever it’s. If the fever is excessive, then the reception shall be good.”

The tax was first launched in 2022 and consists of each Last Worth Added Tax (VAT) and Article 22 Revenue Tax on crypto buying and selling. In its first yr, crypto taxes introduced in 246 billion rupiah. The drop in 2023 raised considerations earlier than the market rebounded sharply final yr.

To handle this rising sector, the federal government launched a number of new laws in 2025. Amongst them are up to date ministerial decrees that set out tax guidelines for crypto asset buying and selling and amend current tax frameworks to replicate the evolving digital asset house.

Indonesia has additionally reclassified crypto property from commodities to monetary property. This transfer brings the sector underneath the oversight of the Monetary Companies Authority (OJK), indicating a shift in how the nation views crypto’s position in its broader monetary system.

Yon Arsal, an advisor to the Minister of Finance, emphasised the necessity for collaboration. “It’s not sufficient to easily develop the scope,” he stated. “We should additionally coordinate. We’re encouraging higher coordination with our exterior stakeholders, together with the Monetary Companies Authority.”

Indonesia Raises Crypto Taxes on International Exchanges, Cuts VAT for Patrons

The federal government additionally rolled out tax reforms in August designed to shift exercise towards home crypto platforms. Taxes on international exchanges had been raised from 0.2% to 1%, whereas home platforms noticed a smaller hike from 0.1% to 0.21%. Patrons, nevertheless, are now not topic to VAT, creating an incentive for native buying and selling.

Crypto mining operations weren’t omitted. VAT on mining has doubled from 1.1% to 2.2%, and a particular 0.1% revenue tax for miners shall be eliminated in 2026. After that, mining revenue shall be taxed underneath common private or company tax charges.

Talking to CryptoNews, Gregory Cowles, Chief Technique Officer of Intellistake.ai, famous that “crypto taxation must strike a stability. It’s truthful that governments need their share, however overly aggressive or unclear insurance policies danger pushing customers offshore or into casual channels.”

He continued, saying, “Particularly in rising markets, crypto is usually extra than simply hypothesis; it’s a workaround for foreign money instability or restricted entry to banking. If taxation turns into too punitive, it might stifle that utility.”

Indonesia implements sweeping cryptocurrency tax will increase as much as 5 instances greater efficient August 1 concentrating on the booming $39.67 billion crypto market.#Indonesia #Cryptohttps://t.co/INFY07kh8f

— Cryptonews.com (@cryptonews) July 30, 2025

Regardless of the volatility challenges, officers view crypto taxation as a rising income. The federal government’s potential to seize earnings from the booming digital asset market, significantly amongst youthful buyers aged 18 to 30, is seen as a long-term alternative.

Nonetheless, the unpredictable nature of crypto costs poses a problem for income planning. As Yoga famous, “It actually relies upon available on the market. If exercise drops, so does the income.”

As 2025 unfolds, the nation’s crypto tax collections could proceed to replicate the highs and lows of a unstable however quickly increasing sector.

Gregory Cowles additional famous that “If governments begin to deal with crypto tax revenue as a secure finances merchandise, they could be setting themselves up for disappointment.”

Indonesia Ranks third Globally for Crypto Adoption as Youth Buying and selling Soars

Indonesia’s crypto sector is seeing a pointy rise in exercise, fueled largely by its younger inhabitants. Over 60% of the nation’s crypto buyers are aged between 18 and 30, in response to knowledge from the Commodity Futures Buying and selling Regulatory Company (Bappebti).

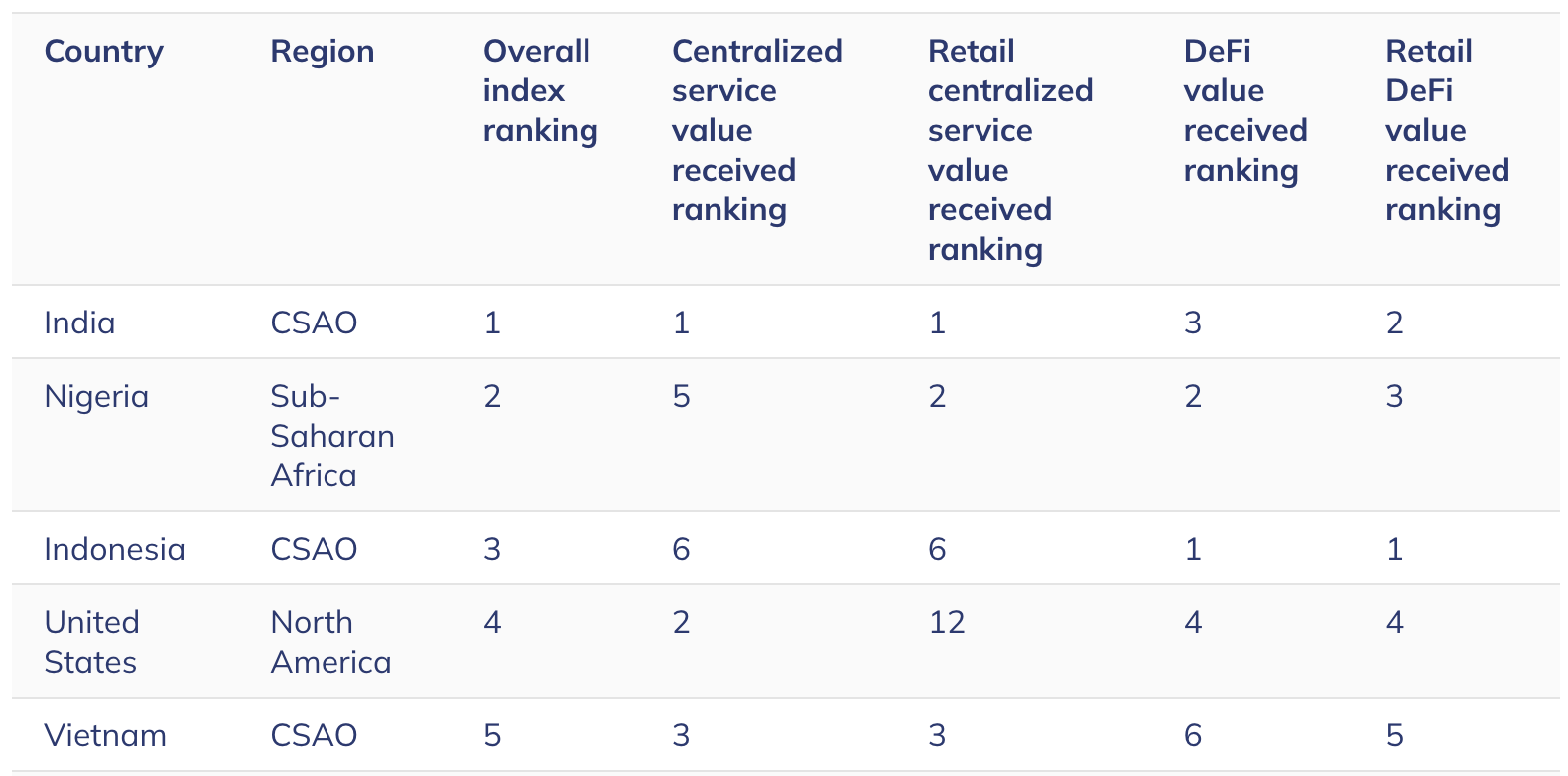

This surge in younger investor participation has helped place Indonesia because the third-highest nation on Chainalysis’s International Cryptocurrency Adoption Index.

In 2024, Indonesia recorded greater than $30 billion in crypto transactions by October, a steep rise from $6.5 billion the earlier yr.

Whereas nonetheless under the 2021 peak of $54 billion, this marks a 352% year-over-year improve. The variety of registered crypto merchants within the nation additionally grew, reaching 21 million.

On the regulatory degree, the nation is present process a shift in oversight. The switch of authority from Bappebti to the Monetary Companies Authority (OJK), initially deliberate for January 2025, was delayed because of the absence of supporting authorities laws.

Indonesia’s crypto regulation switch to OJK, set for Jan. 12, faces setbacks on account of incomplete authorities frameworks.#Indonesia #CryptoRegulation https://t.co/2V7xIu94eI

— Cryptonews.com (@cryptonews) January 2, 2025

As soon as finalized, the OJK is anticipated to offer a extra structured regulatory framework aligned with international requirements, together with clearer guidelines on buying and selling, taxation, and trade operations.

The put up Indonesia’s Crypto Tax Income Skyrockets 181% – However Volatility Raises Pink Flags appeared first on Cryptonews.