The Worldwide Financial Fund on Thursday launched a brand new international evaluation of the stablecoin market, warning that fragmented regulatory frameworks throughout nations are actually creating structural “roadblocks” that threaten monetary stability, weaken oversight, and gradual the event of cross-border funds.

In its report titled “Understanding Stablecoins,” the IMF reviewed how main economies, together with the USA, the UK, the European Union, and Japan, regulate stablecoins and located that nationwide approaches stay broadly inconsistent.

Stablecoins have the potential to reshape cross-border funds and capital flows. They provide alternatives, but additionally convey new dangers—monetary integrity, regulatory oversight, client safety, capital circulation administration, financial sovereignty, and extra. Be taught extra:… pic.twitter.com/cOlZKuqLDF

— IMF (@IMFNews) December 4, 2025

Whereas some nations deal with stablecoins as securities, others regulate them as cost devices, allow solely bank-issued tokens, or go away massive elements of the market unregulated.

Stablecoins Are Shifting Sooner Than Regulators Can Monitor, IMF Warns

The IMF stated this regulatory patchwork permits stablecoins to maneuver throughout borders quicker than oversight can comply with.

Issuers can function from evenly regulated jurisdictions whereas serving customers in stricter markets, limiting authorities’ capability to watch reserves, redemptions, liquidity administration, and anti-money laundering controls.

The fund warned that this creates regulatory arbitrage and weakens international supervision.

The report additionally pointed to technical fragmentation. Stablecoins more and more function throughout completely different blockchains and exchanges that aren’t at all times interoperable.

In line with the IMF, this lack of coordination raises transaction prices, slows market growth, and creates limitations to environment friendly international funds.

Variations in nationwide regulatory remedy additional complicate cross-border utilization and settlement.

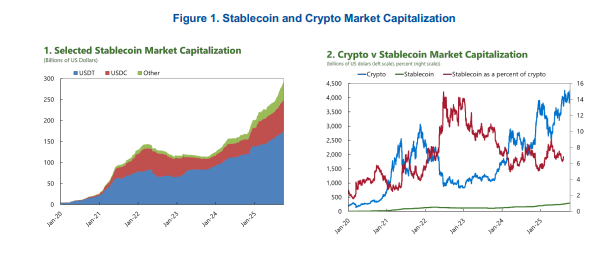

Stablecoins stay dominated by U.S. dollar-denominated tokens. The IMF stated the worldwide stablecoin market is now price greater than $300 billion. Tether’s USDT and Circle’s USDC make up the vast majority of that offer. About 40% of USDC’s reserves are held in short-term U.S. treasuries, whereas roughly 75% of USDT’s reserves are in short-term treasuries, with one other 5% held in Bitcoin.

The focus of reserves in authorities debt markets hyperlinks stablecoins on to conventional monetary techniques

Widespread use of foreign-currency stablecoins can weaken home financial management, decrease demand for native forex, and speed up digital dollarization. Stablecoins additionally make it simpler to bypass capital controls by means of unhosted wallets and offshore platforms.

Along with financial considerations, the fund cited broader monetary stability considerations. Giant-scale redemptions may drive speedy gross sales of Treasury payments and repo property, probably disrupting short-term funding markets which might be important for financial coverage transmission.

The IMF additionally famous that the growing interconnection between stablecoin issuers, banks, custodians, crypto exchanges, and funds additionally will increase the danger of contagion spreading from digital markets into the broader monetary system.

IMF Urges Unified Stablecoin Regulation as Cross-Border Dangers Develop

To handle these dangers, the IMF launched new international coverage pointers supposed to cut back fragmentation. It known as for harmonized definitions of stablecoins, constant guidelines for reserve property, and shared cross-border monitoring frameworks.

The fund stated issuers ought to be topic to the precept of “similar exercise, similar threat, similar regulation,” no matter whether or not the issuer is a financial institution, fintech firm, or crypto platform.

The IMF additionally stated stablecoins ought to be backed solely by high-quality liquid property comparable to short-term authorities securities, with strict limits on dangerous holdings. Issuers should assure full one-to-one redemption at par, on demand, always.

Robust worldwide coordination on anti-money laundering enforcement, licensing, and supervision of huge international stablecoin preparations was additionally included within the new steering.

The IMF’s warning comes as regulatory stress is rising worldwide. In Europe, the European Central Financial institution not too long ago warned that stablecoins, regardless of their small footprint within the euro space, now pose spillover dangers attributable to their rising ties to U.S. Treasury markets.

The ECB warns that stablecoins are rising quick, now topping $280B, with rising spillover dangers as USDT and USDC dominate 90% of the market. #Stablecoins #ECBhttps://t.co/ef16HZzqYL

— Cryptonews.com (@cryptonews) November 24, 2025

The European Systemic Threat Board has additionally known as for pressing safeguards towards cross-border stablecoin constructions working below the EU’s MiCA framework.

In China, the central financial institution has described stablecoins as a risk to monetary stability and financial sovereignty, whereas the Financial institution of England and Basel regulators are reassessing how banks ought to maintain capital towards stablecoin publicity as utilization expands.

The IMF concluded that with out constant international regulation, stablecoins may bypass nationwide safeguards, destabilize weak economies, and transmit monetary shocks throughout borders at excessive pace.

The submit IMF Warns: Fragmented Stablecoin Guidelines Create “Roadblocks” – New Pointers Launched appeared first on Cryptonews.