Donald Trump’s re-election has led to expectations of main adjustments in U.S. cryptocurrency rules.

Latest government orders recommend that regulatory adjustments may quickly have an effect on the cryptocurrency trade.

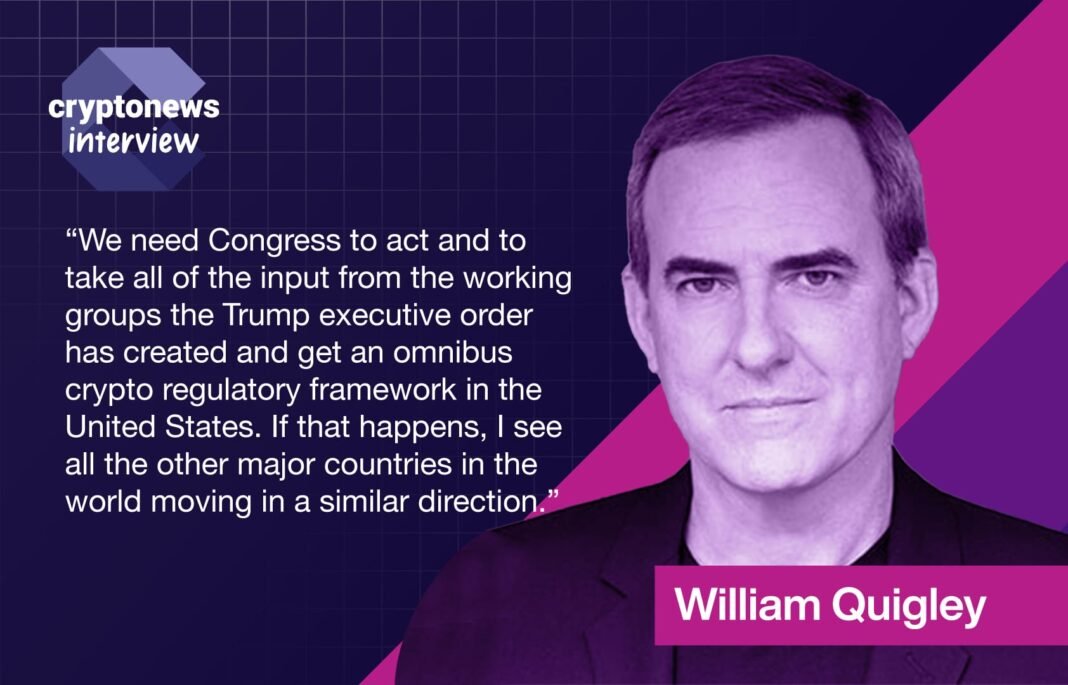

In an interview with Cryptonews, William Quigley, co-founder of Tether and WAX, shared his insights into what the following 4 years below Trump may imply for the trade.

Quigley defined that the administration’s pro-crypto stance, together with key appointments and legislative efforts, may result in clearer rules.

He additionally careworn the function of the personal sector in shaping way forward for cryptocurrency rules.

Trump’s Second Time period and the Way forward for Crypto Regulation

Trump’s alerts of potential adjustments in crypto rules distinction sharply with earlier administrations’ inconsistent approaches.

Beneath Trump, there may very well be an emphasis on putting in pro-crypto figures and fostering personal sector involvement in digital belongings.

Quigley remarked on the shift, “The Obama administration and the Biden administration by way of how they thought of crypto, they have been cautious of it and Congress was not transferring ahead with any regulation. They didn’t appear to see it as necessary or terribly problematic both, except for one federal company, the SEC.”

“The Trump government order may be very optimistic in direction of crypto, the assertion that Trump needs the U.S. to be a frontrunner within the crypto trade,” Quigley added.

These adjustments are anticipated to create a extra predictable regulatory setting, lowering uncertainty and supporting market stability.

Because the administration strikes ahead, regulatory choices will decide how the federal government interacts with the digital forex sector.

Establishing the Digital Asset Working Group

President Trump’s government order led to the creation of the President’s Working Group on Digital Asset Markets inside the Nationwide Financial Council.

This group is chargeable for reviewing present rules and proposing clearer pointers for the digital asset sector.

Quigley shared his views on the affect of those developments, “The Trump government order has created and get an omnibus crypto regulatory framework in the USA. And if that occurs, I see all the opposite main international locations on the earth transferring in the same course.”

“To me, [the executive order] appears fairly quick as a result of there may be a lot to contemplate right here, however I believe earlier than the Trump time period ends, people can have capacity to make use of stablecoins way more freely than they do now.,” mentioned Quigley.

The working group is tasked with crafting a federal regulatory framework particularly for digital belongings like stablecoins, which can contain detailed concerns on how these belongings are issued and operated inside the U.S.

The crypto trade awaits the Working Group’s report, due inside 180 days, anticipating focused legislative proposals that might redefine the regulatory setting and improve market stability.

Quigley Discusses Financial institution Reluctance

The U.S. banking sector stays cautious about cryptocurrency resulting from unclear regulatory steering and the potential for extreme penalties.

This hesitancy persists regardless of extra optimistic remarks from figures like Federal Reserve Chairman Powell, who lately counseled banks for his or her dealing with of cryptos.

JUST IN:

Federal Reserve Chair Jerome Powell says "banks are completely capable of serve crypto clients." pic.twitter.com/IiFJhA8Qg3

— Watcher.Guru (@WatcherGuru) January 29, 2025

William Quigley highlighted the core points, “Banks are nonetheless gradual. This may be as a result of they’ve gotten a lot crosstalk through the years with what they’re allowed to do and never allowed to do.”

“Any optimistic messaging from the White Home and from the Federal Reserve is superb for us,” Quigley additional defined. “However for these establishments, I believe they want black and white steering.”

He additionally mirrored on the broader implications of this reluctance, “In any main monetary establishment in the USA, there are 1000’s, possibly tens of 1000’s of staff who’re primarily simply compliance oriented individuals. There’s all these regulatory our bodies on the federal stage, and a few comparable ones on the state stage, lots of whom both give no steering on crypto, or who give conflicting steering.”

#Bitcoin took 14 years to succeed in $100K. $200K may come by summer time 2025. pic.twitter.com/KK1iIkAaSS

— William E. Quigley (@WilliamEQuigley) January 15, 2025

In conventional banking techniques, readability and compliance stay paramount. The banking sector’s cautious strategy to crypto could change sooner or later, however presently, this wariness serves as a significant impediment to wider acceptance and integration of those applied sciences.

The Want for Congressional Motion in Crypto Regulation

Cryptocurrency regulation within the U.S. suffers from inconsistencies resulting from a number of businesses managing totally different points with out a unified strategy.

This fragmented oversight has highlighted the necessity for a single regulatory physique to supply clear and constant governance.

Trump’s current government order is seen as a pivotal step that may immediate Congress to determine a unified regulator, which may assist scale back confusion and solidify the U.S.’s place within the world crypto market.

“We are able to’t have the IRS calling it property, the CFTC saying, no, it’s a commodity, the SEC saying it’s a safety, after which the U. S. Treasury ceaselessly saying, no, these are currencies, and that existed for years,” mentioned Quigley.

The publish How Tether Co-Founder William Quigley Views Crypto Laws in Trump’s Second Time period appeared first on Cryptonews.