International finance runs on calculated possibilities, but the Web3 ecosystem continues to function on blind religion. Final 12 months alone, the crypto area noticed over $3B in losses from hacks, scams, and venture failures. Till danger is measurable, crypto as an asset class stays successfully uninvestable for institutional capital.

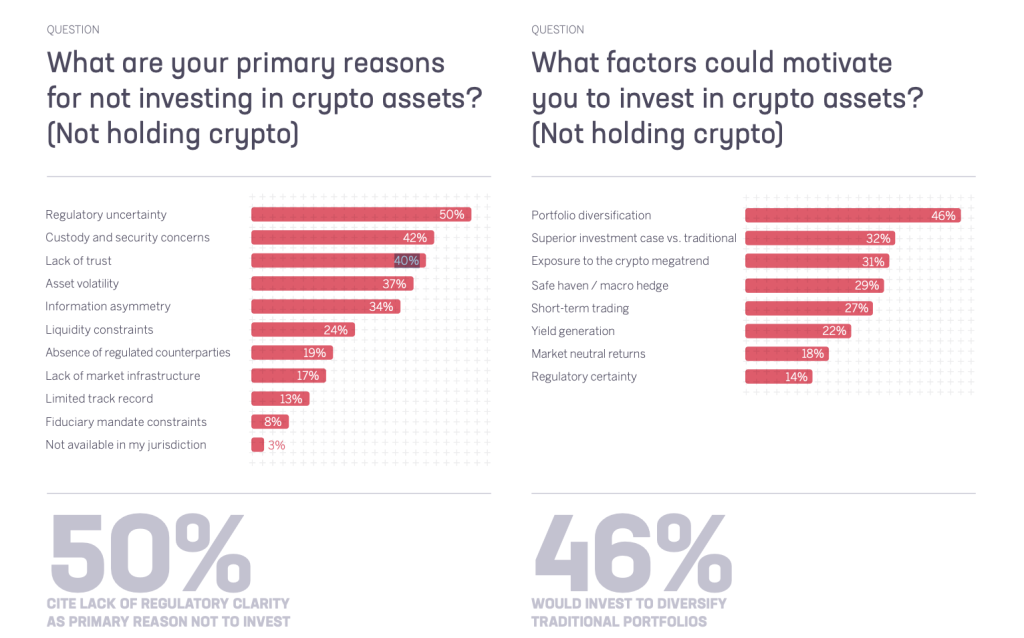

In accordance with the Sygnum Financial institution 2025 report, 40% of organizations chorus from interacting with crypto because of an absence of belief, and 50% of respondents don’t see regulatory readability.

This hesitation has a worth. Whereas the fintech market globally attracted $44.7 billion throughout H1’25, world VC funding in blockchain startups for H1 2025 was roughly 5 occasions decrease, at roughly $ 8 billion. Moreover, a current survey discovered that 9 out of 10 institutional traders cite “counterparty danger” as their main concern.

Take a look at PayPal’s transfer into crypto. They didn’t companion with a cutting-edge DeFi protocol. They went with Paxos, a regulated, predictable companion since 2012. Paxos isn’t essentially the most progressive. But it surely’s protected. It’s understood.

Now think about if PayPal had partnered with a number one decentralized change or a community-driven DAO. The consumer expertise could be radically completely different, extra than simply digital greenback transfers. However that didn’t occur. Not as a result of the tech wasn’t prepared, however as a result of the chance wasn’t.

Wall Road Limits Publicity to Crypto As a result of We Communicate Totally different Danger Languages

The Web2 governments and establishments nonetheless see crypto as unstable, unsustainable, and risky. The concept of “too large to fail” doesn’t apply right here. Mt. Gox & FTX, Terra Luna, Anchor Protocol: every has confronted main incidents whereas having all the explanations to be trusted throughout the DeFi neighborhood. That proves that even the most important gamers will be hacked, mismanaged, or collapse in days, casting a protracted shadow on the entire ecosystem.

Over half of the initiatives launched since 2021 are already gone for good. Establishments can’t afford to speculate on this graveyard. Till a personal U.S. pension fund can see that Undertaking X has a 3% chance of loss and Undertaking Y has a 5% however presents the next premium, they don’t have anything to underwrite.

Subsequently, governments and establishments can’t confidently companion with initiatives they aren’t certain will nonetheless exist in a 12 months. Why? As a result of there’s no widespread language for danger.

The crypto insurance coverage market, a key indicator of institutional consolation, stays nascent, with complete protection capability protecting solely round 9% of the whole property locked in DeFi.

Nonetheless within the Grey Regardless of Nationwide Reserves and ETFs

Even the current wave of Bitcoin ETFs doesn’t show broad institutional belief. ETFs are the most secure potential entry; they let traders acquire publicity to blue chips with out touching the underlying know-how. It’s crypto, sanitized. Faraway from the operational danger, the sensible contract danger, and the group danger. On the one hand, this can be a multi-billion-dollar on-ramp; alternatively, ETFs beat your entire innovation crypto presents: decentralization and anonymity.

The crypto area continues to be a grey zone, a digital Wild West. And whereas that’s been a possibility for some to earn, it’s additionally been a cause for a lot of to remain away. The unique Wild West didn’t finish accidentally. It ended with the arrival of legislation, order, and requirements.

Sadly, the regulatory panorama solely confirms the disaster of requirements. Jurisdictions are dashing to include the chaos, however their divergent approaches are creating world fragmentation, not world confidence.

Singapore regulates to seize financial worth, whereas China and India limit entry to take care of monetary management and stability. The EU builds complete frameworks to draw enterprise, whereas the US abruptly reversed its enforcement posture in 2025 to help business development. Each nation is appearing in its personal pursuits, leaving the blockchain business with out a widespread basis for belief.

This confusion creates a opposite incentive for builders & for establishments: the sheer complexity of compliance is now a main cause to keep away from it each for traders and builders. Because of this, there’s a rise of initiatives designed to be stateless and absolutely decentralized from day one, opting out of the institutional publicity fully as a result of participating with it’s untenable.

The world’s regulators aren’t ready for us to determine the way to measure dangers in Web3. Some are constructing partitions. Others are drafting rulebooks. All of them are creating requirements by default.

That is our final likelihood for self-regulation. Both we construct a reputable framework ourselves, one which works throughout borders and protocols, or we’ll have one imposed on us. And historical past reveals that when options come from the surface, they hardly ever match.

Self-Regulation Can Break the Ceiling

There’s a option to preserve each innovation and security with out sacrificing institutional publicity: credible self-regulation.

Crypto doesn’t want to attend for guidelines to be imposed from the surface. It will probably begin from inside, however this requires greater than good intentions. It calls for a mature, respected participant to chop by way of the noise; an entity that may translate the business’s complexities into a good and environment friendly framework that regulators and builders can each belief.

However with out that shift, development will stall. Crypto has the potential to redefine how we financial institution, make investments, and change worth. However potential isn’t sufficient. With out duty, with out security, with out belief, it gained’t attain the following wave of customers.

And that’s a ceiling the entire business is about to hit.

Disclaimer: The views and opinions expressed on this article are these of the writer and don’t essentially mirror the views of Cryptonews.com. This text is for informational functions solely and shouldn’t be construed as funding or monetary recommendation.

The put up How Crypto’s Unpriced Danger is Preserving Institutional Capital on the Sidelines appeared first on Cryptonews.