Most individuals aren’t centered on worth charts – they care about being paid on time, sending cash with out excessive charges, and finishing transactions with out pointless steps. That’s why extra banks, processors, and cost networks are testing blockchain-based cost rails.

They’re already shifting actual cash in actual workflows, from service provider settlements to cross-border payouts, and it’s taking place sooner than many anticipated.

Card networks take a look at stablecoin settlement, regulators write playbooks, and retailers simply need fewer steps between a sale and cleared funds.

If this know-how needs to succeed past the crypto crowd, it should nail what conventional finance already is aware of: cash motion needs to be predictable, low-cost, and seamless.

Funds Win When the Guidelines Are Clear

Policymakers are leaning in direction of the place the utility is clear. They’re distinguishing speculative exercise from fiat-backed tokens designed to simplify checkout and cross-border funds. Within the European Union, for instance, the MiCA framework units a single rulebook for e‑cash, in addition to asset‑referenced tokens, with phased implementation dates and new ESMA steerage.

One other instance is Singapore, which has finalized a stablecoin regime that requires excessive‑high quality reserves and 1:1 redemption. Moreover, Hong Kong has moved forward with a licensing system for fiat‑referenced stablecoin issuers. The path is straightforward: if a use case solves pace, charges, or entry, authorities will create a lane for it.

Legacy Cost Corporations Are Powering the Change

Regulators opened that lane, and the massive networks already drove into it. Funds now seem like essentially the most scalable possibility for mainstream use. For instance, PayPal’s Pay with Crypto promotes as much as 90% decrease cross‑border prices folded proper right into a checkout stream individuals are already conversant in. No seed phrases, no tutorials, simply pay and receives a commission.

One other big, Visa, studies settling $225M+ in stablecoin quantity and continues to develop supported tokens, blockchains, and even a euro-denominated possibility. In the meantime, Mastercard partnered with Paxos’ International Greenback Community to combine regulated stablecoins into present cash‑motion merchandise.

As well as, PayPal’s PYUSD stablecoin is being launched on the Stellar community to develop on a regular basis funds and remittance choices.

Think about sending low-cost funds internationally that settle immediately.

With @PayPal's PYUSD on Stellar, that have is simply across the nook for consumers and retailers. pic.twitter.com/GrMq7dYA6u— Stellar (@StellarOrg) June 27, 2025

Buying and selling-First Platforms Are Blocking Actual Adoption

The issue is that many crypto platforms nonetheless seem like buying and selling apps, dominated by charts, order varieties, and tickers.

Positive, this strategy labored throughout speculative cycles. But it surely doesn’t assist a contractor who needs to bill in {dollars}, a market that wants identical‑day settlement, or a nook store that merely needs funds to land in a checking account with out surprises.

Complexity on the floor pushes mainstream customers away. To place it merely, if a payout requires selecting a sequence and guessing a community charge, most choose out.

Utility prevails when outcomes are simple: faucet to ship, and funds arrive. Buyer help can deal with the sting instances, and compliance matches into the stream with out scaring customers. A buying and selling‑first mindset makes all of that more durable and narrows the viewers that the business can serve.

The Core Rules of a Monetary Utility

Reshaping this strategy suggests treating the product as a utility that delivers predictable outcomes. Funds settle when they need to. Charges keep clear. Disputes have a path to decision. Uptime is a promise, not a want. If designed this fashion, the expertise would really feel extra like cash motion, slightly than simply mere hypothesis.

Localization issues as a lot because the blockchain, since Europe depends on SEPA and euro settlement whereas the US is determined by ACH, immediate card payouts, and simple enterprise reporting. That’s why cross‑border funds want fiat‑backed tokens that bridge seamlessly to native accounts.

However, compliance can be a part of the product. It begins with easy KYC and KYB checks which are straightforward to finish. Clear disclosures on stablecoin reserves and redemption, together with service provider studies that match real-world accounting, flip these networks into instruments that customers and companies can belief.

Does This Route Actually Work?

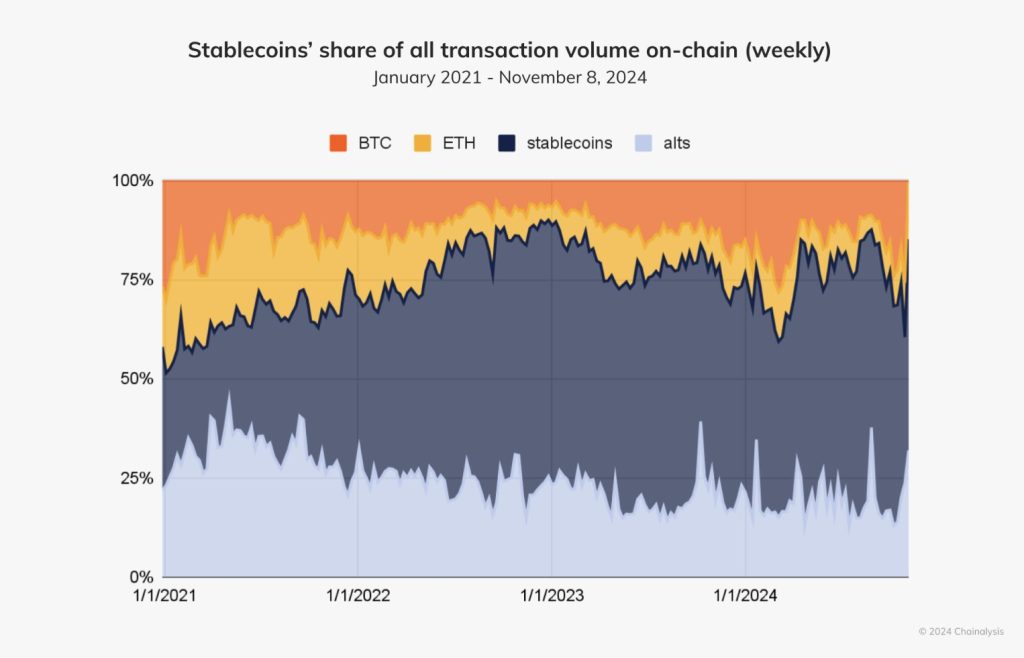

Look the place the site visitors goes–away from worth charts and towards cost channels. Banks and processors combine tokenized funds into actual workflows–service provider settlement, B2B payouts, remittances–as a result of transactions clear sooner with fewer intermediaries. That isn’t a hunch: McKinsey maps the shift, and on-chain information backs it up as Chainalysis exhibits stablecoins now carry a lot of the worth shifting throughout networks.

The actual kicker exhibits up within the prices. Typical card acceptance lands round 1.5% to three.5% per sale, whereas the World Financial institution nonetheless studies greater than 6% to ship $200 throughout borders. Demand rises anyway, and eMarketer initiatives U.S. crypto payers will develop by roughly 82 p.c from 2024 to 2026, although off a small base.

Now zoom out to remittances, the place minutes and cents matter. Remittance flows to low and middle-income nations reached roughly $656–669 billion in 2023 and are monitoring towards about $685 billion in 2024, with the broader international complete close to $900 billion.

When a typical cross-border switch nonetheless takes greater than six cents on the greenback, chopping time and charges isn’t a characteristic request–it’s the job to be accomplished.

The Path Ahead

Finally, platforms face a transparent alternative — both hold optimizing for buying and selling and serve a slender viewers, or evolve into utilities that ship certainty to households and companies.

The second path requires important however much less glamorous work: constructing redundancies, dealing with reconciliations and chargebacks, writing clear disclosures, and managing native payouts. Whereas much less seen, it builds lasting income and real buyer loyalty.

Funds will not be the one use case for these networks, however it’s the one which regulators already help and enterprises can undertake at the moment. That’s the reason card networks, banks, and on‑ramp suppliers now align across the thought of sooner, safer settlement constructed on tokenized cash. Comply with the momentum that exists, then earn belief by making the expertise easy and, actually, slightly boring.

Disclaimer: The opinions on this article are the author’s personal and don’t essentially characterize the views of Cryptonews.com. This text is supposed to supply a broad perspective on its matter and shouldn’t be taken as skilled recommendation.

The publish Neglect Buying and selling Charts, Crypto’s Actual Future is Boring Funds appeared first on Cryptonews.