Bitcoin’s historic November rallies could not materialize this yr, as a number of alerts point out a chronic consolidation fairly than upward momentum.

The world’s largest crypto has spent two weeks trapped between $106,000 and $116,000, weighed down by persistent promoting from long-term holders and muted institutional demand following October’s sharp liquidation occasion.

In the meantime, dramatic shifts in world funding markets are including complexity to the outlook.

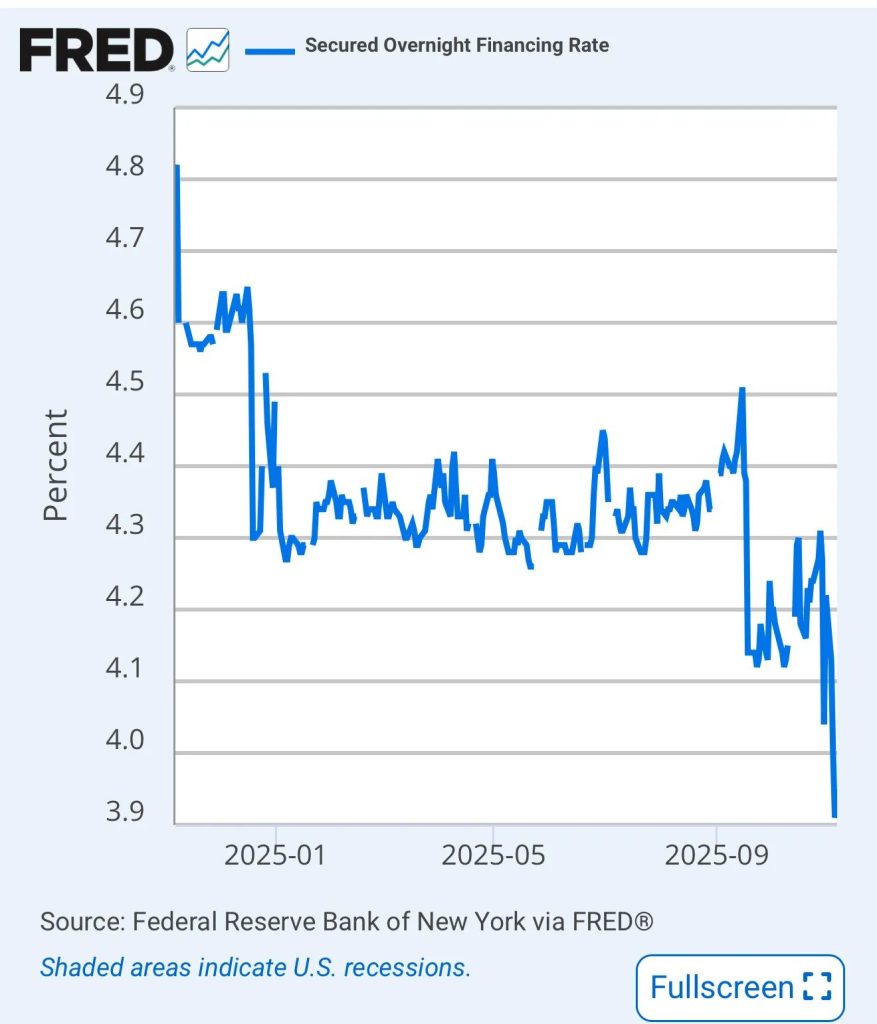

The Secured In a single day Financing Charge plummeted to three.92% on November 6, its lowest stage in two years, a collapse that monetary analyst Shanaka Anslem warns “screams one phrase: panic.“

Persistent Distribution Weighs on Value Motion

In line with Bitfinex’s newest market evaluation, Bitcoin briefly rallied to $116,500 on October 27 earlier than retracing over 8.9% to revisit vary lows.

The report reveals that long-term holders have accelerated distribution to 104,000 BTC per 30 days, the sharpest promoting wave since mid-July.

“Until ETF inflows or new spot demand returns to soak up ongoing distribution, BTC is prone to stay range-bound, with a threat bias towards retesting the $106,000–$107,000 zone,” Bitfinex analysts wrote of their November 3 report.

The agency warned that “a sustained break beneath this stage might open the trail to $100,000 per BTC.“

Choices markets additionally add to the mounting uncertainty, with implied volatility compressing steadily for the reason that October 10 liquidation occasion.

The Put/Name quantity ratio has oscillated between extremes as merchants alternate between chasing rallies and adopting defensive positions, indicating what Bitfinex described as “a broad lack of directional conviction.“

Fed Ends Steadiness Sheet Runoff Amid Liquidity Considerations

The Federal Reserve formally ended its stability sheet runoff and lower rates of interest by 25 foundation factors to three.75-4% on October 29.

Fed Chair Jerome Powell acknowledged that “indicators have clearly emerged that we have now reached that commonplace in cash markets” relating to sufficient reserve ranges.

Starting December 1, the Fed will roll over all maturing Treasury securities whereas reinvesting the proceeds from mortgage-backed securities into Treasury payments, successfully restoring $25-35 billion in month-to-month liquidity.

Powell described the lower as “threat administration” amid weakening hiring and wages however pressured that future selections are “not on a pre-set course.“

Constancy’s Jurrien Timmer famous that “the Fed’s reverse repo facility (RRP) is now depleted and the Treasury’s money stability (TGA) has grown to $1 trillion.”

He described this as “a strong cache of ‘fiscal QE’ ready to be deployed.“

With final week’s price lower additionally comes the tip of the Fed’s stability sheet discount (QT). The Fed’s reverse repo facility (RRP) is now depleted and the Treasury’s money stability (TGA) has grown to $1 trillion. That’s a strong cache of “fiscal QE” ready to be deployed. I’m not… pic.twitter.com/pZlNfhTW2t

— Jurrien Timmer (@TimmerFidelity) November 7, 2025

Deep Division Over December Charge Reduce

Earlier at this time, the Wall Road Journal’s Nick Timiraos reported that Federal Reserve officers are “fractured over which poses the larger menace—persistent inflation or a sluggish labor market.”

Kansas Metropolis Fed President Jeff Schmid dissented towards October’s lower, whereas Cleveland’s Beth Hammack and Dallas’s Lorie Logan publicly opposed additional reductions.

Powell acknowledged these divisions, stating, “individuals simply have completely different threat tolerances, in order that leads you to individuals with disparate views.”

Timiraos famous that Powell “pushed again so bluntly towards expectations” of a December lower “to handle a committee riven by seemingly unbridgeable variations.“

Fed officers are fracturing over a December price lower after inflation-focused hawks pushed for a pause after final month's price discount.

Officers are divided on three questions that come right down to judgment calls: Will tariff-driven price will increase actually be a one-off? Does weak…— Nick Timiraos (@NickTimiraos) November 12, 2025

San Francisco Fed President Mary Daly made the dovish case, warning that the economic system dangers “shedding jobs and progress within the course of” of preventing inflation.

She argued that slowing wage progress signifies falling labor demand fairly than provide constraints.

Combined Financial Indicators Cloud Outlook

Bitfinex’s report detailed deteriorating labor circumstances, noting that year-over-year wage progress cooled from 4.7% in early 2023 to three.7% by August.

The Convention Board’s Shopper Confidence Index fell to 94.6 in October from 95.6 in September.

Treasury yields have declined considerably since summer season, with 10-year notes dropping 51 foundation factors from 4.5% in June to 4% by late October.

Bitfinex analysts famous this “displays a mixture of shifting expectations, together with prospects of price cuts, softer financial progress, and rising safe-haven demand.“

Bitcoin stays caught between conflicting forces as conventional November energy clashes with 2025’s distinctive macroeconomic backdrop.

With out sustained institutional demand, analysts count on continued range-bound buying and selling via the tip of the month.

The submit Overlook “Moonvember” — Analysts Say Bitcoin May Commerce Sideways This Month appeared first on Cryptonews.