The Workplace of the Comptroller of the Forex confirmed that nationwide banks could interact in riskless principal crypto-asset transactions, eliminating a key barrier between conventional banking and digital belongings.

The choice permits banks to behave as intermediaries in crypto trades by concurrently shopping for from one buyer and promoting to a different with out holding stock.

The coverage shift marks the OCC’s most aggressive step but towards integrating crypto into mainstream banking, constructing on earlier approvals for custody companies and stability sheet holdings.

Banks can now facilitate consumer crypto trades whereas assuming solely minimal settlement and credit score threat.

OCC Interpretive Letter 1188 confirms {that a} nationwide financial institution could interact in riskless principal crypto-asset transactions as a part of the enterprise of banking. https://t.co/gXirMExhCi pic.twitter.com/uPRFGqb2NZ

— OCC (@USOCC) December 9, 2025

Banking’s Crypto Gateway Opens Below New Framework

In Interpretive Letter 1188, senior deputy comptroller Adam Cohen mentioned the exercise falls squarely inside the enterprise of banking as a result of it mirrors present brokerage capabilities.

Nationwide banks have lengthy acted as monetary intermediaries in securities, derivatives, and different asset courses via riskless principal transactions, taking momentary possession to bridge purchaser and vendor.

The OCC utilized the identical logic to crypto-assets, noting that banks eradicate market threat via offsetting trades whereas retaining restricted publicity to counterparty defaults.

Cohen emphasised that the authority extends past securities to any crypto-asset, together with these not labeled below federal securities legislation, as a result of the transactions align with banks’ conventional middleman position.

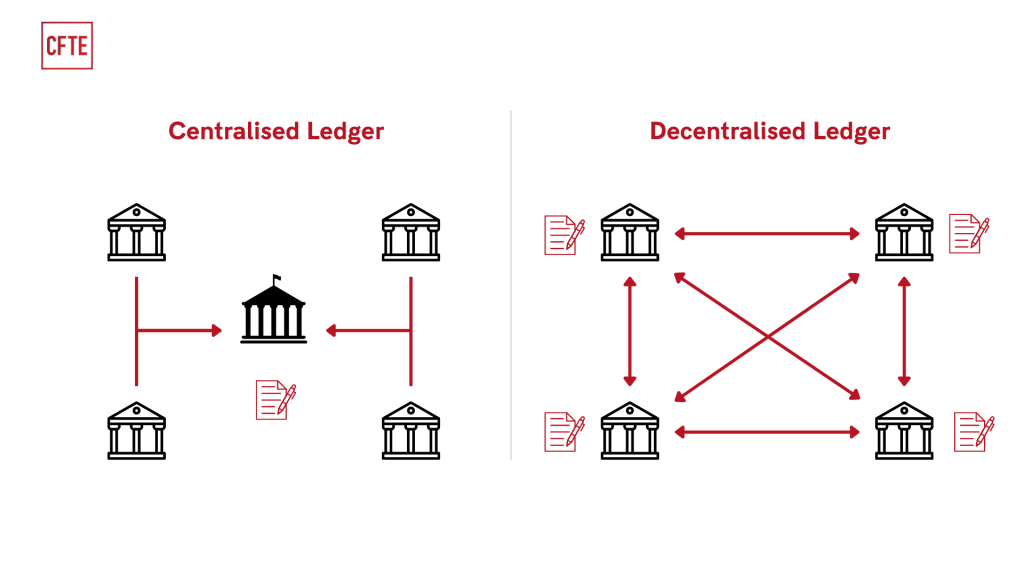

In the meantime, the regulator dismissed issues about operational complexity, arguing that banks already handle comparable dangers when settling securities through digital ledgers.

Cohen mentioned distributed ledger expertise merely represents a contemporary methodology of recording transactions, no totally different in precept from book-entry settlement programs that banks have used for many years.

Why This Modifications Financial institution Crypto Operations

The choice removes a structural impediment that compelled banks to both keep away from crypto buying and selling solely or depend on third-party intermediaries for consumer transactions.

By permitting direct riskless principal exercise, the OCC allows banks to supply seamless crypto companies whereas sustaining regulatory compliance and buyer protections.

Banks can now serve purchasers who need crypto publicity with out partnering with unregulated exchanges or pseudonymous counterparties.

U.S. banks formally cleared to carry crypto following the @USOCC coverage reversal, a serious win for digital belongings and conventional finance. #OCC #Bankshttps://t.co/PYpmuOPZmK

— Cryptonews.com (@cryptonews) November 19, 2025

The framework requires banks to implement know-your-customer protocols, transaction monitoring, and the power to freeze or reverse transfers when needed, options constructed into sure blockchain platforms, corresponding to Stellar.

The coverage additionally strengthens banks’ aggressive place in opposition to fintech rivals and crypto-native companies looking for federal financial institution charters.

A number of main establishments have already moved towards crypto integration, with Financial institution of America authorizing advisers to suggest Bitcoin ETFs and JPMorgan permitting clients to fund Coinbase accounts through Chase playing cards.

Regulatory Momentum Builds Throughout Digital Property

The OCC’s transfer comes as federal companies speed up the event of stablecoin and tokenized deposit frameworks below the GENIUS Act.

The FDIC will publish its first stablecoin rule proposal later this month, establishing capital, liquidity, and reserve necessities for bank-issued dollar-backed tokens.

Federal Reserve Vice Chair Michelle Bowman mentioned the central financial institution is coordinating with peer companies on requirements to anchor digital belongings to conventional finance.

The Treasury Division closed its second public session on non-bank stablecoin issuers in current weeks, creating parallel oversight tracks that can govern your complete US stablecoin market.

Appearing FDIC chair Travis Hill revealed that steering on tokenized deposits can be underway, clarifying how blockchain-based representations of financial institution deposits can be handled below present laws.

The trouble responds to rising trade curiosity in utilizing distributed ledgers for funds and settlement.

OCC head Jonathan Gould mentioned that crypto companies looking for federal financial institution charters ought to be evaluated on par with conventional monetary companies.#OCC #USBankCharter #DigitalAssetFirmshttps://t.co/hXWT3OU9GX

— Cryptonews.com (@cryptonews) December 9, 2025

Jonathan Gould, who turned the OCC’s first everlasting comptroller since 2020 after affirmation in July, has pushed again in opposition to banking trade complaints about approving crypto agency charters.

Talking on the Blockchain Affiliation Coverage Summit final week, he mentioned digital asset custody and safekeeping have operated electronically for many years, including there isn’t a justification for treating crypto in another way.

The OCC acquired roughly 14 financial institution constitution purposes this 12 months, together with from Coinbase, Circle, and Ripple, all looking for federal oversight for stablecoin and custody operations.

Gould dismissed issues about supervisory capability, noting the company already supervises a crypto-native nationwide belief financial institution and fields every day inquiries from conventional banks launching modern merchandise.

The publish Federal Regulator Approves Riskless Crypto Buying and selling for US Banks appeared first on Cryptonews.