The Federal Reserve (Fed) has unveiled plans to grant stablecoin issuers and fintech corporations direct entry to its cost infrastructure with out requiring partnerships with conventional banks.

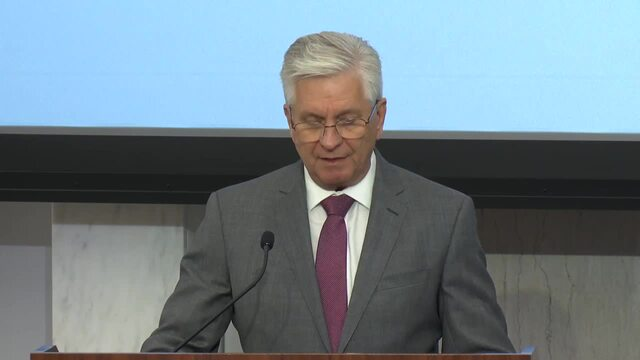

Fed Governor Christopher Waller introduced the proposal in the course of the central financial institution’s inaugural Funds Innovation Convention on October 21, introducing what he termed “cost accounts” or “skinny grasp accounts” for legally eligible establishments.

The transfer represents a significant coverage reversal from the Fed’s traditionally cautious stance towards crypto corporations, a number of of which have spent years combating for banking entry.

Firms like Custodia Financial institution and Kraken, which have pursued Fed grasp accounts via prolonged authorized battles, may benefit instantly from the streamlined approval course of.

Streamlined Fed Accounts Goal Stablecoin and Fintech Suppliers

The proposed cost accounts would offer direct connections to Federal Reserve cost rails whereas sustaining threat controls absent from full grasp accounts.

“This cost account idea could be focused to offer primary Federal Reserve cost providers to legally eligible establishments that proper now conduct cost providers primarily via a third-party financial institution,” Waller said in his opening remarks.

BIG NEWS out of the @federalreserve Funds Innovation Convention this morning.

Governor Chris Waller introduced the central financial institution is proposing a brand new sort of limited-access grasp account (or what he calls a “skinny grasp account”) for ALL legally eligible establishments to… https://t.co/lZh0I0Tj3a pic.twitter.com/Wg7ygjpvJj— Eleanor Terrett (@EleanorTerrett) October 21, 2025

Establishments receiving these accounts would face particular operational restrictions designed to restrict Fed steadiness sheet publicity.

Moreover, the accounts wouldn’t earn curiosity on deposited balances, and so they may carry necessary steadiness caps to regulate their measurement.

Members would lose entry to sunlight overdraft privileges, which means transactions could be rejected as soon as account balances attain zero.

The accounts would additionally exclude low cost window borrowing and sure Fed cost providers the place the central financial institution can’t adequately management overdraft dangers.

“The thought is to tailor the providers of those new accounts to the wants of those companies and the dangers they current to the Federal Reserve Banks and the cost system,” Waller defined throughout his speech.

Waller additionally emphasised that each legally eligible entity may qualify for a cost account underneath present authorized frameworks, with no adjustments to eligibility necessities.

“Funds innovation strikes quick, and the Federal Reserve must sustain,” Waller instructed convention attendees.

Ripple and Anchorage Digital, each of which filed grasp account functions in 2025, may see accelerated choices underneath the proposed framework.

Trade Leaders Collect as Fed Shifts Stance on Digital Property

The announcement drew fast consideration at a convention bringing collectively crypto executives, together with Chainlink CEO Sergey Nazarov, Coinbase CFO Alesia Haas, and Circle President Heath Tarbert, alongside Fed officers.

“The defi trade just isn’t considered with suspicion or scorn,” Waller instructed the roughly 100 private-sector innovators assembled on the Federal Reserve Board in Washington.

“Relatively, in the present day, you’re welcomed to the dialog on the way forward for funds in the USA and on our dwelling discipline—one thing that will have been unimaginable just a few years in the past,” he added.

Throughout panel discussions, Sergey Nazarov identified main interoperability challenges in the course of the convention’s opening panel on bridging conventional finance with digital property.

“Nazarov expressed appreciation for regulators’ lively function, noting the importance of getting these essential conversations on the Federal Reserve itself,” based on stay convention protection.

In the meantime, Michael Shaulov, CEO of Fireblocks, emphasised some great benefits of blockchain custody throughout panel discussions on resilience and DeFi integration.

“Bettering rules within the US are facilitating these discussions,” Shaulov said, referencing difficulties conventional financial institution IT groups face in adopting blockchain infrastructure.

Equally, Jennifer Barker of BNY Mellon emphasised the necessity for collaboration between conventional finance and DeFi to permit seamless integration.

“DeFi allows 24/7 greenback actions beforehand unimaginable for a lot of banks,” Barker famous in the course of the convention panels.

Whereas the Fed has not specified an implementation timeline for the cost account proposal, Gov. Waller indicated that Fed employees would have interaction with stakeholders to collect suggestions on the advantages and downsides earlier than finalizing the framework.

The publish Fed Proposes Letting Stablecoin Issuers Entry Banking System Straight With out Banks appeared first on Cryptonews.