The Monetary Conduct Authority has launched detailed analysis into crypto possession throughout the UK, and there are some headline-grabbing statistics.

Of explicit word is that this: regardless of Bitcoin buying and selling effectively above $110,000 when 1000’s of Britons had been polled, there’s been a pointy drop within the variety of customers who put money into digital belongings.

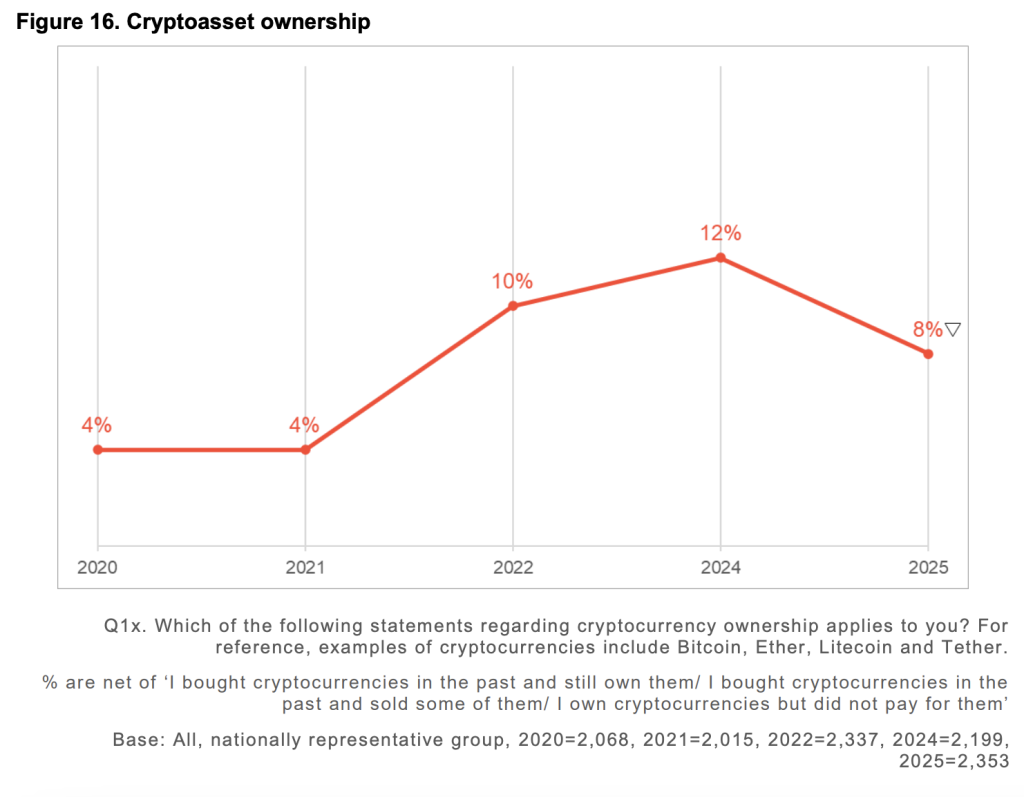

Again in 2024, this determine stood at 12% of the grownup inhabitants — the equal of about seven million folks. However based on the most recent examine, possession has now dwindled by a 3rd to eight%, a drop to 4.6 million.

Though this may seem to be a loss of life knell for crypto on the face of it, there’s loads of nuance if you delve into the numbers. For one, the FCA notes that possession has nonetheless doubled since 2021.

And right here’s one other factoid: among the many traders who’ve stored on HODLing, many at the moment are including to their positions. The variety of Britons with £1,001 to £5,000 of their pockets has jumped from 17% to 21%, whereas these with balances between £5,001 and £10,000 are up three share factors to 11%.

A slowdown in adoption displays one of many dominant themes of the present cycle: an absence of retail involvement. Latest value rises have been spurred on by institutional curiosity and purchases of Bitcoin ETFs, moderately than on a regular basis customers opening accounts on exchanges.

Nevertheless, the FCA believes Britons who’re dabbling in digital belongings are much more savvy and knowledgeable in regards to the potential risks.

“These taking part in these actions are typically extra educated, extra snug with threat, and extra conscious of our warnings than the typical crypto person.”

Usually, traders usually tend to be males, between the ages of 18 and 34, from an ethnic minority background and belong to the ABC1 demographic — which normally denotes these with increased ranges of disposable revenue.

Bitcoin’s Dominance Grows

Unsurprisingly given it’s the world’s greatest cryptocurrency, Bitcoin has probably the most model recognition amongst Britons who took half within the Monetary Conduct Authority’s survey at 79%.

Nevertheless, simply 57% of present traders really personal BTC as of 2025. This determine has been rising step by step over latest years — up 5 share factors in contrast with 2024, however far beneath the 64% seen again in 2021. We’ve additionally seen Bitcoin’s dominance, referring to its general share of the crypto market, creep up over this four-year interval.

Possession of Ether has remained fairly fixed at 43%, a determine little question boosted by this digital asset’s outperformance within the run-up to when this survey was taken. And even though it’s at present languishing behind in ninth place in CoinMarketCap’s rankings, Dogecoin seems in 20% of British crypto investor portfolios.

Low ranges of recognition of altcoins among the many British public is especially telling. Simply 8% of these polled mentioned that they had heard of Solana and XRP, falling to 7% for Chainlink and TRON, and 5% for the likes of BNB and Cardano. This powerfully illustrates how tough it may be for newer digital belongings to chop by the noise and achieve significant market share.

Regulation, and crypto corporations encouraging customers to embrace digital belongings pegged to fiat currencies as a cost methodology, helps clarify why consciousness surrounding stablecoins continues to rise — hitting 53%.

Why Are Folks Shopping for Crypto?

It’s additionally fascinating to have a look at the motivations of these dabbling in digital belongings — with those that have a family revenue of £50,000 or extra saying their fundamental ambition is to diversify their portfolio. Fascinatingly, those that have the very best annual earnings (that’s above £100,000) say they’re shopping for cryptocurrencies to be able to save for his or her retirement. That is regardless of regulatory warnings about their volatility.

So… what about those that are nonetheless sitting on the fence? The overwhelming majority of those that aren’t planning to purchase cryptocurrencies say it’s as a result of they don’t know sufficient about how they work. In the meantime, 17% consider they’re too dangerous due to value volatility — and 12% have appropriately recognized that there are few protections if one thing goes flawed. An extra 11% argue the amount of cash they must spend isn’t sufficient to make the funding worthwhile.

The Monetary Conduct Authority might have a cool angle in the direction of digital belongings, however analysis like this affords a compelling perception into the well being of the crypto sector.

The publish Fascinating Report Exposes New Traits in UK Crypto Possession appeared first on Cryptonews.