Former Citadel staff Ian Krotinsky and Aashiq Dheeraj have secured $17 million in funding for Fin, a stablecoin-powered funds app designed to allow immediate cross-border cash transfers with out the complexity of conventional crypto platforms.

In response to a Fortune report, Pantera Capital led the spherical, with participation from Sequoia and Samsung Subsequent, because the startup prepares to pilot with import-export companies subsequent month.

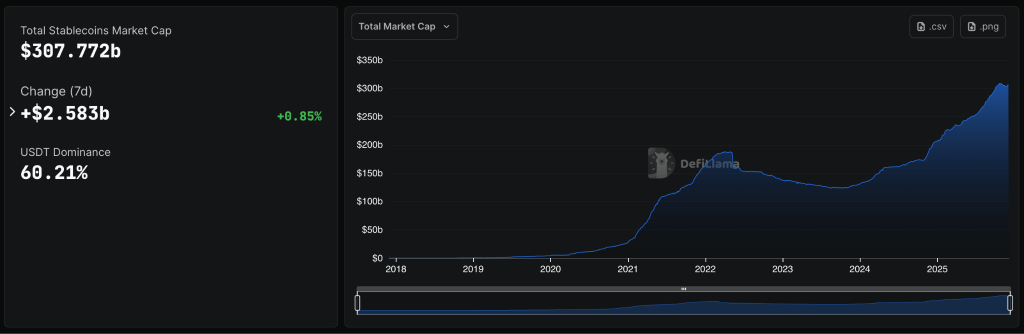

The funding arrives amid explosive development within the stablecoin sector, which now exceeds $300 billion in whole market capitalization.

Krotinsky and Dheeraj found the friction in worldwide funds whereas constructing aspect tasks at Citadel, once they tried to pay $50 to customers who reached the entrance web page of a Reddit-like platform they created.

Constructing Cost Infrastructure for Massive Transfers

Fin targets a niche in current cost methods by specializing in large-value transactions within the tons of of hundreds or hundreds of thousands of {dollars}.

The app permits customers to ship cash to different Fin customers, financial institution accounts, or crypto wallets, leveraging stablecoin rails to cut back switch charges in comparison with conventional banking channels dramatically.

Krotinsky described the platform as “constructed because the funds app of the long run,” emphasizing that it leverages the advantages of stablecoins “with out all of the complexity” and can work wherever on the planet.

The startup shared an unique walkthrough with Fortune, revealing a easy but elegant design prioritizing user-friendliness over technical jargon.

Conventional wire transfers by way of business banks can take a number of days and incur substantial charges, notably for worldwide transactions between international locations with completely different monetary methods.

Fin goals to disrupt this mannequin by providing near-instant settlement for eventualities resembling Swiss watch sellers promoting to US prospects or home transfers exceeding the bounds imposed by Venmo and Zelle, which can’t course of funds of $100,000 immediately resulting from delays or verification holds.

Income Mannequin and Aggressive Positioning

The corporate plans to generate income by way of transaction charges, although these will stay cheaper than alternate options, plus curiosity earned on stablecoins held in Fin wallets.

Whereas the app has not launched publicly, the pilot program with companies within the import-export area represents step one towards broader business availability.

Krotinsky positioned his startup in opposition to main business banks like JPMorgan Chase and Barclays quite than crypto-native opponents.

He argued that enormous monetary establishments have constructed cost merchandise incorrectly for many years and can wrestle emigrate current methods onto stablecoin rails.

“I feel now we have the chance of being the subsequent largest funds app on the planet,” Krotinsky mentioned. “Persons are going to be shocked at how shortly we transfer to get there.“

Stablecoin Sector Attracts Conventional Finance Giants

Fin’s funding follows main institutional strikes into stablecoin infrastructure.

Citadel Securities, the market maker based by Ken Griffin, invested $200 million in crypto change Kraken at a $20 billion valuation in November, deepening Wall Avenue’s dedication to digital belongings after years of hesitation over regulatory uncertainty.

The agency additionally participated in Ripple’s $500 million funding spherical alongside Fortress Funding Group, which reveals conventional finance is exhibiting curiosity in established crypto platforms as regulatory readability improves underneath the Trump administration.

Most just lately, ten main European banks fashioned a consortium to launch a euro-backed stablecoin by mid-2026, addressing considerations about overwhelming reliance on dollar-denominated tokens, which presently account for 99.58% of the worldwide stablecoin market.

Sony Financial institution plans to roll out its 1:1 USD-pegged stablecoin for funds and settlement inside its gaming and anime enterprise.#SonyBank #SonyStablecoin $USDStablecoinhttps://t.co/8wVvOWo89Z

— Cryptonews.com (@cryptonews) December 1, 2025

Sony Financial institution can also be reportedly making ready to subject a GENIUS-regulated US greenback stablecoin for American prospects as early as fiscal 2026, aiming to cut back cost charges throughout its gaming and anime companies.

Whereas there’s a large ongoing innovation in stablecoins with massive companies positioning themselves for what they see as the subsequent wave of economic revolution, Customary Chartered just lately warned that over $1 trillion might stream from emerging-market banks into stablecoins by 2028 as international adoption accelerates.

In truth, Federal regulators are additionally advancing implementation of the GENIUS Act, with the FDIC anticipated to publish its first stablecoin rule framework later this month.

Performing FDIC Chair Travis Hill confirmed the company is drafting guidelines for the way stablecoin issuers will apply for approval, with separate prudential requirements deliberate for early subsequent yr.

The put up Ex-Citadel Engineers Increase $17M for Stablecoin Funds Startup Fin appeared first on Cryptonews.