The Ethereum Basis has set a brand new technical roadmap prioritizing safety over velocity for zero-knowledge Ethereum Digital Machines (zkEVMs), establishing three vital milestones stretching via the tip of 2026.

The shift comes after zkEVM groups efficiently diminished proving instances from 16 minutes to 16 seconds whereas reducing prices by 45 instances, with 99% of Ethereum blocks now provable in below 10 seconds heading in the right direction {hardware}.

Regardless of these efficiency achievements, the muse warned that safety stays “the elephant within the room,” with many STARK-based zkEVMs counting on unproven mathematical conjectures that latest analysis has begun to disprove.

“If an attacker can forge a proof, they will forge something: mint tokens from nothing, rewrite state, steal funds,” the muse acknowledged in a December 18 submit.

zkEVMs crushed the 2025 boss: real-time proving

2026 boss: 128-bit provable safety

New weblog submit on the following stage for Ethereum zkEVMs: three milestones, paving the trail to mainnet-grade L1 zkEVMs.https://t.co/mueR1JWW6c

Sport on.— George Kadianakis (@asn_d6) December 19, 2025

Provable Safety Turns into Non-Negotiable Normal

The inspiration established 128-bit provable safety because the necessary goal for mainnet-grade zkEVMs, aligning with requirements really useful by cryptographic standardization our bodies.

The primary milestone requires zkEVM groups to combine their proof system parts with soundcalc, a newly created safety estimation device, by the tip of February 2026.

By Could 2026, groups should obtain 100-bit provable safety with ultimate proof sizes below 600 kilobytes whereas offering compact descriptions of their recursion structure.

The ultimate milestone requires 128-bit provable safety, with proof sizes restricted to 300 kilobytes, and formal safety arguments for recursion soundness by year-end 2026.

George Kadianakis from the EF cryptography workforce emphasised the strategic timing of securing zkEVM architectures earlier than they develop into shifting targets.

“As soon as groups have hit these targets and zkVM architectures stabilize, the formal verification work we’ve been investing in can attain its full potential,” he wrote.

Current cryptographic advances, together with compact polynomial dedication schemes like WHIR, strategies equivalent to JaggedPCS, and well-structured recursion topologies, now make these bold safety targets achievable.

The inspiration plans to publish detailed technical posts in January outlining proof system strategies for reaching the safety and proof dimension necessities.

Basis Expands Institutional Adoption Push

Whereas tightening technical requirements, Ethereum has concurrently accelerated institutional outreach via its new “Ethereum for Establishments” portal launched in October.

The platform guides enterprises and monetary establishments constructing on Ethereum’s infrastructure, highlighting the community’s decade-long reliability with over 1.1 million validators and steady uptime.

The inspiration emphasised privacy-preserving applied sciences, together with zero-knowledge proofs, totally homomorphic encryption, and trusted execution environments, as important for compliant institutional purposes.

“Privateness options are now not theoretical — they’re dwell and scaling in manufacturing,” the muse famous, pointing to tasks like Chainlink, RAILGUN, and Aztec Community.

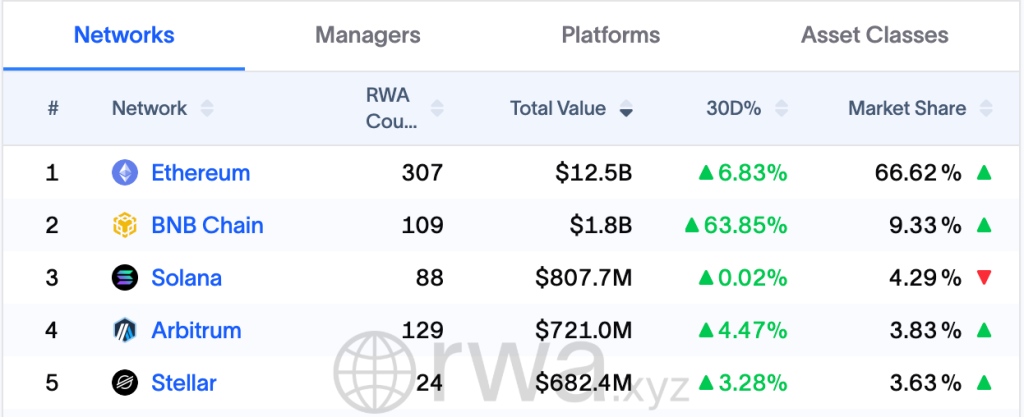

Ethereum at present hosts over 66% of all tokenized real-world property in line with RWA.xyz, with main monetary companies together with BlackRock, Securitize, and Ondo Finance deploying tokenized devices.

JPMorgan Chase just lately launched its first tokenized money-market fund on Ethereum, seeding the MONY fund with $100 million and opening it to certified buyers with minimal investments of $1 million via its Kinexys Digital Belongings platform.

The financial institution’s asset administration head, John Donohue, informed the Wall Avenue Journal there may be “a large quantity of curiosity from purchasers round tokenization,” including that JPMorgan expects to guide the area with product choices that match conventional money-market funds on the blockchain.

Simplicity Problem Emerges as Crucial Precedence

A couple of days in the past, Co-founder Vitalik Buterin recognized protocol complexity as a basic menace to Ethereum’s trustlessness in a December 18 assertion.

“An vital and underrated type of trustlessness is rising the quantity of people that can really perceive the entire protocol from prime to backside,” Buterin wrote, arguing the ecosystem ought to settle for fewer options if mandatory to enhance understanding.

@VitalikButerin says Ethereum’s trustlessness relies upon not simply on decentralization, however on how many individuals can perceive the protocol.#Ethereum #Buterinhttps://t.co/mIcGdixX8Z

— Cryptonews.com (@cryptonews) December 18, 2025

The priority resulted from the rising rigidity between superior performance and accessibility as Ethereum’s technical abstractions multiply.

“If solely 5 folks can perceive how your privateness protocol works, you haven’t achieved trustlessness, you’ve simply modified who you belief,” privacy-focused layer-2 community INTMAX acknowledged.

The inspiration acknowledged these challenges in its roadmap, describing Ethereum as “too complicated” for many customers whereas outlining plans for good contract wallets that simplify fuel charges and key administration.

In the meantime, the muse briefly paused open grant purposes for its Ecosystem Help Program in August, citing plans to shift towards extra focused infrastructure funding after awarding almost $3 million to 105 tasks in 2024 alone.

The submit Ethereum Shifts Focus From Velocity to Safety With New 2026 Deadline appeared first on Cryptonews.