Key Takeaways:

- Ethereum enters December under final 12 months’s shut, signalling rising uncertainty after a risky November.

- Liquidity stays the principle pressure driving Ethereum, and specialists warn the market is ready for exterior catalysts.

- The $3,000 month-to-month shut exhibits equilibrium, not energy, with key assist sitting round $2,800.

- A break under $2,800 may open the trail to $2,400–$2,500, in line with analysts.

- Bullish situations rely on the Fusaka improve and expectations round a possible US Ethereum ETF approval in early 2026.

- Stablecoin provide above 300 billion exhibits robust liquidity however isn't a simple bullish sign.

- Choose narratives carried out effectively in November, together with prediction markets, privateness tokens, AI and zero-knowledge sectors.

- General sentiment stays combined, and Ethereum’s December efficiency will doubtless form market tone heading into 2026.

Desk of Contents

- In This Article

Ethereum Worth Enters December in a ‘Not Bullish, Not Bearish’ State Stablecoin Progress Sparks a New Debate: Bullish or Bearish for Crypto? Not All Tokens Fell: The Narratives That Stayed Sturdy in November Conclusion Key Crypto Occasions to Watch in December 2025

- In This Article

- Ethereum Worth Enters December in a ‘Not Bullish, Not Bearish’ State

- Stablecoin Progress Sparks a New Debate: Bullish or Bearish for Crypto?

- Not All Tokens Fell: The Narratives That Stayed Sturdy in November

- Conclusion

- Key Crypto Occasions to Watch in December 2025

Present Full Information

Ethereum (ETH), because the main altcoin, typically units the tone for the remainder of the crypto market. Weak ETH normally means weak altcoins. Sturdy ETH brings curiosity again to your entire sector. The query now’s what occurs if ETH drops even decrease.

Ethereum’s December closing worth is without doubt one of the most necessary markers of the 12 months. The December candle typically turns into the place to begin of the subsequent cycle. It captures market sentiment, shapes investor confidence and units the muse for the way the asset performs within the early months of the brand new 12 months.

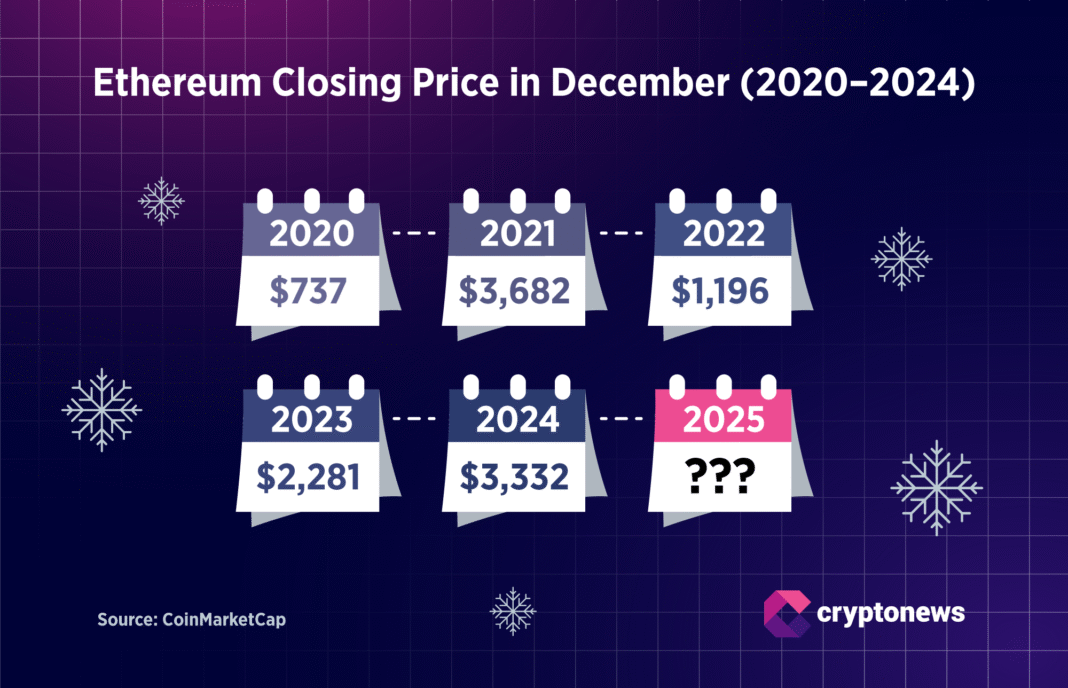

Ethereum’s efficiency since 2020, the December shut has normally elevated in comparison with the earlier 12 months. The one exception was the 2021–2022 interval. Throughout that point, ETH collapsed by practically 67.5%. Since then, the pattern has turned optimistic once more.

- From 2022 to 2023, Ethereum gained 90.7%.

- From 2023 to 2024, it added one other 46.1%.

December 2025, nonetheless, is shaping as much as be far much less simple. The present ETH worth stays under the December 2024 shut of $3,332. Market alerts are combined, and uncertainty is rising.

On this month-to-month Cryptonews report, we spoke with specialists to grasp what Ethereum and the broader altcoin market may face this December. We additionally take a look at whether or not a repeat of the 2021–2022 situation, when the value dropped by greater than 67%, continues to be on the desk.

Ethereum Worth Enters December in a ‘Not Bullish, Not Bearish’ State

November 2025 was tough for Ethereum, simply because it was for Bitcoin and the broader crypto market. Even with destructive strain from crypto and international macro, ETH managed to shut the month close to $3,000. However the wick all the way down to $2,620 seems unsettling. It wasn’t random — the market was clearly testing decrease ranges.

Cais Manai, Co-Founder and Head of Product at TEN Protocol, informed Cryptonews that Ethereum is exhibiting weak point, however this doesn’t imply bears are in management:

ETH closing the month nearly precisely at $3,000 is a reminder of the place the market sits, not bullish, not bearish, however undecided. It’s a degree that displays equilibrium reasonably than momentum. Bulls will level to the truth that ETH defended a key higher-timeframe construction, whereas bears will argue that failing to interrupt above $3,300 exhibits ETH nonetheless isn’t main the market the best way it usually does in late-cycle rotations.

Talking with Cryptonews, he additionally famous that one of many major points proper now’s the shortage of liquidity. In line with him, the month-to-month shut close to $3,000 exhibits the market is at a turning level:

Proper now, ETH isn’t sending a robust sign both manner, it’s ready on liquidity. The $3,000 shut merely marks the purpose the place each side paused. The subsequent transfer will come from exterior situations, not from something ETH is doing internally.

Eneko Knorr, CEO and founding father of Stabolut, defined to Cryptonews that Ethereum nonetheless holds a serious benefit. He believes the Fusaka improve may change into the important thing driver for ETH on the finish of 2025. One other catalyst is the anticipated approval of a US Ethereum ETF in early 2026, which can appeal to extra institutional demand:

We may see ETH’s worth enter the $6,000–$7,000 vary by the top of January, as institutional capital flocks to the sector’s most important ‘protocol economic system.’

Nevertheless, these similar components may create a bearish end result if one thing goes fallacious. Knorr notes that ETH may revisit decrease ranges underneath a number of situations:

A decline could be triggered by two key components: a big delay or failure within the Fusaka improve, which might harm developer and market confidence, or a serious macroeconomic shock that reverses danger urge for food throughout all asset courses, pushing ETH again to check robust assist round $2,500.

Manai additionally highlights the significance of the $2,800 space. If ETH fails to carry it and regain $3,000, the value could slide towards decrease helps. However even this situation wouldn’t break the bigger construction:

The bearish setup is equally clear. If the macro setting stays tight, if rate-cut expectations fade, or if rotation into BTC and high-velocity ecosystems like Solana accelerates, ETH trades closely. A break under $2,800 would affirm that and opens the door to $2,400–$2,500. That wouldn’t be a collapse, however it might reset sentiment and delay any try and retest the highs.

Stablecoin Progress Sparks a New Debate: Bullish or Bearish for Crypto?

One of many key components shaping Ethereum’s worth and the broader altcoin market proper now stays liquidity. And this brings consideration to stablecoin dynamics. In line with Artemis, the mixed stablecoin provide (by token) has stayed above 300 billion for 2 consecutive months.

This can be a notable improve in comparison with the start of the 12 months. Stablecoins play a essential position in market construction. They supply liquidity, allow quick entries and exits, and act as gasoline for any main market transfer.

Many merchants learn this stablecoins growth as a bullish sign. The “printing press” hasn’t slowed down, which may recommend the market is making ready for a extra energetic section. However stablecoins additionally accumulate throughout downturns. They can be utilized for brief positions or stored on the sidelines for future dip-buying. The query is whether or not the subsequent drop turns into a backside with a reversal or solely the start of a deeper transfer.

Stablecoin development seems bullish at first look, nevertheless it isn’t at all times that easy. Frank Combay, COO of Subsequent Era NGPES, informed Cryptonews that rising stablecoins provide displays far more complicated market habits than simple optimism. He notes that stablecoins are used not solely in bullish phases but in addition throughout corrections, each for cover and for extra aggressive buying and selling:

Typically, and the present cycle isn’t an exception, the rising provide of stablecoins isn’t a simple bullish indicator. It displays complicated buying and selling behaviors reasonably than purely optimistic sentiment. Whereas a rise typically suggests accessible shopping for energy, it will probably additionally sign defensive positioning by skilled traders in each bull and bear markets.

In line with Combay, the constant demand for stablecoins is tied extra to market infrastructure than emotion. Performance, not sentiment, is what sustains stablecoin capitalization:

Stablecoins stay in fixed demand as a result of they assist liquidity, buying and selling, and arbitrage, whereas additionally serving as a safer asset throughout downturns. Their rising market capitalization is pushed primarily by increased buying and selling exercise and the rise of perpetual derivatives that use stablecoins as collateral.

Even so, Combay cautions that stablecoin development alone doesn’t give the market a transparent route:

The robust and rising demand for stablecoins is usually a bullish indicator, nevertheless it should be thought of alongside different necessary metrics.

Not All Tokens Fell: The Narratives That Stayed Sturdy in November

Regardless of the broader market correction, a number of segments confirmed surprising energy in November. Among the many prime 100 property by market capitalization, the perfect performer was Rain (RAIN), a brand new token from the decentralized prediction markets sector.

This may provide clues about which narratives stay resilient. Nonetheless, it is very important word {that a} single outperformer doesn’t at all times symbolize the true state of a complete sector. Usually, one token can push a class increased by itself.

Curiosity in prediction markets stays noticeable, and a few trade contributors see extra room for development. Paul Thomas, Founding father of Somnia, informed Cryptonews that technological progress and extra environment friendly on-chain fashions may make prediction markets considerably extra mainstream:

I believe that prediction markets can have one other nice 12 months in 2026, and can really change into extra mainstream than they’re right this moment. We’ll additionally see a serious improve when it comes to effectivity, which might be one of many main forces driving this development.

He provides that as prediction markets migrate away from centralized components and transfer totally on-chain, new use circumstances will emerge:

When these markets are introduced on-chain, we are going to see far more complicated bets that might even be used for issues like flight insurance coverage, with vacationers betting towards their very own arrivals to make sure themselves a refund.

The second-strongest token in November was Monero (XMR), a token from the privateness funds sector. Curiosity in privateness surged after a pointy rally in Zcash (ZEC), with some within the crypto neighborhood arguing that the trade is “returning to its roots.” The narrative could proceed to develop, however these property stay excessive danger. The latest strikes have been sharp, and markets typically enter a correction after such spikes.

One other asset value noting is Web Laptop (ICP), which ranked fifth for November efficiency. The token is linked to the AI narrative, and its rise doubtless displays the broader enthusiasm round synthetic intelligence. This means the sector stays promising, though not all AI tokens will profit equally. ICP was the one AI-linked asset amongst prime performers, however the class overlaps with different narratives that might achieve momentum as AI adoption grows.

A kind of narratives is Zero Information (ZK) expertise. Terence Kwok, CEO and Founding father of Humanity Protocol, informed Cryptonews that ZK programs have gotten more and more sensible and may even see new demand in 2026:

In 2026, ZK tech stands out as a result of it’s lastly turning into sensible for on a regular basis purposes, enabling providers to confirm humanity, eligibility, or authenticity with out accessing private information.

There may be seen exercise within the sector, together with Starknet (STRK). Nevertheless, ZK tokens stay dangerous, and lots of are nonetheless deep in drawdown. It’s unclear whether or not AI-driven momentum can meaningfully revive them.

Kwok additionally notes that the rise of synthetic intelligence creates a brand new structural drawback. That is the place AI and ZK narratives intersect:

As AI accelerates the unfold of artificial identities, pretend engagement, and manipulated discourse, on-line belief turns into a structural requirement for the digital economic system, and ZK affords a technique to assist that belief whereas preserving privateness.

The concept AI and ZK can reinforce one another is compelling, even when each narratives stay excessive danger for traders.

Conclusion

Gold-pegged stablecoins have been additionally amongst November’s prime performers, which is particularly notable given Bitcoin’s absence from the record regardless of its “digital gold” fame. This means that traders are taking a cautious strategy. Bitcoin’s unsure trajectory continues to weigh on Ethereum and the broader altcoin market. If BTC stays weak, the remainder of the market will doubtless wrestle as effectively.

On the similar time, the info exhibits that some narratives and tokens proceed to carry out. Progress has change into extra selective, and merchants now must establish these pockets of energy reasonably than depend on broad market momentum. December might be an necessary month for each crypto and conventional markets. Volatility is more likely to keep excessive, making warning and precision important.

Key Crypto Occasions to Watch in December 2025

December 3

• Ethereum (ETH) Fusaka improve

December 4

• Stellar (XLM) Home Miami panel

December 5

• Renzo (REZ) token burn

December 13

• Bittensor (TAO) halving

December 15

• Starknet (STK) 127M token unlock

• Sei (SEI) 55.56M token unlock

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation.

The submit Ethereum Worth Winter Dilemma: $7,000 or $2,400? Specialists Are Break up appeared first on Cryptonews.