Ethereum is heading right into a important technical part after sliding 7.3% this week, monitoring Bitcoin’s broader market selloff. With ETH now sitting simply above a significant help cluster, merchants are asking the identical query: Is that this a breakdown in progress, or the beginning of a deeper accumulation part pushed by long-term holders?

ETH Slips as Trendline Break Alters Market Construction

Ethereum broke beneath its multi-month ascending trendline earlier this week, ending a construction that had supported each corrective transfer since spring. The failure to reclaim the breakdown zone close to $3,500 has stored the market defensive, and the descending trendline that has guided value since October continues to cap each try at restoration.

The day by day chart reinforces the shift in tone. ETH was rejected cleanly off the 20-EMA, which has now rolled downward and is appearing as dynamic resistance. Momentum indicators echo the weak spot: the RSI is pinned close to 34, sitting in bearish territory with no significant divergence to sign exhaustion.

Current candlestick habits tells an identical story. A cluster of small-bodied candles adopted by a pointy push decrease resembles the early levels of a 3 black crows formation, usually a precursor to a broader pattern continuation.

Whales Reposition: Lengthy-Time period Holders Enhance Spending

Whale habits provides one other layer to the image. In accordance with Glassnode, 3–10 yr ETH holders have elevated their spending to over 45,000 ETH per day, marking the very best degree since February 2021.

Traditionally, this shift has occurred close to main market turning factors, both throughout the early levels of deeper pullbacks or forward of multi-month accumulation phases.

Since late August, as Ethereum pulled again from its new peak, 3–10 yr holders have ramped up their common day by day spending to >45K ETH/day (90D-SMA).

This marks the very best spending degree by seasoned traders since Feb 2021.https://t.co/EO1LpkLbmL pic.twitter.com/eMw5rKteTX

— glassnode (@glassnode) November 14, 2025

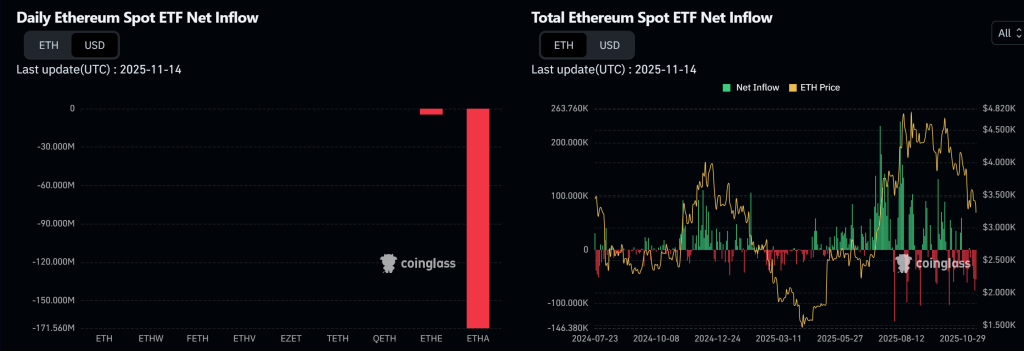

ETF exercise has additionally cooled. Current Coinglass knowledge reveals that ETH-focused funds logged considered one of their largest single-day outflows this quarter, reinforcing the defensive stance amongst establishments. Taken collectively, the on-chain and circulate knowledge recommend giant gamers are repositioning fairly than panic-selling, however they’re not including aggressively both.

Ethereum (ETH/USD) Key Ranges: Is $2,730 the Remaining Protection Earlier than a Slide to $2,110?

Ethereum value prediction is bearish as ETH is hovering above $2,730, a help band that acted as a springboard in late Might. Whereas a response from this zone is feasible, the broader technical geometry leans towards additional draw back until consumers reclaim the $3,500 breakdown level.

A possible state of affairs is a brief rebound into the underside of the damaged trendline, basically a traditional retest, adopted by one other transfer decrease towards the high-liquidity area round $2,110.

For novice merchants, the cleanest setup is to keep away from calling the underside and as an alternative look ahead to affirmation:

- Bearish continuation: A day by day shut beneath $2,730 exposes $2,110, the place deeper liquidity might appeal to consumers.

- Bullish reversal: A reclaim of $3,500 invalidates the breakdown and opens a path towards $3,960.

Till considered one of these triggers fires, ETH stays inside a corrective channel, the place endurance, not prediction, stays essentially the most disciplined place.

Bitcoin Hyper: The Subsequent Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a brand new part to the Bitcoin ecosystem. Whereas BTC stays the gold customary for safety, Bitcoin Hyper provides what it at all times lacked: Solana-level velocity. The outcome: lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Seek the advice of, the venture emphasizes belief and scalability as adoption builds. And momentum is already robust. The presale has surpassed $27 million, with tokens priced at simply $0.013265 earlier than the subsequent enhance.

As Bitcoin exercise climbs and demand for environment friendly BTC-based apps rises, Bitcoin Hyper stands out because the bridge uniting two of crypto’s largest ecosystems. If Bitcoin constructed the inspiration, Bitcoin Hyper might make it quick, versatile, and enjoyable once more.

Click on Right here to Take part within the Presale

The put up Ethereum Worth Prediction: ETH Dropped 7.3% This Week Following BTC’s Nostril Dive – What Do the Whales Do? appeared first on Cryptonews.