Ethereum (ETH) has reclaimed the $4,500 degree, gaining 0.54% up to now 24 hours with a market capitalization of $543.9 billion. The renewed momentum follows a shift in international financial sentiment as merchants weigh the Federal Reserve’s path for rates of interest and anticipate contemporary easing that might enhance digital property like Ethereum.

Dallas Fed President Lorie Logan stated Thursday that whereas the central financial institution’s September quarter-point fee lower was justified to cushion a cooling labor market, policymakers should stay cautious to not overstimulate the economic system. Inflation stays above goal, and rising tariffs may result in greater costs within the quick time period.

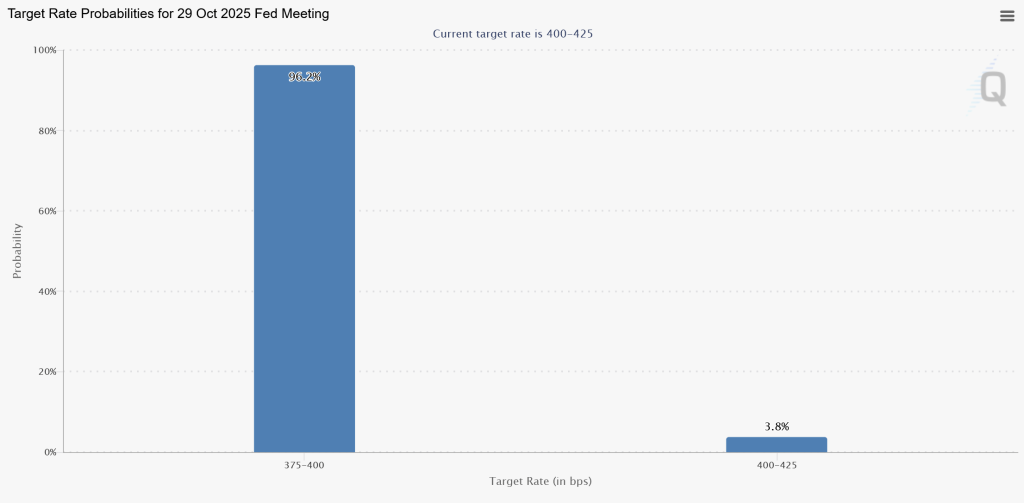

Nonetheless, markets stay assured that the Fed will proceed with additional cuts. CME Group’s FedWatch Device now assigns a 97% likelihood of a 25-basis-point lower in October, and an 85% likelihood of one other discount by December.

The postponed non-farm payrolls report, because of the U.S. authorities shutdown, hasn’t deterred merchants, who’re as an alternative counting on different information pointing to a gradual softening of labor markets.

Why Price Minimize Bets Are Fueling ETH’s Momentum

Expectations of decrease rates of interest have change into one of many strongest macro tailwinds for Ethereum. When borrowing prices fall, traders usually shift from yield-bearing property into riskier, growth-oriented property, similar to expertise shares and cryptocurrencies. For Ethereum, this shift means extra liquidity flowing into each the token itself and its surrounding decentralized finance (DeFi) ecosystem.

Ethereum, particularly, tends to learn as a result of it underpins most blockchain purposes, from stablecoins to NFTs and staking protocols. As real-world yields ease, ETH staking — which at the moment provides an estimated annualized return of three–4% — turns into comparatively extra engaging. This helps clarify why Ethereum has outperformed smaller altcoins in current weeks.

Rising institutional participation additionally amplifies this dynamic. Funds anticipating simpler financial situations usually rebalance portfolios towards long-term innovation property. If fee cuts materialize, capital inflows into Ethereum-based ETFs, staking merchandise, and DeFi platforms may broaden additional, reinforcing ETH’s standing because the second-largest asset available in the market and a key barometer for crypto liquidity cycles.

Ethereum Worth Prediction – Technical Outlook

Technically, the Ethereum value prediction stays bullish as ETH consolidates above $4,500, holding agency inside a rising parallel channel shaped since late September. The chart reveals a sample of upper highs and better lows, underpinned by a bullish SMA crossover — with the 50-period common ($4,372) now above the 100-period ($4,294).

Momentum indicators stay supportive. The RSI close to 58 alerts the market has cooled from overbought ranges however nonetheless holds optimistic traction. Current candlesticks present smaller our bodies and several other Doji formations, indicating transient consolidation after a robust rally.

Ethereum holds regular above $4,500, using a robust uptrend inside an ascending channel. RSI cooling close to 58 hints at wholesome consolidation — a bounce from $4,440–$4,420 may gasoline the subsequent leg towards $4,675–$4,765. #Ethereum #ETH #Crypto pic.twitter.com/JxjWCnrAAL

— Arslan Ali (@forex_arslan) October 4, 2025

A possible bounce from the decrease trendline close to $4,440–$4,420 may supply a horny buy-the-dip setup, concentrating on resistance at $4,675–$4,765. For draw back safety, stops could also be positioned under $4,375, aligning with the short-term help degree.

A break under that might expose $4,200, although so long as Ethereum maintains its channel, the bias stays upward.

Presale Maxi Doge ($MAXI) Blends Meme Energy With Gymnasium-Bro Power

Maxi Doge ($MAXI) is a meme-fueled token designed for degens who thrive on 1000x leverage and relentless hustle. Greater than only a meme coin, $MAXI represents a community-driven tradition that fuses buying and selling depth with gym-bro vitality, caffeine, and aggressive camaraderie.

By holding $MAXI, traders unlock staking rewards, buying and selling contests, and entry to gamified accomplice occasions. The good contract has been audited by SolidProof and Coinsult, giving added confidence within the undertaking’s foundations.

Momentum is powerful. The presale has already raised over $2.7 million, with tokens priced at simply $0.0002605. This determine will rise because the presale progresses, making early entry extra engaging.

$MAXI holders acquire entry to:

- Staking rewards with dynamic APYs

- Buying and selling contests with leaderboard prizes

- Group-driven accomplice occasions and future integrations

You should purchase $MAXI on the official Maxi Doge web site utilizing ETH, BNB, USDT, USDC, or a financial institution card.

Go to the Official Maxi Doge Web site Right here

The put up Ethereum Worth Prediction: $4,500 Reclaimed – Why Rising Price Minimize Expectations Are Now Fueling ETH’s Momentum appeared first on Cryptonews.