Ethereum is experiencing one in all its greatest declines this cycle, dropping towards $2,400 as the broader crypto market turns cautious. Whereas Bitcoin and different main altcoins are additionally falling, Ethereum’s losses are steeper in proportion phrases.

ETH has dropped about 9 to 10% within the final 24 hours, and buying and selling quantity has jumped above $50 billion. This implies panic promoting somewhat than regular profit-taking. Low liquidity and excessive leverage have made the sell-off worse, dashing up losses because the weekend approaches.

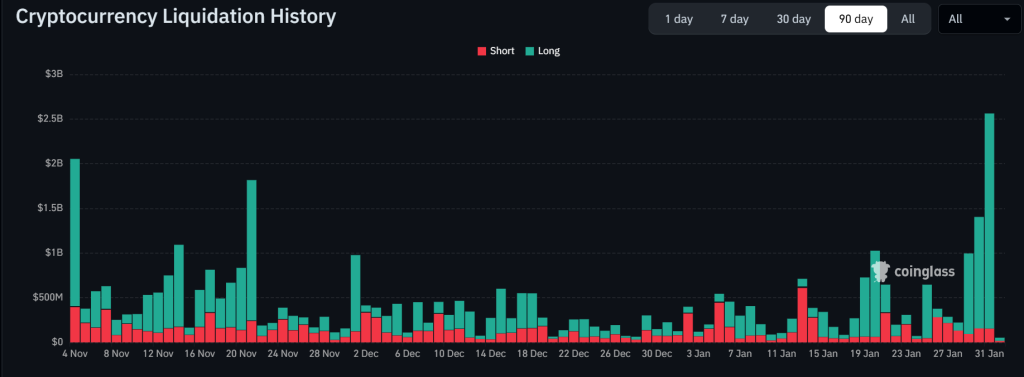

$2.5Billion Liquidations and Massive Holder Promoting Are Pushing Costs Down

Aggressive compelled liquidations have pushed the sell-off. Over $2.5 billion in crypto positions had been worn out in at some point, with Ethereum making up the largest portion. As a result of many merchants had been betting on costs going up, ETH grew to become weak when key help ranges broke, resulting in a wave of margin calls.

In the meantime, massive buyers and establishments have added to the promoting stress. After months of shopping for, massive holders at the moment are lowering their positions. ETF flows and derivatives additionally present that buyers are attempting to decrease their threat. As the whole crypto market cap drops towards $2.6 trillion and concern ranges keep excessive, market sentiment remains to be weak.

Ethereum Value Outlook: ETH Drops to $2,400 as Downtrend Speeds Up

Trying on the charts, Ethereum value prediction is clearly in a bearish part. The day by day chart reveals ETH caught in a downward channel that has formed its value since late 2025. The worth was rejected on the $3,200 to $3,300 space, slightly below the falling 100-day and 200-day transferring averages, ending the final try and stabilize.

When ETH fell beneath $2,800, which had been a key help stage, it confirmed that the downtrend is continuous. Current value bars present sturdy promoting stress, with little signal that sellers are operating out of steam.

Momentum indicators additionally present weak spot. The RSI has fallen into the mid-20s, which suggests ETH is deeply oversold however there are not any indicators of a reversal but. In sturdy downtrends, this normally means promoting might proceed for now.

Essential Value Ranges and What to Count on Subsequent

attainable value paths, there are two principal situations. ETH might see a short-term bounce as much as $2,600 to $2,700, the place outdated help and the decrease channel now act as resistance. If ETH can’t transfer above that space, costs might fall to $2,250 subsequent, and presumably $2,100 if promoting picks up.

A extra constructive outlook will take time. Ethereum wants to carry above $2,400, set a better low, and shut above $2,800 to start out a restoration towards $3,100 to $3,300 afterward. For now, ETH appears to be going via a leverage reset, which is hard however typically wanted earlier than a stronger restoration can occur.

Bitcoin Hyper: The Subsequent Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a brand new part to the BTC ecosystem. Whereas BTC stays the gold normal for safety, Bitcoin Hyper provides what it at all times lacked: Solana-level pace. The consequence: lightning-fast, low-cost sensible contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Seek the advice of, the challenge emphasizes belief and scalability as adoption builds. And momentum is already sturdy. The presale has surpassed $31.4 million, with tokens priced at simply $0.013665 earlier than the subsequent improve.

As Bitcoin exercise climbs and demand for environment friendly BTC-based apps rises, Bitcoin Hyper stands out because the bridge uniting two of crypto’s greatest ecosystems. If Bitcoin constructed the inspiration, Bitcoin Hyper might make it quick, versatile, and enjoyable once more.

Click on Right here to Take part within the Presale

The publish Ethereum Value Prediction: $2.5B Liquidated as ETH Slides to $2,400 – Is $2,100 Subsequent? appeared first on Cryptonews.