Key Takeaways:

- Fartcoin led April’s meme coin rally with a 145% worth bounce, however consultants warning that the sector stays fragile and closely depending on Bitcoin’s efficiency.

- Sui stood out amongst L1s with a 56% acquire, supported by sturdy DeFi metrics and stablecoin integration, although token unlocks might carry near-term volatility.

- AI tokens continued to achieve traction, with Bittensor and Digital Protocol amongst April’s prime performers, however analysts warn that sustained progress will rely upon real-world adoption.

The final days of April gave merchants motive to be hopeful. Bitcoin (BTC) climbed again above $90,000, serving to elevate sentiment throughout the broader crypto market. As BTC rebounded, altcoins adopted.

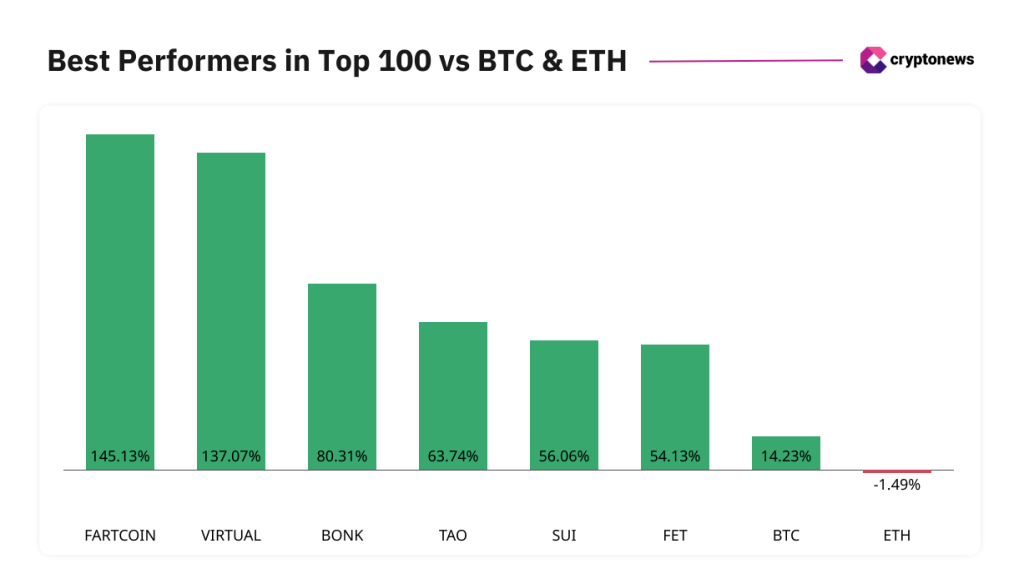

Among the many prime 100 tokens by market capitalization, Fartcoin (FARTCOIN) led the month-to-month positive aspects with a 145% enhance in April. One other meme coin, Bonk (BONK), additionally made the highest three with an 80% rise. The renewed curiosity in such high-risk belongings could sign that merchants are once more prepared to tackle extra publicity after steep losses in March and April.

The Synthetic Intelligence (AI) sector additionally noticed sturdy momentum. Three AI-related tokens, Virtuals Protocol (VIRTUAL), Bittensor (TAO), and Synthetic Superintelligence Alliance (FET), all landed within the prime 10 month-to-month performers.

Sui (SUI), a Layer 1 blockchain token, additionally stood out with a 56% acquire. For this April altcoin recap, Cryptonews spoke with consultants about what may form the market in Could.

Desk of Contents

- In This Article

Meme Cash Again in Play? FARTCOIN Leads with 145% Bounce 'Indicators Recommend Sui Is on the Verge of Inflection Level' What Are the Value Predictions for AI Tokens After Their April Growth? What to Count on in Could Key Altcoin Occasions to Watch in Could 2025

- In This Article

- Meme Cash Again in Play? FARTCOIN Leads with 145% Bounce

- 'Indicators Recommend Sui Is on the Verge of Inflection Level'

- What Are the Value Predictions for AI Tokens After Their April Growth?

- What to Count on in Could

- Key Altcoin Occasions to Watch in Could 2025

Present Full Information

Meme Cash Again in Play? FARTCOIN Leads with 145% Bounce

April introduced a wave of pleasure to the meme coin market. Fartcoin surged by 145% and shortly grew to become one of the crucial talked-about tokens of the month. However whereas some merchants see this as an indication of revival, consultants say it’s nonetheless too early to name it a full comeback.

Matas Čepulis, Founder & CEO of LuvKaizen, advised Cryptonews that the sector is displaying indicators of life, however total, “it’s removed from restoration nonetheless.” Whereas a number of tasks like FARTCOIN are gaining traction, many in style tokens, together with Pepe (PEPE), stay nicely beneath their all-time highs.

Čepulis attributes FARTCOIN’s breakout efficiency to its fast-growing social media presence and strategic execution:

Fartcoin obtained insane traction and flooded social media immediately whereas creating FOMO. The crew performed very nicely on the execution, market making, listings — and obtained immediate traction.

Nonetheless, the professional notes that almost all different meme cash failed to point out any significant restoration in April:

Sadly, Murad’s tokens like SPX6900, Retardio, Sigma and others are nonetheless down exhausting with zero to no optimistic restoration within the final month.

The general image stays difficult by Bitcoin’s dominance. Based on Čepulis, when BTC is climbing, altcoins usually battle to maintain up, and when it drops, they have a tendency to fall even tougher. “Memes are those who get the most important pink candle,” Čepulis mentioned.

‘Indicators Recommend Sui Is on the Verge of Inflection Level’

Amongst Layer-1 protocols, Sui emerged as an surprising chief in April. It outperformed each Solana (SOL) and Ethereum (ETH) in worth positive aspects, regardless of lingering market volatility. Nonetheless, some consultants warning towards untimely optimism.

Jason Tucker-Feltham, CEO of the Stablepor platform, advised Cryptonews that Sui’s current rally could also be partly attributable to timing, and never simply fundamentals. The broader market hasn’t seen a powerful altcoin season but, and international financial uncertainty continues to weigh on sentiment:

The market has nonetheless but to see a convincing altcoin season, and with unstable macro developments, we might proceed to see volatility throughout your entire crypto market.

Nonetheless, Tucker-Feltham sees optimistic alerts in Sui’s improvement technique. He believes stablecoins might be a key theme for 2025 and sees their integration on Sui as a progress catalyst:

Integration of Circle’s USDC on Sui units the stage for real-world funds. Stablecoins on Sui, coupled with the cross-chain capabilities enabled by Sui Bridge, might see it take a extra significant chew out of the worldwide stablecoin alternative.

Kelghe D’Cruz, CEO of Pairs, factors to encouraging on-chain knowledge:

Key indicators would recommend that Sui is on the verge of an inflection level. Transaction counts and pockets progress sign rising person engagement, whereas rising DeFi TVL interprets into extra belongings, extra trades, and extra demand.

He additionally highlights the significance of strategic partnerships that assist strengthen the broader Sui ecosystem. However regardless of these positives, D’Cruz warns of a number of dangers that might decelerate momentum:

Nonetheless, it’s not all easy crusing. The Transfer language, whereas modern, carries safety dangers attributable to its relative newness. Regulatory strain on DeFi’s yield mechanics might additionally sluggish momentum. And liquidity fragmentation throughout chains may dilute capital effectivity.

24h7d30d1yAll time

What Are the Value Predictions for AI Tokens After Their April Growth?

April was a powerful month for the AI token sector. Three synthetic intelligence–linked tasks landed within the prime 10 gainers throughout the crypto market. Virtuals Protocol led the surge with a 137.07% acquire. TAO adopted with almost 64%, serving to elevate your entire phase. On condition that TAO stays the most important AI-focused token by market cap, its progress seemingly performed a key position in driving the sector ahead.

In a dialog with Cryptonews, Abbas Abdul Sater, Head of Gross sales at Capital.com, pointed to TAO’s restricted provide as a significant factor behind its attraction:

There’s solely 21 million TAO tokens in whole. That sort of exhausting cap naturally creates shortage — and in crypto, shortage could be a highly effective driver of worth.

He famous that TAO at present holds a market cap of round $3 billion, with a completely diluted valuation of $6.8 billion. A pointy uptick in buying and selling quantity suggests rising investor curiosity, however Abdul Sater additionally urged warning:

It’s not but clear if that is only a hype-driven rally or one thing extra elementary. We’re watching intently to see if this momentum holds.

Abdul Sater added that TAO’s current progress could have been supported by the launch of a brand new system often known as the SN44 Rating. This software expands TAO’s utility by introducing real-world video knowledge integration, and one thing buyers are beginning to discover:

Integrating real-world video knowledge is an enormous step. It’s opened up a brand new use case for TAO, and buyers are paying consideration.

Whereas the tech continues to be in its early phases, Abdul Sater says many gamers are already “taking positions upfront,” betting on long-term potential. Nonetheless, the sustainability of the development will rely upon how real-world adoption unfolds. If demand for utilized AI use circumstances continues, TAO might strengthen its lead within the sector.

Different AI tokens, exterior of VIRTUAL TAO and FET, additionally posted positive aspects in April. In the meantime, among the many prime AI tokens by market cap, solely Web Laptop and Story posted damaging returns. NEAR Protocol (NEAR), which has positioned itself as AI-compatible, ended April with a modest 0.65% enhance.

What to Count on in Could

Could has began with indicators of cooling after a turbulent April. The meme coin market nonetheless attracts consideration, notably following the surge in Fartcoin. Nonetheless, the dearth of sturdy fundamentals and continued reliance on Bitcoin could restrict additional upside.

Within the Layer-1 sector, Sui continues to face out because of bettering DeFi metrics and an increasing stablecoin ecosystem. The danger of a sell-off following its Could 1 token unlock stays a priority.

AI tokens are additionally holding the highlight. Sustained demand for TAO and technical updates just like the SN44 Rating might assist the present uptrend. Nonetheless, a lot will rely upon whether or not short-term hype turns into lasting momentum.

Key Altcoin Occasions to Watch in Could 2025

- Could 5: Hyperliquid Price & Staking Tier Replace. New construction for charges and staking goes stay, probably affecting liquidity on the platform.

- Could 6: Aave aUSDC MetaMask Card Dialogue. Governance debate on whether or not aUSDC ought to be built-in as a spendable token for MetaMask Card customers.

- Could 7: Pet.enjoyable Launch. A brand new meme coin-focused launchpad anticipated to draw speculative curiosity and check meme market momentum.

- Could 22: SEC Altcoin ETF Resolution Deadlines. Vital rulings anticipated on ETF filings tied to XRP and different altcoins — potential market mover relying on consequence.

The submit Ethereum Value Consolidates Close to $1,800 Whereas US Financial system Is Unsure: Good Buyers Wager on Digital Belongings appeared first on Cryptonews.