Ethereum (ETH) took the highlight within the crypto market in July, as company holdings logged their largest month-to-month improve on report.

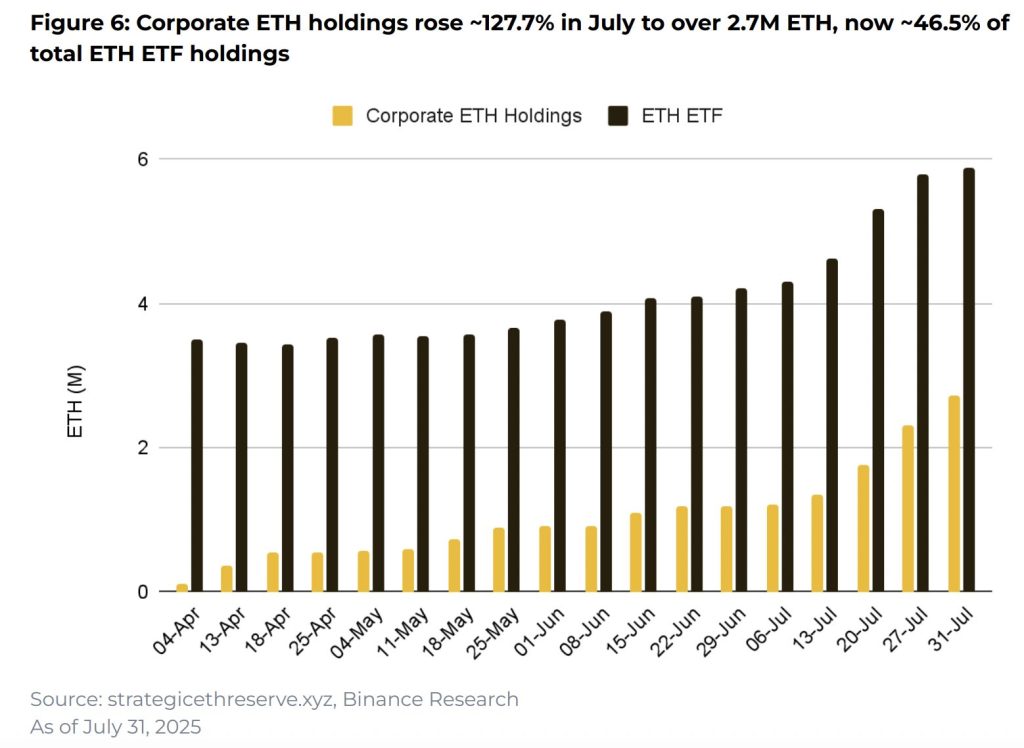

Binance Analysis stated in its month-to-month market insights report that balances held by firms climbed about 127% to greater than 2.7m ETH ($11.6b).

The rally was accompanied by a rise within the variety of firms holding Ethereum on their books. Twenty-four new entities joined the ranks, bringing the whole to 64.

Collectively, these corporates now maintain roughly 46.5% as a lot ETH as exchange-traded funds, which noticed their very own property rise 39.5% to over 5.8m ETH, the report stated.

Company ETH Reserves Outpace Ethereum Basis as Adoption Accelerates

This surge displays a shift towards direct Ethereum publicity, transferring past passive ETF allocations. Some firms now maintain extra ETH than the Ethereum Basis itself. Bitmine leads with 1.1m ETH, adopted by Sharplink with 521,000 ETH.

Further disclosures are anticipated within the coming months, as extra companies reveal comparable methods. The Ether Machine was a notable late-July entrant, reflecting the momentum in company ETH adoption.

This buildup in holdings coincided with robust market efficiency. Ethereum rose greater than 50% through the month, turning into one of many best-performing large-cap digital property. The ETH-to-Bitcoin ratio hit a six-month excessive of 0.032, signaling renewed energy relative to Bitcoin as traders rotated capital.

Ethereum’s Staking Yield and Deflationary Design Draw Company Consumers

Whereas company Bitcoin treasuries have been within the highlight for some time, many of those new Ethereum methods seem impressed by Michael Saylor’s playbook.

Nevertheless, they’re additionally leveraging Ethereum’s distinctive attributes, resembling staking rewards, a deflationary provide mechanism and its position as the first collateral in decentralized finance.

Regulatory tailwinds have added to the attraction. The US SEC’s implicit recognition of ETH as a commodity, mixed with the passage of landmark stablecoin laws, has boosted confidence within the asset’s long-term viability.

July Brings Strongest Institutional Demand for ETH to Date

The development is unfolding towards a backdrop of wider market positive aspects. Binance Analysis reported that world cryptocurrency market capitalisation rose 13.3% in July 2025. The climb was pushed by Bitcoin setting repeated all-time highs, surging institutional curiosity in Ethereum and main altcoins, report ranges of company treasury adoption, and stronger regulatory readability.

Though Bitcoin remained a dominant drive, July noticed a transparent rotation into altcoins, led by Ethereum. The asset drew inflows from each spot ETFs and company treasuries desirous to seize extra staking yield, reinforcing its position within the evolving digital asset combine.

Ethereum’s market share rose to 11.8%, whereas Bitcoin’s dominance slipped to about 60%. The month additionally marked a report 19 consecutive days of optimistic internet inflows into Ethereum spot ETFs, underscoring sustained investor demand.

The outlook for company Ethereum adoption stays promising, although the market continues to be maturing.

Greater volatility in contrast with Bitcoin may take a look at the sturdiness of those treasury methods, however for now, Ethereum’s attraction amongst institutional and company consumers seems to be rising at its quickest tempo but.

The publish Ethereum Led July Rally as Company Holdings Surged 127% to 2.7M ETH: Binance appeared first on Cryptonews.