Key Takeaways:

- Ethereum value outlook stays weak, with analysts anticipating a troublesome month and no clear indicators of a near-term rebound.

- A drop beneath $2,000 is feasible, as ETH continues to underperform Bitcoin throughout market corrections.

- The hole between Ethereum’s robust fundamentals and its value motion persists, regardless of its central function in crypto infrastructure.

- Bitcoin’s habits stays the important thing driver. Till BTC exhibits stability, strain on Ethereum and altcoins is prone to proceed.

- Privateness cash have re-entered the highlight, led by Zcash and Monero, as regulatory strain and surveillance considerations develop.

- For Ethereum, the difficulty is timing, not relevance. Lengthy-term confidence stays, however the short-term outlook stays cautious.

Pessimism has returned to the market. Issues look weaker now, and traders are beginning to really feel it once more.

Ethereum value seemed bullish again in January. ETH even managed to climb above $3,300 for a short while. That optimism has pale. The chance is now a lot clearer, and shedding the $2,000 degree is now not a distant state of affairs.

This brings again a well-recognized situation, one which has been mentioned repeatedly over time. The disconnect between Ethereum’s energy as an ecosystem and the efficiency of its token.

Ethereum has change into the spine of crypto infrastructure. Many main tasks wouldn’t exist with out it at present. But the value of ETH nonetheless fails to replicate that function.

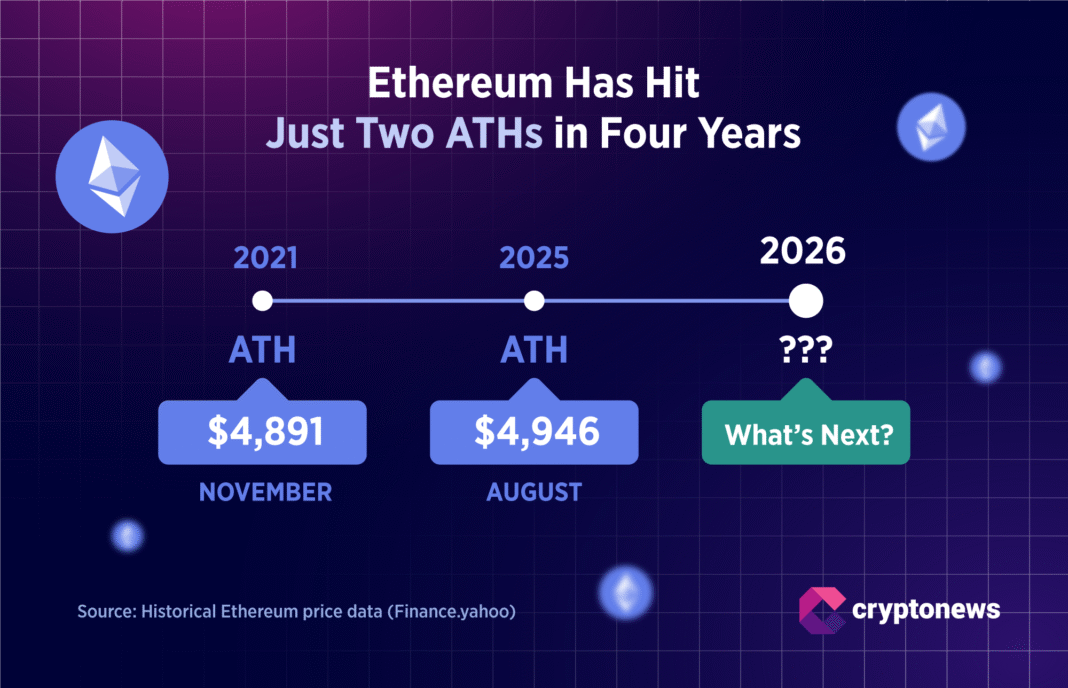

Over the previous 4 years, Ethereum has set solely two new all-time highs, one in 2021 and one other in 2025. There was little distinction between the 2. In 2025, ETH by no means managed to interrupt above $5,000, regardless of widespread expectations that it will.

Analysts proceed to level to Ethereum’s significance as an ecosystem. In the long term, forecasts stay optimistic. However the value tells a unique story, and the outlook right here is way much less convincing. Some analysts nonetheless imagine ETH can carry out effectively this 12 months, but expectations for the close to time period are noticeably extra cautious.

On this month’s Cryptonews report, we spoke with specialists about what to anticipate from Ethereum value and altcoins within the weeks forward, and why persistence might matter greater than optimism proper now.

A Acquainted Setup From Final Yr

Earlier than wanting forward, it helps to look again a couple of 12 months. The setup feels acquainted, even when the timing shouldn’t be precisely the identical.

In December 2024, the crypto market peaked alongside Bitcoin, which climbed above $110,000 for the primary time. The broader market had been trending greater since August, using a gradual uptrend. Then momentum pale, and costs began to roll over.

By February 2025, Bitcoin had dropped to round $97,000, whereas Ethereum was buying and selling close to $2,800. These ranges are usually not removed from the place the market stands at present. The distinction lies in how shortly issues performed out. In 2026, costs have already moved nearer to the decrease finish of these ranges.

Among the many high 10 cryptocurrencies by market capitalization, Solana was hit the toughest. A 12 months in the past, SOL was buying and selling close to $200. At present, it sits nearer to $90.

In a separate Bitcoin report, Cryptonews famous that in April 2025, Bitcoin discovered a backside close to $74,000. A restoration adopted, ultimately pushing Bitcoin to a brand new all-time excessive. Solely after that rebound did Ethereum start to maneuver greater, one thing it had struggled to do for years. That sequence feels related once more.

The market has been below strain since October 2025, a month many now describe as a crypto crash. The timing is totally different this time, however the backdrop feels acquainted. Each downturns adopted Donald Trump’s taking workplace. Now, the strain is even heavier. Macroeconomic uncertainty, tariffs, and geopolitics are all weighing on crypto directly.

Why Ethereum Value and Crypto Really feel Extra Fragile

Talking with Cryptonews, Gavin Thomas, CEO and co-founder of TEN Protocol, defined why Bitcoin and the broader crypto market are at present extra delicate than conventional belongings:

Geopolitical tensions are usually not easing up and with crypto being a 24h buying and selling trade the Bitcoin actions are doubtlessly an early indicator of how world TradFi markets are going to react once they open.

Thomas added that this atmosphere is extra prone to scare smaller holders than massive gamers. Huge traders, he stated, are extra inclined to maintain accumulating. That features Michael Saylor, one in all Bitcoin’s most vocal supporters:

Will probably be the smaller holders promoting into the Bitcoin slide while mega whales will proceed to build up. Chatter round MicroStrategy’s Bitcoin place being underwater might be taking part in on many individuals’s minds however the actuality is Saylor has loads of choices accessible to handle their threat and keep away from compelled promoting.

For now, the main target stays on Bitcoin. How consumers reply to corrections issues. If Bitcoin exhibits stability and energy, Ethereum might get its likelihood to get well.

If Bitcoin continues to battle, strain will unfold throughout the crypto market. There could also be exceptions. Some tokens can nonetheless rally sharply, even towards the pattern. However for Ethereum, every part nonetheless relies on Bitcoin.

How Low Might Ethereum Value Fall?

Thomas stated Ethereum might fall beneath the $2,000 degree. He additionally defined why ETH at present feels extra fragile than Bitcoin:

Ethereum has all the time been extra risky than Bitcoin. Ethereum might effectively hit $1,800 as a result of it traditionally underperforms in comparison with Bitcoin.

Increasing on that view, Thomas stated a drop beneath $2,000 wouldn’t be shocking. A robust rebound, nonetheless, appears to be like unlikely within the close to time period.

Ethereum might proceed to battle for now. New value peaks are most likely off the desk this month. On the similar time, he harassed that the broader image has not modified.

That stated, the Ethereum ecosystem continues to develop, innovate and appeal to the eye of establishments who’re prepared to maneuver a few of their enterprise on-chain. There are only a few alternate options to Ethereum for corporations critical about utilizing blockchain expertise.

This structural energy is unlikely to translate into a brand new all-time excessive anytime quickly. Thomas believes that second will come later.

As a substitute it is going to strengthen Ethereum’s rally on the again finish of this present cycle.

An identical view was shared by Tanisha Katara, a blockchain governance marketing consultant and researcher for Avail, Filecoin, and Polygon. She stated she doesn’t anticipate a significant upside transfer from the market this month both.“

I’ve seen this film earlier than in 2018, March 2020, and post-FTX. Every time felt like the tip; every time created generational entry factors for these with conviction and persistence. This month, I’m not seeing the structural circumstances for a V-shaped restoration.

Katara added that corrections like this all the time really feel uncomfortable. That doesn’t make them uncommon:

Nevertheless, in the long term, this can repay, and I’m an knowledgeable optimist about that.

Knowledge from Curvo.eu exhibits that Ethereum’s final robust efficiency 12 months was 2023, when ETH gained roughly 86%. The standout 12 months stays 2021, when Ethereum surged by 436%.

In contrast, 2025 now ranks amongst Ethereum’s weaker years, with a decline of round 21.5%. Within the context of the broader crypto market, the place sharp corrections are frequent, this drop shouldn’t be excessive. It has been disappointing for a lot of traders. Expectations for 2025 have been excessive. A brand new all-time excessive close to $5,000 was extensively anticipated. Thus far, that state of affairs has didn’t materialize.

The place the Market Is Wanting Now

Since October, privateness cash have been quietly transferring again into focus. The rally began with Zcash, then unfold to Monero. What was as soon as a sidelined area of interest has become one of many extra talked-about segments of the market.

Specialists say the renewed curiosity shouldn’t be random. Rising regulatory strain, tighter compliance guidelines, and rising considerations round surveillance are pushing some traders towards privacy-focused belongings. That stated, the broader market nonetheless issues. Sentiment stays fragile, and privateness cash are usually not resistant to wider crypto tendencies.

Cais Manai, CPO and co-founder of TEN Protocol, informed Cryptonews that what we’re seeing now appears to be like extra like a structural shift than a short-lived commerce:

After years on the sidelines, crypto privateness has staged probably the most convincing sector comebacks available in the market. Since autumn 2025, privacy-focused belongings have been among the many strongest performers in crypto, outperforming many large-cap tokens throughout a interval of broader market weak point. This isn’t a short-term anomaly. It displays a deeper shift in how traders, customers, and establishments are eager about transparency, surveillance, and the way forward for blockchain infrastructure.

Manai added that the latest rally in privateness cash following Zcash should be in its early levels:

The important thing takeaway for traders is that crypto privateness is now not a contrarian aspect wager. It’s turning into a core design requirement for on-chain programs working in a surveilled world. The rally that started in late 2025 appears to be like much less like a peak and extra just like the opening section of an extended structural repricing.

Eneko Knorr, CEO of Stabolut, shared his view that the rally in privateness cash displays rising rigidity between the crypto market and regulators:

Monero and Zcash are rallying as a result of they’re the one sincere cash left, however let’s be actual: we’re heading for a road struggle. Governments hate what they will’t management, so they may proceed bullying centralized exchanges into delisting these tokens to choke off their liquidity.

Not all specialists are equally optimistic. Tanisha Katar urged traders to separate short-term value motion from long-term fundamentals. On the similar time, Katara famous that privacy-focused applied sciences are prone to hold evolving, even when their function in regulated markets stays restricted:

Privateness cash like Monero and Zcash are having a second, however I’d separate the value motion from the funding thesis. Privateness cash resolve for anonymity — hiding who you might be totally. That works for sure use instances, however it’s essentially incompatible with institutional adoption. You may’t fulfill AML (anti-money laundering) necessities with a coin designed to make transactions untraceable. That’s why we’re seeing delistings and the EU’s 2027 ban on privateness cash from regulated platforms.

Privateness cash are usually not the one space drawing consideration proper now. Alongside renewed curiosity in anonymity, one other a part of the market is transferring in the other way. As regulation tightens, some traders are leaning into readability reasonably than avoiding it. That is the place euro-pegged stablecoins come into focus.

Frank Combay, COO of Subsequent Era NGPES, informed Cryptonews that the EUR stablecoin market has entered a brand new section following the rollout of MiCA:

The EUR-pegged stablecoin market, whereas nonetheless a fraction of its dollar-pegged counterpart, has entered a transformative section of accelerated development following the EU’s landmark MiCA regulation. After a pre-MiCA contraction, the sector reversed course in 2025, with its mixed market capitalization doubling to just about $700 million. Month-to-month transaction volumes have surged almost ninefold to over $4 billion, signaling early adoption, even when the market stays small in comparison with dollar-based stablecoins.

Combay added that this 12 months may very well be decisive for the sector, as development more and more relies on real-world use instances reasonably than crypto-native demand alone.

We see 2026 as a make-or-break 12 months for EUR stablecoins. Progress now relies on transferring into the monetary mainstream, from settling tokenized real-world belongings to functioning as environment friendly fee rails. With MiCA offering authorized certainty and banks turning into much less reluctant to interact, euro stablecoins have a transparent path to broader adoption.

Conclusion

Ethereum sits between robust fundamentals and weak value motion. Analysts see little purpose to anticipate a significant rebound this month, particularly whereas Bitcoin struggles to regain stability. On this atmosphere, a transfer beneath the $2,000 degree can’t be dominated out.

On the similar time, few query Ethereum’s function within the broader crypto ecosystem. The problem shouldn’t be demand, expertise, or long-term relevance. It’s timing. Till market circumstances enhance and Bitcoin finds firmer footing, Ethereum’s value is prone to stay below strain, whilst its long-term case stays intact.

February 2026: Crypto and Macro Occasions to Watch

February 5

- USD — ISM Non-Manufacturing Costs, Jan

- USD — ISM Non-Manufacturing PMI, Jan

- USD — Preliminary Jobless Claims

February 6

- Hyperliquid (HYPE) — 9.92M Token Unlock

February 8

- Sei (SEI) — V6.3 Mainnet Improve (Approx.)

- USCR (USCR) — Stablecoin Purposes

February 10

- USD — Retail Gross sales (MoM), Dec

- USD — Core Retail Gross sales (MoM), Dec

February 11

- USD — CPI (MoM), JanUSD — CPI (YoY), Jan

- USD — Core CPI (MoM), Jan

February 12

- USD — Preliminary Jobless ClaimsFebruary 13USD — Present Dwelling Gross sales, Jan

February 16

- Arbitrum (ARB) — 92.65M Token Unlock

February 20

- USD — S&P World Providers PMI, Feb

- USD — S&P World Manufacturing PMI, Feb

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation.

The publish Ethereum in a Massacre: Analysts Name It a Misplaced Month for ETH Value | February Altcoin Report appeared first on Cryptonews.