Ethereum (ETH) may very well be set for a serious comeback towards Bitcoin (BTC), in response to new information from on-chain analytics agency CryptoQuant.

Ethereum might have hit backside vs Bitcoin.

The ETH/BTC ratio simply surged 38% from a 5-year low. Demand is rising, promoting strain is falling, and ETFs are loading up.

This might sign the start of an Alt season. pic.twitter.com/dosAgvW6UE— CryptoQuant.com (@cryptoquant_com) Might 16, 2025

A mix of historic patterns, rising investor demand, and declining promoting strain means that ETH may very well be coming into a recent cycle of outperformance—what many within the crypto group discuss with as the start of an “alt season.”

The ETH/BTC worth ratio, a key indicator of Ethereum’s efficiency relative to Bitcoin, has surged 38% over the previous week after lately hitting its lowest degree since January 2020, CryptoQuant studies.

Traditionally, this degree has marked a backside for ETH and has preceded massive altcoin rallies. In truth, in response to CryptoQuant, Ethereum simply entered an excessive undervaluation zone relative to Bitcoin based mostly on the ETH/BTC MVRV metric—the primary such occasion since 2019.

Comparable situations in 2017, 2018, and 2019 have been adopted by highly effective mean-reversion strikes in ETH’s favor.

The current restoration in ETH seems to be underpinned by a shift in market conduct. Merchants and traders are growing their ETH publicity at a fast tempo.

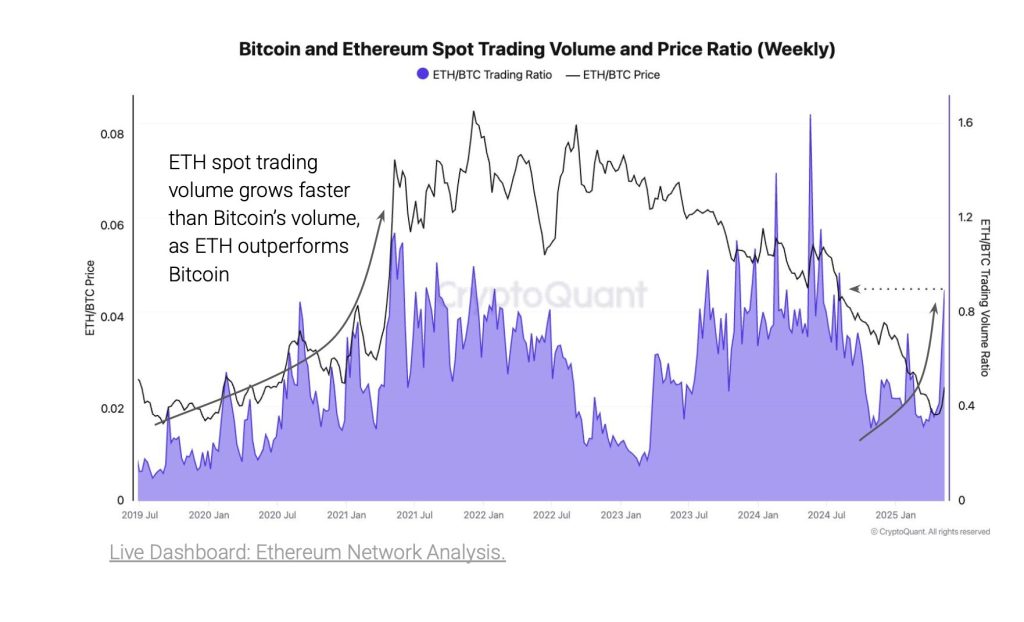

ETH-to-BTC Spot Buying and selling Quantity Ratio Spike

The ETH-to-BTC spot buying and selling quantity ratio has spiked to 0.89, its highest since August 2024. This metric echoes the same pattern noticed between 2019 and 2021, when ETH outperformed Bitcoin by an element of 4.

Institutional flows are additionally pointing in Ethereum’s favor. CryptoQuant notes a pointy uptick within the ETF holdings ratio of ETH relative to BTC since late April.

This means that fund managers are allocating extra closely to Ethereum, probably in anticipation of favorable market dynamics resembling current scaling enhancements or a extra ETH-friendly macro outlook.

Influx Knowledge Reveals Bullish Indicator for ETH

In accordance with CryptoQuant, alternate influx information reveals one other bullish indicator for ETH. The ETH/BTC alternate influx ratio has dropped to its lowest degree since 2020, suggesting that fewer ETH holders are sending cash to exchanges to promote. In distinction, Bitcoin seems to be going through comparatively increased promoting strain.

CryptoQuant’s information paints an image of rising ETH demand amid decreased promoting strain and relative undervaluation. If historic patterns maintain true, Ethereum could also be on the verge of regaining its dominance over Bitcoin and doubtlessly main the broader altcoin market into a brand new section of development.

The put up Ethereum Flashes Excessive Undervaluation – CryptoQuant Eyes 38% ETH/BTC Rally Quickly appeared first on Cryptonews.