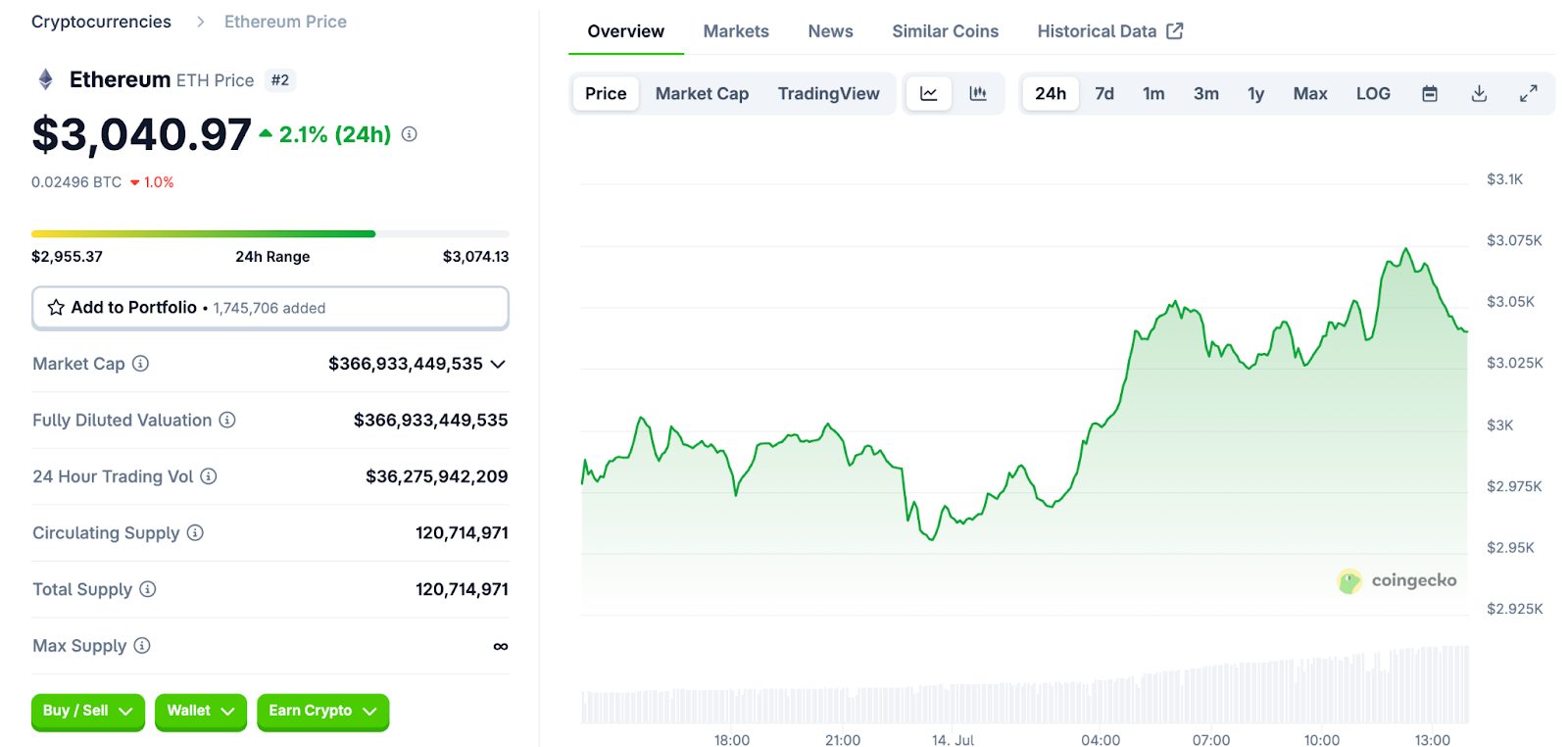

Ethereum ($ETH) rebounded, breaking by way of the $3,000 psychological degree because it climbed about 2.13% prior to now 24 hours to at the moment commerce at $3,028. This marks a 19% improve over the previous week, because the buying and selling quantity of $ETH stays properly above $30 billion, reflecting a wave of optimism throughout the crypto market.

Market sentiment is firmly in greed territory, reflecting bullish investor psychology.

Hovering Institutional Demand and Report Community Progress on the Ethereum Community

Ethereum ($ETH) continues to solidify its dominance within the decentralized finance house with $74.4 billion in whole worth locked (TVL) on DeFiLlama. This demonstrates sustained demand for on-chain lending, staking, and buying and selling actions on the premier good contract community.

In the meantime, day by day lively ERC-20 addresses are at 414,706, reflecting robust person engagement throughout Layer-1 and Layer-2 options.

As of July 12, 2025, Ethereum’s 327.97 million distinctive wallets marked a 20% year-over-year improve. The creation of recent wallets is seen as an indication of rising curiosity by merchants and builders alike.

As Ethereum trades proper on the $2,500 degree, the utility and progress of the community continues wanting more healthy than ever. The quantity of recent weekly $ETH addresses created is ranging round 800K-1M per week, in comparison with about one third much less at this level final 12 months. pic.twitter.com/K1nxFBVlqL

— Santiment (@santimentfeed) June 19, 2025

Decentralized exchanges additionally processed $1.71 billion in 24-hour quantity, whereas protocol revenues topped $2.11 million, exhibiting robust market participation.

Moreover, institutional curiosity in $ETH is on the rise. U.S. spot Ethereum ETFs have seen the second-largest inflows in latest months, reflecting regular institutional demand.

#Ethereum Spot ETF flows have remained constructive for the eighth consecutive week, with web inflows topping 61,000 $ETH pic.twitter.com/aTANkr4RCy

— glassnode (@glassnode) July 7, 2025

Following the SEC approving choices buying and selling on spot ETFs in April to boost buying and selling flexibility, company stability sheets at the moment are bulking up on $ETH.

Nasdaq-listed SharpLink Gaming has overtaken the Ethereum Basis by amassing 270,000 $ETH, driving $81.8 million in unrealized good points

SharpLink Gaming Acquires 176,271 ETH for $463 Million, Formally Changing into Largest Publicly-Traded ETH Holder

— zerohedge (@zerohedge) June 13, 2025

Market sentiment stays bullish, with the latest maintain above $3,000 echoing expectations of additional inflows and stability sheet additions from company our bodies.

Ethereum Pauses After Bullish Breakout as Market Gauges Subsequent Transfer

Ethereum ($ETH) is buying and selling round $3,028 following a breakout from a bullish pennant construction earlier within the week.

The sample had shaped over a number of days of consolidation, with worth coiling between converging trendlines earlier than making a clear transfer above $3,030. The breakout, nevertheless, has not but accelerated right into a sustained rally. As a substitute, $ETH is consolidating just under the breakout zone.

The latest pullback is comparatively shallow. RSI sits close to 54, indicating a impartial stance with no instant indicators of overbought or oversold circumstances. MACD stays above the sign line, though momentum is starting to flatten. These indicators collectively level to a market in wait-and-see mode.

Quantity footprint knowledge on the $ETH futures contract reveals a shift so as circulate. Initially, purchase imbalances had been dominant, significantly at $3,085 and $3,092.

In a while, particularly in the newest candles, sell-side aggression returned. Giant damaging deltas, particularly close to $3,076, counsel some merchants are utilizing the post-breakout vary to dump danger or set up new brief positions.

Moreover, Ethereum has seen a pointy uptick in speculative exercise. CoinGlass knowledge exhibits quantity is up 112% to $99.6 billion, with open curiosity climbing modestly to $44.6 billion.

Choices exercise can be elevated, rising 238% to over $2 billion. The 24-hour lengthy/brief ratio is balanced at 0.9956, pointing to a scarcity of directional conviction. Nonetheless, the positioning of prime merchants at Binance and OKX nonetheless favors longs, with ratios above 2.4.

ETH now sits at a key degree. A clear transfer above $3,100 might reinvigorate bullish momentum and validate the pennant breakout, opening the best way to the measured goal close to $3,250. A drop under the ascending base, alternatively, could point out a failed sample and shift market focus again to $2,880–2,900.

The publish Ethereum ($ETH) Blasts Previous $3K on 19% Weekly Surge – Will ETFs Gas the Subsequent Leg? appeared first on Cryptonews.