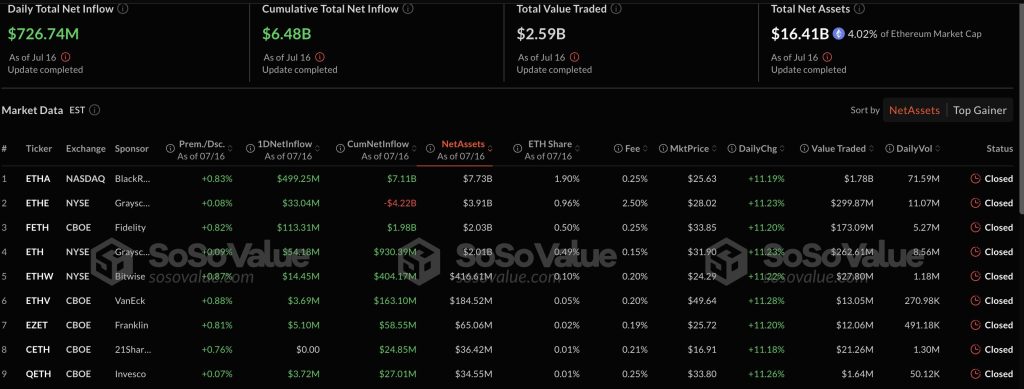

Spot Ethereum ETFs posted a record-breaking internet influx of $726.74m on July 16, based on knowledge from SoSoValue.

This marks the most important single-day influx within the class’s quick however quickly rising historical past, pushing whole cumulative internet inflows to $6.48b.

It’s a turning level for Ether ETFs, which initially confronted investor hesitation following their approval final yr.

BlackRock’s ETHA led the pack with a staggering $499.25m in internet inflows in someday, bringing its cumulative whole to $7.11b. The ETF now holds $7.73b in internet property, with a market share of 1.90% of all Ethereum.

Constancy’s FETH adopted with $113.31m in inflows, whereas Grayscale’s ETHE added $33.04m regardless of lingering results from early redemptions.

Ethereum Tops $3,200, Outpaces Bitcoin and Solana in Every day Features

The surge got here as Ethereum crossed the important thing $3,200 threshold, rising greater than 6.8% on the day to commerce close to $3,347. It outpaced each Bitcoin and Solana, reflecting rising institutional curiosity within the asset. Every day volumes soared, and whole worth traded throughout ETH spot ETFs reached $2.59 billion.

Open curiosity in ETH futures has additionally reached a brand new peak of $45b, up 60% since late June. This surge in derivatives exercise factors to elevated institutional positioning and heightened expectations of additional value momentum.

ETH Features Attributed to Staking Yields, Deflation and Lengthy-Time period Utility

Bitget Pockets CMO Jamie Elkaleh mentioned Ethereum’s present momentum indicators greater than short-term bullishness. “Ethereum is rising because the yield-generating infrastructure play,” he mentioned, citing staking yields of 4% to six% and deflationary provide mechanics post-EIP-1559.

“BlackRock’s accumulation of ETH isn’t just about value upside—it’s a strategic place in what many see because the spine of future onchain finance,” he added.

ETH ETFs are actually seen as a bridge between crypto-native methods and conventional finance. BlackRock’s accumulation, as an illustration, is broadly considered as a long-term wager on Ethereum’s rising function in powering decentralized finance, NFTs and Web3 infrastructure.

Investor Confidence Returns as Redemption Strain Fades

These document inflows are particularly notable contemplating that many ETFs struggled with outflows throughout their early months, largely resulting from Grayscale belief redemptions. The July reversal suggests renewed investor confidence, now that redemption-driven promoting has waned.

Regardless of the bullish narrative, dangers persist. Regulatory ambiguity round whether or not ETH qualifies as a safety continues to hold over the market. In the meantime, competitors from high-speed alternate options like Solana and Layer 2 scaling options may splinter Ethereum’s dominance.

Nonetheless, Ethereum’s attraction lies in its twin id, as each a yield-bearing monetary instrument and the spine of onchain innovation.

The put up Ethereum ETFs Smash Information with $727M Single-Day Influx Surge appeared first on Cryptonews.