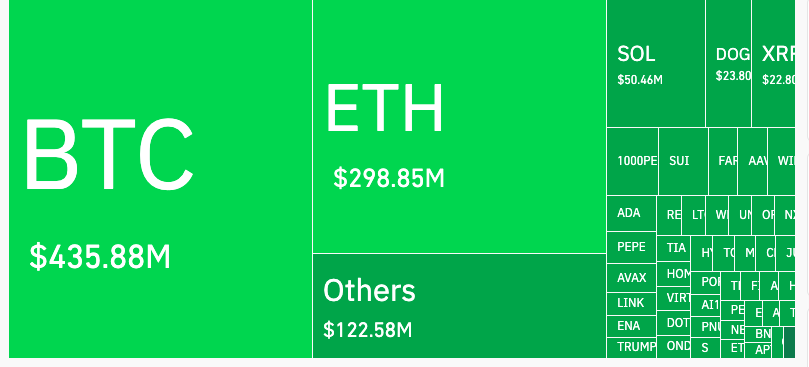

Ethereum ($ETH) plunged 9% Friday morning, wiping out $298 million from 80,000 merchants. Whereas panic promoting dominated, good cash was shopping for the dip underneath $2,500. The crypto adopted the market-wide crash, nosediving from $2,771 to $2,443 earlier than discovering footing close to $2,509.

Commerce conflict fears triggered the sell-off, however savvy buyers seen this as a reduction window.

$35.22B Open Curiosity Explosion: BlackRock and Contemporary Cash Flood $ETH Throughout Crash

Regardless of the sell-off, open curiosity (OI) in Ethereum has elevated to $35.22 billion over the previous 24 hours.

Main exchanges, together with Chicago Mercantile Trade (CME), Binance, Gate, and Bitget, are witnessing the best exercise, averaging $4 billion value of $ETH publicity every.

Contemporary capital is flowing into the market as open curiosity rises. This means that the pattern may proceed. Extra merchants are opening or rising their positions.

An Ethereum whale has simply positioned a considerable wager, taking a $16.6 million lengthy place. This main transfer demonstrates sturdy bullish confidence within the altcoin, regardless of market fluctuations.

Institutional buyers proceed to purchase Ethereum aggressively in the course of the hunch. They’re not backing down.

BlackRock, the world’s main asset administration agency with over $73 billion in cryptocurrency holdings, has maintained every day Ethereum purchases for over two weeks.

JUST IN:

BlackRock has been shopping for Ethereum each single day for the previous two weeks

They’ve now gathered $570M value of $ETH

Sensible cash isn’t slowing down, they’re doubling down pic.twitter.com/POwikXTkHq— Jeremy (@Jeremyybtc) June 13, 2025

Over the previous 14 days, the normal finance big has gathered a complete of $570 million in ETH.

In accordance with information tracked by Arkham Intelligence, BlackRock now controls over 1.5 million $ETH, valued at $3.83 billion at present market costs.

In a parallel transfer, SharpLink Gaming lately acquired 176,271 $ETH for $463 million, establishing itself as the biggest publicly traded holder of Ethereum.

Historic 29-Day Ethereum ETF Streak Breaks Data as DeFi Adoption Surges

Ethereum spot ETFs have recorded optimistic inflows for 29 consecutive days, marking the primary time such a sustained streak has occurred since their launch.

With the SEC adopting a extra favorable stance towards DeFi protocols and Ethereum serving as the first infrastructure for decentralized finance functions, institutional adoption continues to speed up.

Ethereum’s provide on exchanges has dropped to its lowest stage in eight years. This scarcity may drive costs greater quickly. Many crypto buyers consider these components set ETH as much as break $4,000 by late 2025.

CLS World, a serious market maker, is much more bullish. They’re eyeing $5,400 for Ethereum within the close to time period.

$ETH/USD Evaluation:

Doubled from $1.4k to $2.8k in 2 months. What's subsequent?Key factors:

– Robust momentum with weakening promoting stress

– Native goal: $5.4k potential continuation

– Lengthy-term view: Possible range-bound $2k-7k for subsequent 2 years

– Presently testing resistance at… pic.twitter.com/h8QBWqoUt4— CLS GLOBAL (@CoinLiquidity) June 11, 2025

Their long-term projection anticipates $7,000 by 2027, representing a considerable upside from present ranges.

$2,500 Check: Make-or-Break Degree Decides $ETH’s Subsequent Transfer

The Ethereum every day chart reveals that $ETH has been consolidating inside a broad vary between roughly $2,300 and $2,700, with present worth motion testing the decrease boundary of this formation.

A significant breakout occurred in late 2024, when $ETH surged from round $1,800 to almost $2,900 earlier than coming into the present sideways consolidation part.

The current sell-off has pushed Ethereum again to check key help inside this consolidation zone, particularly the $2,500-$2,550 space.

This stage is vital. If $ETH breaks beneath it decisively, the sideways buying and selling may come to an finish.

The worth might then fall towards $2,300 and even check the $2,000 help stage. Nevertheless, if the present help holds sturdy, Ethereum may bounce again. In such a scenario, the following targets can be $2,700-$2,800, the center or high of its current vary.

The submit Ethereum Dips 9%, But BlackRock Bets $570M: $4K Rally Forward? appeared first on Cryptonews.