Key Takeaways:

- Ethereum is making an attempt to carry above $4,000. A powerful shut might kick off altseason.

- Bitcoin wants to remain above $110,000 to keep away from deeper losses. Whale exercise has added stress.

- Solana is hovering round $200. A breakout might ship it towards $225 to $260.

- Altcoin rotation relies on Ethereum’s stability and a drop in Bitcoin dominance.

- Unclear macro indicators depart the market course unsure for now.

August 2025 made crypto historical past. After an extended wait, Ethereum (ETH) got here near breaking the $5,000 mark. Over simply three months, the ETH worth jumped from $2,100 to a brand new all-time excessive of $4,946.

However that rally has misplaced momentum. Some buyers count on the correction to finish quickly, whereas others warn of a deeper pullback. In the meantime, macro knowledge paints an unsure image. Jerome Powell hinted at doable price cuts throughout the Jackson Gap assembly, however there isn’t any assure it should occur this month. Sturdy labor and housing numbers assist a comfortable touchdown narrative, however that very same resilience might delay coverage easing.

On this Cryptonews Market Report, we break down what this all means for Ethereum, Bitcoin (BTC), and Solana (SOL), and what ranges matter most this September.

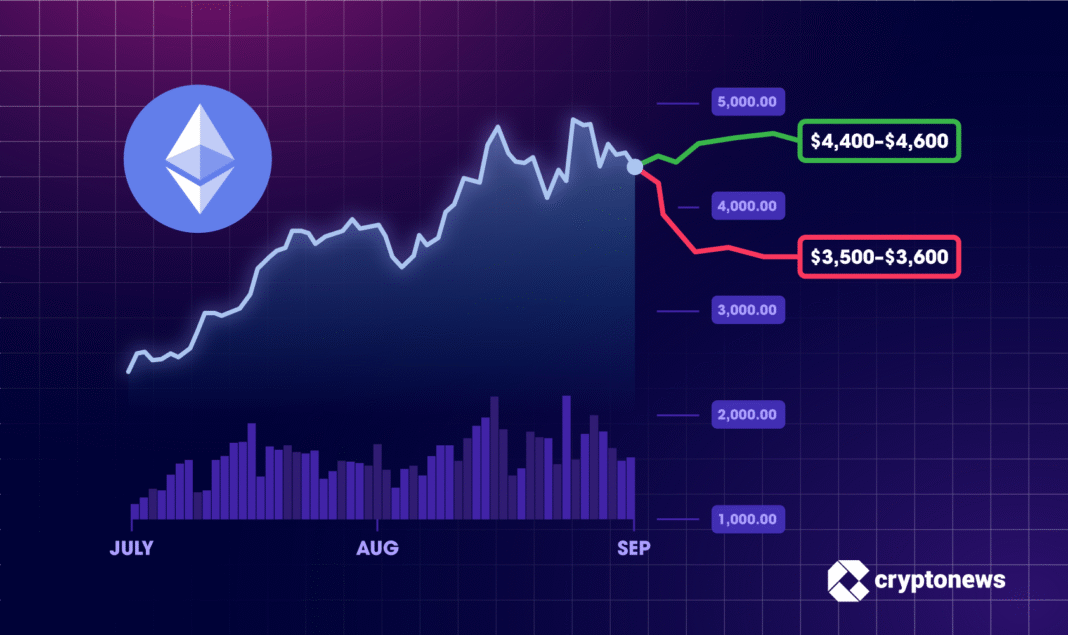

ETH Value Battles for $4,000

Ethereum enters September after a historic rally that almost pushed it previous $5,000. However with the value now caught between $3,800 and $4,200, the large query is whether or not ETH worth can break by way of or if a deeper correction is coming.

In keeping with Leo Zhao, Funding Director at MEXC Ventures, ETH’s outlook will rely not simply on worth ranges but in addition on broader market liquidity:

As Ethereum enters September with an optimistic outlook, the market holds its breath to observe whether or not it might probably maintain above the $4,000 stage. If that seems to be true, it might assist set the stage for what may very well be the long-awaited altseason.

A drop under $3,800 might sign rising weak spot available in the market if general liquidity begins to dry up. Zhao highlights this threat as value watching:

The potential of failure to maintain above $3,800 would imply warning, particularly if broader liquidity circumstances handle to tighten. The momentum for Ethereum proper now lies in community exercise as a substitute of simply worth. Community actions like DeFi volumes, Layer-2 adoption, and renewed vitality round its ecosystem tasks are the final word fuels for a sustainable upside.

Eneko Knorr, founder and CEO of Stabolut, factors to Ethereum’s place because the main chain for institutional and tokenization-driven flows. Whereas momentum stays robust, he notes the market might pause earlier than the subsequent transfer:

It’s fairly clear why it’s shifting. It’s the go-to chain for severe cash and the entire tokenization pattern. It’s had an enormous run-up, so actually, I wouldn’t be stunned to see it cool off a bit or commerce sideways for some time to catch its breath. The actual battleground for September is the $4,000 mark. If it might probably break by way of and maintain that stage, the trail to its previous all-time excessive close to $4,800 seems huge open. If it will get rejected there, I’m watching the $3,550–$3,600 space as the primary line of protection.

Sunil Raina, CEO of CereBree, is watching the identical $4,000 stage as a key turning level:

I just like the setup however $4,000 is the make-or-break stage. A powerful weekly shut above $4,000 that holds might open the door to $4,400–$4,600, with a shot on the prior highs if momentum broadens. If it stalls, I’d search for patrons round $3,620–$3,680, and worst case, nearer to $3.420.

Whereas ETH worth has pulled again barely, this rally was lengthy anticipated by many available in the market. Now the main focus shifts as to whether it might probably maintain momentum or if a deeper cooldown is forward.

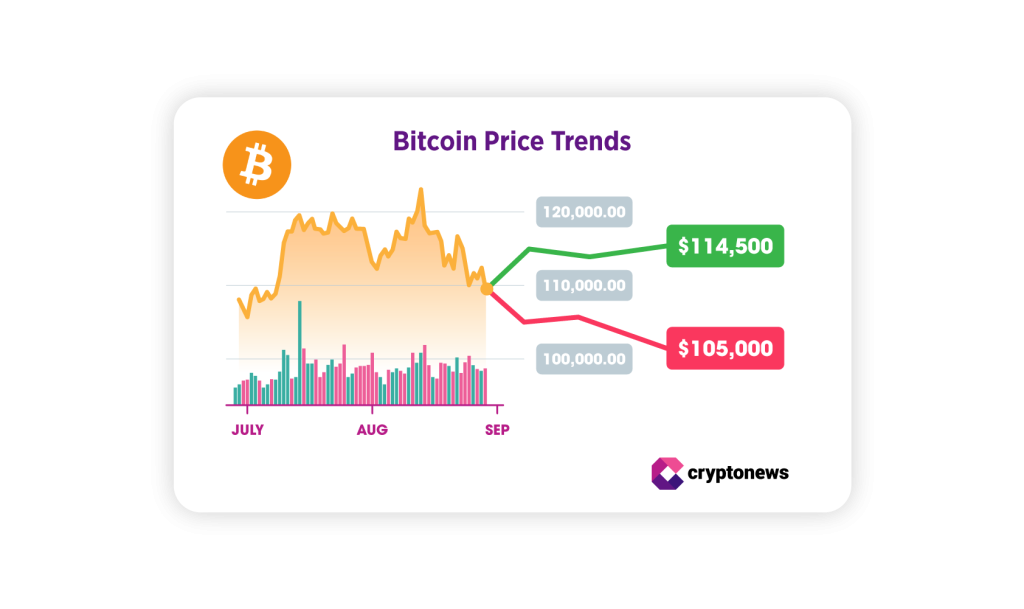

Bitcoin Holds the Line at $110,000

In keeping with Abbas Abdul Sater, Head of Gross sales at Capital.com, Bitcoin’s technical setup has turned fragile after a serious sell-off:

Bitcoin has damaged the assist stage of $114,500, which led to heavy promoting. A major spike occurred as a result of a whale offered 24,000 BTC, inflicting the value to drop. The worth wants to carry above the $110,000 stage. In any other case, we might even see additional declines available in the market.

The stress from giant holders has elevated short-term volatility. A sustained breakdown under $110,000 might set off additional panic, whereas stability above that mark might restore confidence heading into September.

Sunil Raina believes Bitcoin’s habits in early September will form the altcoin outlook:

I’m cautiously optimistic about an altseason in September, but it surely’s not a given. If Bitcoin cools off and dominance drifts decrease, I believe cash rotates into the large alts, led by Ethereum. A sizzling macro print or one other sharp Bitcoin leg up would possible delay that.

Altseason expectations stay intently tied to BTC dominance. So long as Bitcoin stays the primary liquidity magnet, altcoins might wrestle to take the lead.

Solana Joins Ethereum within the Highlight

Traditionally, Solana tends to rally after Ethereum. As ETH leads the cost, capital typically rotates into sooner, extra unstable altcoins — and SOL has been a prime beneficiary in previous cycles. However this time, each cash have been rising aspect by aspect. In August, Solana repeatedly touched and briefly surpassed the $200 mark, signaling rising investor curiosity.

Sunil Raina sees energy within the community’s fundamentals and believes $200 stays a key milestone:

I’m extra outright constructive. The ecosystem has actual traction, liquidity is bettering, and builders are transport. Clearing $200 and holding it might be a transparent risk-on sign for me, with $226–$232 subsequent after which $255–$262. If the market wobbles, $172–$176 is first assist; lose that and $152–$156 is the place I’d count on dip-buyers.

Leo Zhao factors out that September is a pivotal month for Solana. Whereas Ethereum has attracted many of the latest consideration, SOL’s skill to carry key ranges might decide if it joins the subsequent wave of institutional inflows:

Solana, this cycle has turn out to be the stage for its standout efficiency. Come September, it might be the actual take a look at for Solana to see if it might probably keep that management. The crucial stage to observe for Solana lies round $140. Surpassing it might preserve the uptrend intact and invite extra institutional flows, one that’s into its DeFi and shopper app ecosystem.

Nevertheless, Zhao notes {that a} drop under $120 might weaken confidence within the brief time period:

Ought to the value slip under $120, short-term sentiment might develop sullen. As Solana continues doing its finest to draw builders and retail customers alike, it has grown into changing into one of many best-positioned networks to profit if there’s certainly a broader altcoin rotation.

In keeping with Eneko Knorr, Solana could also be gaining energy because it approaches a key worth threshold:

Wanting on the chart, SOL appears to be build up steam for its subsequent leg up. The important thing quantity for September is $200. A clear break above that psychological stage can be very bullish, and I’d be $225 after which its all-time excessive round $260 as the subsequent targets. On the flip aspect, it wants to carry assist round $170. If that stage breaks, we might see it dip again to the stronger assist zone round $150.

Will ETH Value Lead the Market? September Might Form This autumn Tendencies

After a dramatic summer season rally, the crypto market enters September at a crossroads. ETH worth is battling to remain above $4,000, and its efficiency might decide whether or not altseason lastly kicks off or will get delayed as soon as once more. Bitcoin is below stress after breaking key assist, with whale exercise and macro knowledge including to the uncertainty. Solana continues to point out energy, however its subsequent transfer relies on holding above key psychological ranges like $200.

If macro circumstances stay regular and investor sentiment holds, September might open the door for renewed upside, particularly in altcoins. Nevertheless, considerations about liquidity, inflation, and insider-driven volatility stay in play.

Key Crypto Occasions to Watch in September 2025

- September 2 — Eurozone CPI & US Manufacturing PMI

Inflation knowledge from the Eurozone and U.S. manufacturing exercise might form expectations for rate of interest strikes. - September 3 — ECB President Christine Lagarde Speech

Markets will search for indicators on the European Central Financial institution’s subsequent steps amid combined macro circumstances. - September 4 — U.S. Labor and Providers Information

Preliminary jobless claims and Providers PMI provide a snapshot of U.S. employment and shopper exercise. - September 5 — U.S. Unemployment Fee (August)

A key indicator of labor market energy forward of the Fed’s subsequent determination. - September 10 — U.S. Producer Value Index (PPI)

Wholesale inflation knowledge which will affect forecasts for upcoming CPI readings. - September 11 — ECB Curiosity Fee Determination

A pivotal second for eurozone financial coverage that might have an effect on world threat sentiment. - September 11 — U.S. CPI Inflation Launch (August)

Month-to-month and annual CPI knowledge — one of the vital necessary macro occasions for crypto markets. - September 17 — U.S. Federal Reserve Fee Determination

No hike is anticipated, however Jerome Powell’s tone on inflation and future coverage might transfer each crypto and conventional markets.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation.

The put up ETH Value Might Hit $5K or Crash to $3K | September Market Report appeared first on Cryptonews.