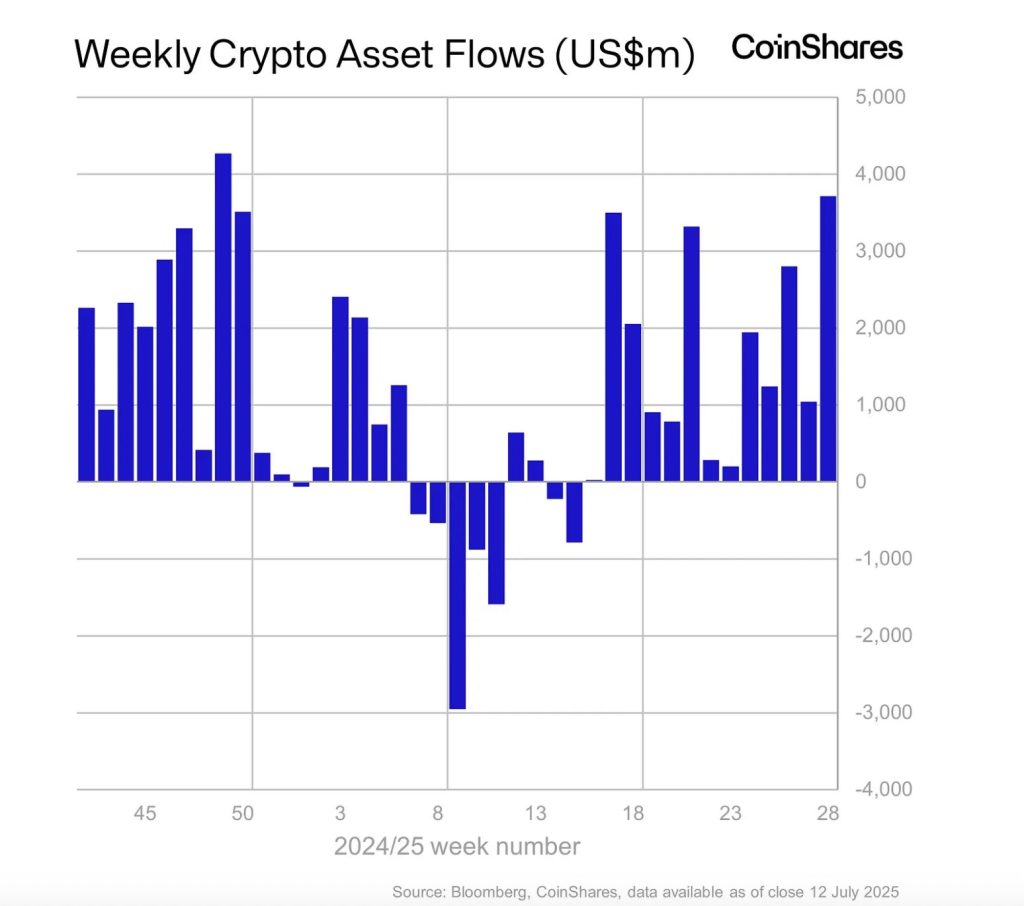

Digital asset funding merchandise recorded a staggering US$3.7 billion in inflows final week, marking the second-largest weekly whole in historical past, in response to CoinShares analyst James Butterfill.

In a weblog put up the analyst experiences the surge in capital drove whole belongings underneath administration (AuM) throughout crypto exchange-traded merchandise (ETPs) to an all-time excessive of US$211 billion.

Buying and selling exercise additionally intensified, with ETP volumes reaching US$29 billion—double the 12 months’s weekly common.

Butterfill notes that July 10 alone noticed the third-largest each day influx on report, exhibiting intensifying institutional urge for food and reinforcing the bullish sentiment that has sustained 13 consecutive weeks of web inflows.

Bitcoin and Ethereum Lead the Cost

Bitcoin stays the dominant asset of selection, attracting US$2.7 billion in inflows, elevating its whole AuM to US$179.5 billion. This milestone signifies that Bitcoin ETPs now account for 54% of the worth held in gold exchange-traded merchandise, underscoring the asset’s rising stature as digital gold.

Regardless of the rally, quick bitcoin merchandise recorded little exercise, suggesting a prevailing bullish bias. Ethereum additionally made headlines, securing its twelfth straight week of constructive flows.

With US$990 million added final week alone—the fourth-highest weekly determine on report—Ethereum’s 12-week cumulative inflows now characterize 19.5% of its AuM, outpacing Bitcoin’s 9.8% over the identical interval.

In response to Butterfill, this means a rising investor conviction in Ethereum’s long-term fundamentals.

Regional Divergence and Altcoin Developments

Regionally, the US dominated flows with the whole lot of the US$3.7 billion weekly influx.

In the meantime, Germany skilled notable outflows of US$85.7 million, pointing to attainable regional profit-taking or shifting regulatory sentiment. Switzerland and Canada bucked the development, posting reasonable inflows of US$65.8 million and US$17.1 million, respectively.

Amongst altcoins, Solana stood out with US$92.6 million in inflows, reinforcing its place as a well-liked layer-1 wager exterior of Ethereum. In distinction, XRP suffered the biggest weekly outflows at US$104 million, hinting at waning investor confidence or reactionary strikes following latest value motion.

Butterfill emphasised that regardless of some combined altcoin efficiency, the sustained capital influx throughout the broader market is a robust indicator of renewed institutional and retail engagement within the digital asset sector.

The put up Digital Asset Inflows Hit $3.7B in Second-Largest Week Ever, Pushing Complete AuM to $211B: Coinshares appeared first on Cryptonews.