Bitcoin has rebounded to round $92,000 after final week’s $2 billion liquidation occasion, however merchants are adopting cautious positioning amid excessive volatility and looming central financial institution selections.

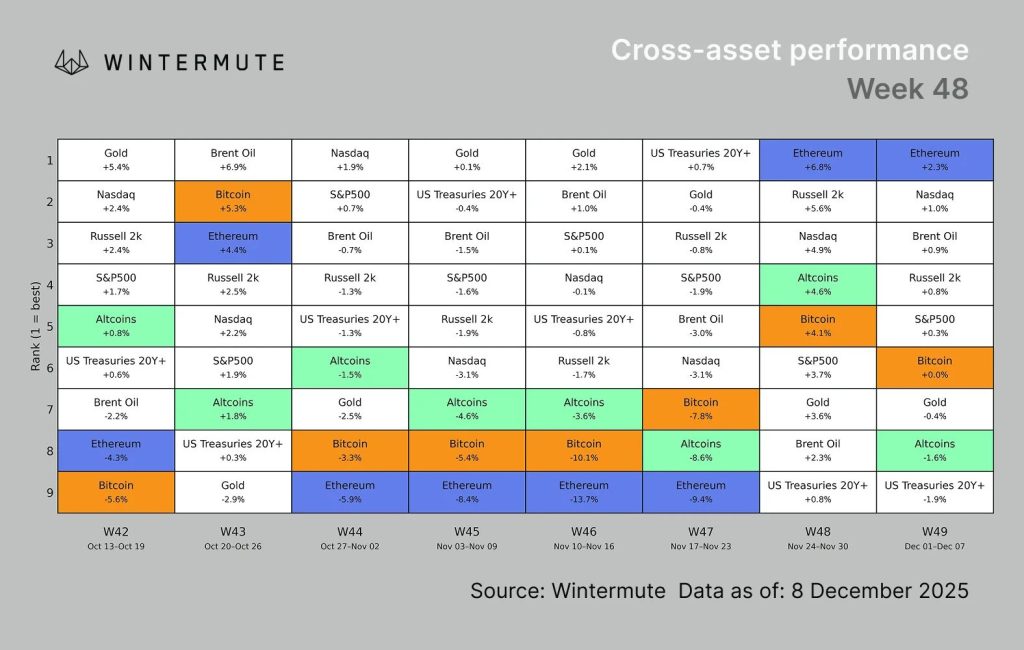

In accordance with market maker Wintermute, market exercise has narrowed sharply into Bitcoin and Ethereum, with buyers favoring delta-neutral and carry methods over directional altcoin publicity whereas awaiting readability from the Federal Reserve and macro indicators.

The consolidation follows two months of macro uncertainty that triggered sturdy market turbulence. Complete crypto market capitalization has recovered to roughly $3.25 trillion.

But, compressed foundation charges and subdued funding ranges point out restricted urge for food for leveraged positions forward of this week’s Fed choice and subsequent week’s Financial institution of Japan fee announcement.

Market Absorbs Shock With out Observe-Via Promoting

Friday’s sharp drawdown was a significant blow to Bitcoin’s restoration, with cascading liquidations erasing roughly $4,000 in simply over an hour.

The liquidation occasion eradicated roughly $2 billion in leveraged positions, briefly pushing Bitcoin under $88,000 earlier than consumers stepped in at decrease ranges.

Regardless of the violent intraday transfer, the market absorbed the shock with out triggering sustained promoting strain.

Glassnode information exhibits Bitcoin’s 14-day RSI climbing from 38.6 to 58.2, whereas spot quantity elevated 13.2% to $11.1 billion.

This means consumers remained lively on the lows at the same time as broader conviction stays uneven throughout on-chain, derivatives, and ETF metrics.

Yr-end implied volatility stays elevated, with traders positioning for either $85,000 or $100,000 by December 26.

Choices information reveals heightened warning, with the 25-delta skew reaching 12.88% and volatility unfold turning sharply destructive at -14.6%, indicating sturdy demand for draw back safety regardless of the current bounce.

Institutional Flows Flip Destructive Amid Rising Warning

ETF flows have emerged as a significant headwind, flipping from a $134.2 million influx to a $707.3 million outflow.

The reversal signifies profit-taking or weakening institutional curiosity following Bitcoin’s current volatility, which is including strain to near-term worth motion.

Whereas ETF commerce quantity rose 21.33% to $22.6 billion and ETF MVRV elevated to 1.67, the substantial outflows recommend some buyers are profiting from elevated costs to cut back publicity.

Talking with Cryptonews, Arthur Azizov, founder and investor at B2 Ventures, famous the affect of persistent withdrawals.

“Greater than $2.7 billion has left BTC merchandise over the previous 5 weeks, and one other $194 million left simply in a single day,” he mentioned.

“When such a row of withdrawals persists, the entire market turns into quieter and will get much less help.“

Nonetheless, MicroStrategy continues its aggressive accumulation technique, lately buying 10,624 BTC for about $962.7 million at a median worth of $90,615 per bitcoin.

Technique has acquired 10,624 BTC for ~$962.7 million at ~$90,615 per bitcoin and has achieved BTC Yield of 24.7% YTD 2025. As of 12/7/2025, we hodl 660,624 $BTC acquired for ~$49.35 billion at ~$74,696 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/oyLwSuW7nW

— Michael Saylor (@saylor) December 8, 2025

The corporate now holds 660,624 BTC acquired for roughly $49.35 billion at a median price of $74,696, with 2025 additions totaling $21.48 billion, simply $500 million wanting its complete 2024 accumulation.

Merchants Prioritize Yield Seize Over Directional Bets

Futures open curiosity has declined to $30.6 billion, whereas perpetual funding charges have turned extra supportive, with long-side funds rising to $522,700.

Nonetheless, the compressed CME foundation has pushed rising curiosity in delta-neutral methods in lower-cap property, the place carry alternatives stay engaging, confirming restricted urge for food for directional altcoin danger.

On-chain metrics present modest stabilization, with lively addresses rising barely to 693,035 and entity-adjusted switch quantity rising 17.1% to $8.9 billion.

Nonetheless, Realised Cap Change fell to only 0.7%, nicely under its low band, indicating softer capital inflows, whereas the STH-to-LTH ratio climbed to 18.5%, indicating continued dominance by short-term holders.

Whereas talking with Cryptonews, Ignacio Aguirre, CMO at Bitget, additionally warned of extra strain from worldwide financial coverage.

“A stronger yen raises the danger of unwinding yen carry trades, which is a transfer that may quickly weigh on crypto valuations as leveraged positions reset throughout world markets,” he mentioned.

Azizov emphasised key resistance ranges forward. “Solely a robust transfer above $100,000 may flip the script, restore confidence, and open the way in which towards $120,000+ stage,” he mentioned.

“If that fails, a deeper pullback to the broad $82,000–$88,000 zone could also be wanted.“

The submit Crypto Merchants Flip Cautious, Favor Bitcoin Over Dangerous Altcoin Bets appeared first on Cryptonews.