October hope has flipped to concern. The overall crypto market cap sits close to the mid $3.6 trillion vary, with 24-hour quantity leaping, a sample that usually signifies compelled promoting fairly than affected person bids.

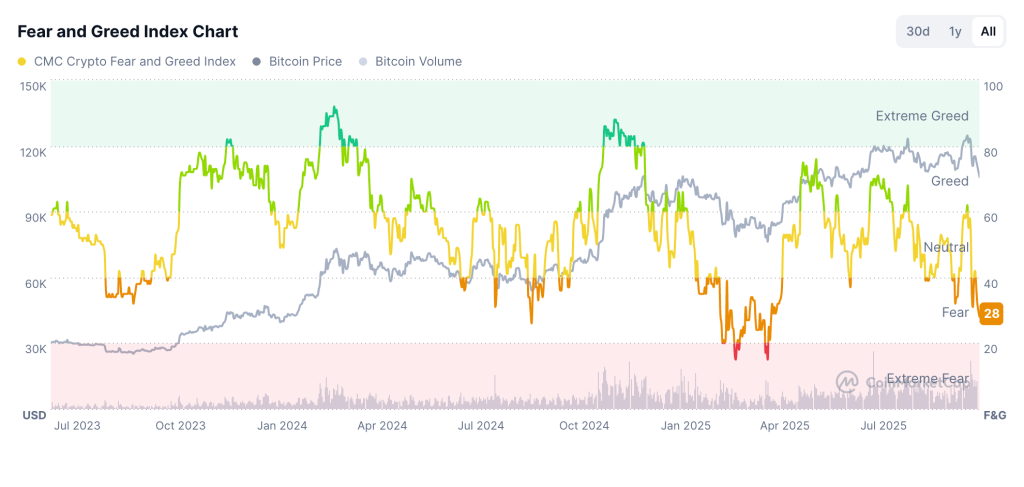

Sentiment is bruised. The Crypto Worry and Greed Index slid towards excessive concern. That backdrop feeds a self-reinforcing crypto market crash narrative.

Worry and Greed Index (Supply: CoinMarketCap)

Market Collapse Situation

A Bitcoin crash would doubtless speed up if the value loses the 200-day space once more and closes under it with rising quantity. Barrons flagged that breach and warned about pattern harm throughout this slide.

Macro stress compounds threat. Reuters recorded a spike within the Cboe Volatility Index (VIX) towards latest highs, an indication that usually tracks de-risk strikes throughout belongings. Correlation waves can pull crypto decrease throughout fairness stress.

Whole market cap can also be the road of scrimmage. CoinMarketCap locations the broad gauge close to $3.62 trillion. A decisive drop via that area would hold sellers in management and prolong the crypto market crash setup.

Bitcoin, XRP, ETH, SOL Ranges

Bitcoin is at present buying and selling close to $106,000, bouncing again from the earlier degree of $105,000 immediately. Watch $100,000 for protection and $110,000 for reduction. A rebound wants regular spot demand with calmer momentum fairly than a funding spike.

Bitcoin Worth (Supply: CoinMarketCap)

Ethereum is at present buying and selling close to $3,800, and the $3,600 to $3,700 pocket acted like a pivot this month. A each day shut above $4,000 would ease strain and cut back speak of a deeper leg decrease.

XRP is buying and selling close to the $2.3 vary. $2.00 is the focal assist after latest volatility; nevertheless, prints under that line would intensify speak of an XRP crash towards the higher $1s.

Solana is at present buying and selling close to the low $180s, though CoinMarketCap confirmed $181 to $190 in latest trades. $170 is the primary assist, then $160. A detailed above $195 would begin a brief restore.

Bitcoin And Ether Lead Crypto Selloff Amid Credit score Concernshttps://t.co/WphPQac5e6 pic.twitter.com/xLDoUe62Li

— Forbes (@Forbes) October 17, 2025

As a substitute of Panicking, What To Do Now

Begin with value and dimension. A gentle reclaim towards $3.7 trillion with rising spot quantity on inexperienced days suggests consumers are lively, not simply quick protecting.

Affirm with leaders. Bitcoin, close to $106,000, and Ethereum, close to $3,800, want agency each day closes above close by resistance. BTC again above the 200-day marker has lowered crash threat in previous cycles. ETH above $4,000 improves tone for majors.

Gauge stress with sentiment. The Worry and Greed Index within the low 20s signifies warning. A drift into the excessive 30s with stronger closes typically marks panic exhaustion. Deal with spikes throughout purple days otherwise from upticks throughout inexperienced days.

Monitor quantity high quality. Rising spot quantity on down days factors to distribution. Rising spot quantity on up days factors to accumulation. Use CoinMarketCap’s quantity prints for BTC, ETH, XRP, and SOL to match day-to-day.

Thoughts macro strain. Reuters hyperlinks the slide to commerce stress and fairness stress. If these headlines cool, crypto typically stabilizes sooner than equities. In the event that they intensify, anticipate added draw back threat.

Set clear triggers. For consumers, give attention to closes that reclaim damaged ranges with increased spot quantity. For hedgers, use power to counter resistance to scale back threat. For sidelined readers, anticipate the entire cap to base above $3.9T with calmer each day ranges.

The publish Crypto Market Collapse Danger: Panic Promoting Assessments Bitcoin, ETH, XRP, SOL appeared first on Cryptonews.