The crypto ETF market got hit again, with over $290 million in combined outflows from U.S. spot Bitcoin (BTC) and Ethereum (ETH) ETFs on October 1, 2024.

This comes amid escalating geopolitical tensions in the Middle East, leading to sharp declines in both Bitcoin and Ethereum prices.

According to SoSoValue data, the bulk of the outflows were concentrated in Bitcoin ETFs, which saw $242.53 million in withdrawals, while Ethereum ETFs recorded $48.52 million in outflows.

Crypto ETF Outflows: Bitcoin ETF Struggle

Bitcoin ETFs faced significant outflow pressure, with over $240 million withdrawn from several major funds.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the exits, which saw $144.67 million in net outflows, marking its largest day of losses in recent history.

This is a big difference compared to the past week, during which Bitcoin ETFs had amassed over $1 billion in net inflows.

The ARK 21Shares Bitcoin ETF (ARKB) followed closely behind, shedding $84.35 million.

BingX and VanEck’s Bitcoin ETF (HODL) also saw notable outflows, with $32.7 million and $15.75 million, respectively, leaving their funds.

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) recorded a more modest outflow of $5.9 million.

Interestingly, the only Bitcoin ETF to post positive net inflows was BlackRock’s iShares Bitcoin Trust (IBIT), which secured $40.84 million on the day, making it the best-performing BTC ETF in the market, with over $21.54 billion in cumulative net inflows.

The sudden shift in investor sentiment coincided with a sharp decline in Bitcoin prices, which fell roughly 4% to around $60,000 following reports of Iran’s missile attack on Israel.

Even th U.S. stock indices also experienced losses of around 1%.

While Bitcoin briefly rebounded to $61,450 by the time of publication, the outflows from ETFs indicate that many investors are bracing for further turbulence in the near term.

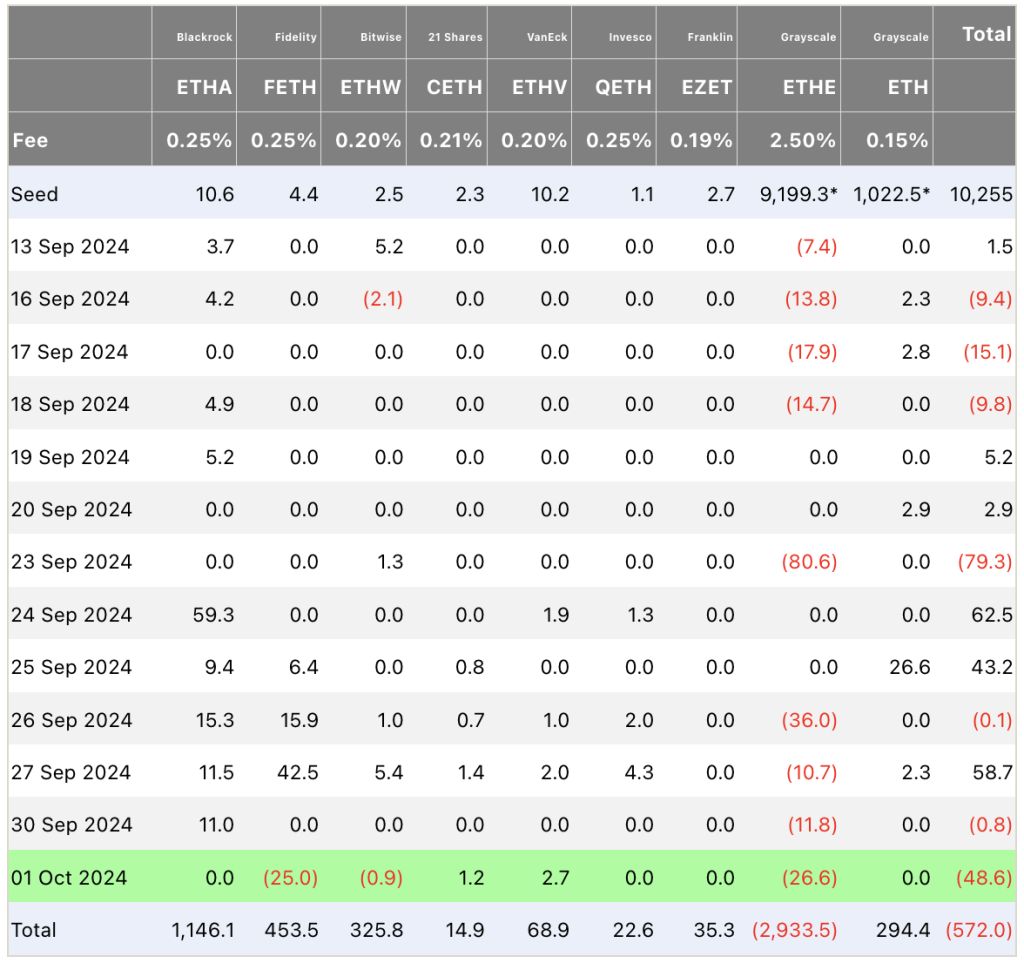

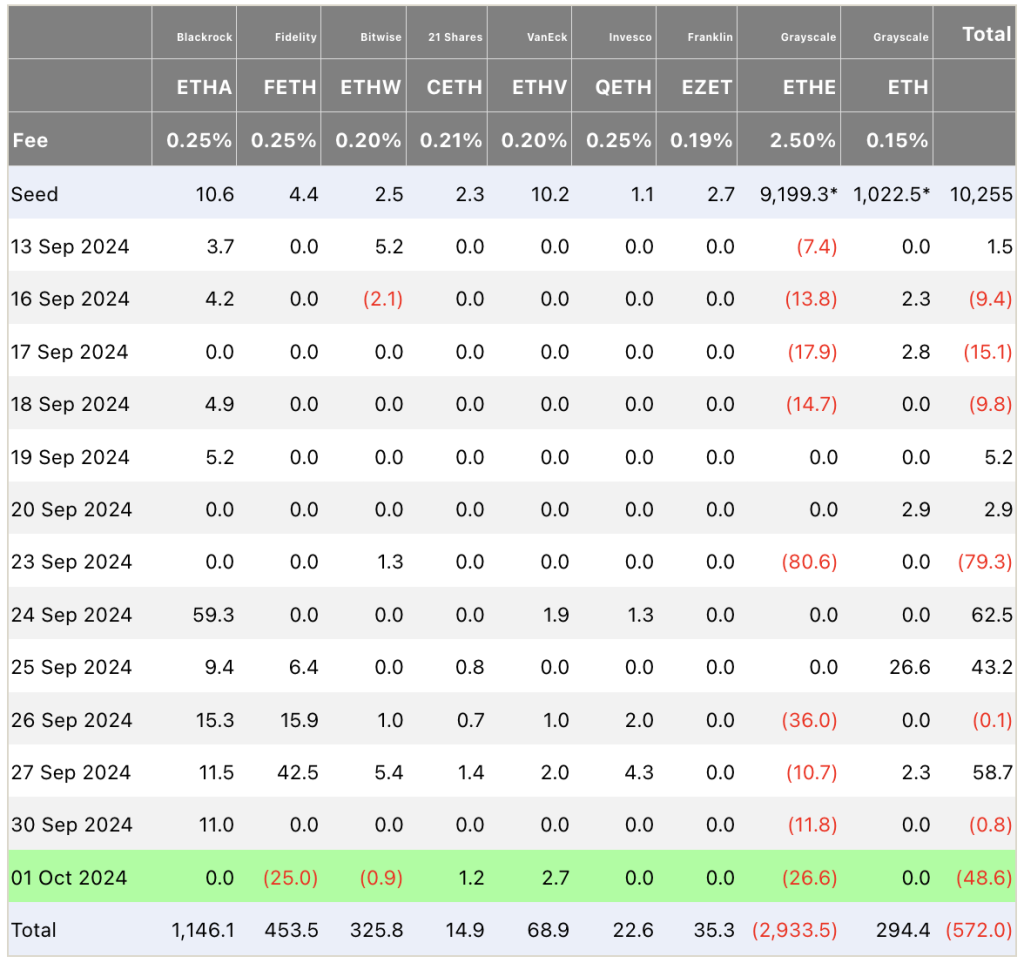

Ethereum ETFs Follow Bitcoin Trend

Ethereum ETFs mirrored the trend seen in Bitcoin ETFs, with $48.52 million in total outflows.

Fidelity’s Ethereum Fund (FETH) also led the exits, which saw $24.97 million in outflows, marking its largest-ever day of losses.

Grayscale’s Ethereum Trust (ETHE) also posted significant outflows of $26.64 million, continuing its prolonged trend of investor withdrawals that have contributed to a cumulative net outflow of nearly $3 billion.

The Bitwise Ethereum ETF (ETHW) saw smaller, yet notable outflows of $895,650.

Despite the broader market sentiment, VanEck’s Ethereum Trust (ETHV) bucked the trend, recording modest net inflows of $2.74 million.

Additionally, the 21Shares Core Ethereum ETF (CETH) posted $1.25 million in inflows, its largest since early August.

The outflows from Ethereum ETFs come as the token experienced a sharp 6.5% price drop, falling to a low of $2,450 in response to the same geopolitical tensions that rocked Bitcoin.

Similar to Bitcoin, Ethereum saw some recovery but remained under pressure, with market participants growing increasingly cautious amid rising uncertainty.

The global geopolitical turbulence, particularly the escalating conflict between Iran and Israel, has heightened market volatility.

Both cryptocurrencies and traditional financial markets have been reactive to these developments, as investors are preparing for potential economic disruptions.

Additionally, the crypto market has been under increasing regulatory scrutiny, particularly in the U.S.

The Securities and Exchange Commission (SEC) has intensified its oversight of crypto firms, with legal battles involving major players like Coinbase, and Ripple over claims of dealing in unregistered securities.

The post Crypto ETF Market Faces Outflow Pressure, Fidelity Ethereum ETF Records Largest appeared first on Cryptonews.