Justin Solar’s USDD stablecoin formally launched on Ethereum, increasing past its native TRON blockchain to problem Tether’s dominance.

The Ethereum launch coincides with the community’s stablecoin provide reaching a report $165 billion, creating an opportune second for USDD to faucet into the most important decentralized finance ecosystem whereas Tether maintains its $169 billion market cap lead.

USDD’s multi-chain deployment comes with an airdrop marketing campaign providing as much as 12% APY rewards for Ethereum holders, although the token faces robust headwinds given Tether’s 367 occasions bigger market capitalization.

Huge information: #USDD is now natively LIVE on Ethereum— with an Unique Airdrop launching quickly!

A brand new period begins as #USDD expands past TRON, bringing stability & scalability to the most important good contract ecosystem.

Right here’s what’s coming your method:Zero-slippage swaps with… pic.twitter.com/6gAJyIHmiM

— USDD 2.0 (Ethereum Native Dwell

Airdrop Coming) (@usddio) September 8, 2025

USDD’s Algorithmic Mannequin Faces Ethereum Take a look at

The TRON DAO Reserve’s stablecoin operates by way of overcollateralization, sustaining a 204.5% backing ratio, primarily supported by TRX tokens after Solar eliminated $726 million in Bitcoin collateral in August.

The USDD stablecoin has seen the removing of 12,000 Bitcoin, valued at roughly $726 million, from its collateral. #JustinSun #USDDhttps://t.co/SrvbTdG6iI

— Cryptonews.com (@cryptonews) August 23, 2024

Following a complete CertiK audit, the Ethereum deployment introduces a Peg Stability Module, which permits seamless 1:1 swaps with USDT and USDC to handle liquidity considerations.

The mechanism builds on classes from Terra’s algorithmic collapse, although USDD weathered main depegging occasions, together with drops to $0.983 throughout Terra’s Could 2022 implosion and $0.97 throughout FTX’s November collapse.

In the meantime, the launch options tiered rewards starting from 12% at low complete worth locked to six% as adoption will increase, with distributions occurring each eight hours by way of the Merkl Dashboard based mostly on each day snapshots.

The contract handle went dwell with fast USDT and USDC swap performance. Future plans embody launching sUSDD as an interest-bearing model for passive yield technology.

Past DeFi integration, USDD’s Ethereum presence spans 10 blockchain networks, together with BSC, Avalanche, and Polygon, supported by cross-chain bridges from Stargate Finance, Symbiosis, and DeBridge.

The deployment coincides with TRON’s broader ecosystem progress, together with SunSwap sustaining $3 billion in month-to-month quantity and JustLend experiencing a 23% improve in borrowing transactions in comparison with 2024 ranges.

USDD Confronts Tether’s Trillion-Greenback Ecosystem

Tether’s supremacy seems just about unassailable. Its each day buying and selling quantity exceeds USDD’s by an element of 23,500 whereas sustaining near-universal alternate help throughout centralized and decentralized platforms.

In July, CryptoQuant information revealed that TRON surpassed Ethereum in USDT liquidity with $80.8 billion versus $73.8 billion.

TRON dethrones Ethereum in USDT dominance, processing extra stablecoin transactions. #Crypto #DeFihttps://t.co/AJipQ3embr

— Cryptonews.com (@cryptonews) July 28, 2025

USDT now processes over $24.6 billion each day on TRON alone by way of 2.3 to 2.4 million transactions, dwarfing most competing stablecoins’ complete volumes throughout all networks.

This infrastructure benefit extends to order backing, the place Tether claims 75.86% U.S. Treasury payments and 12.09% in a single day repos, completely different from USDD’s risky TRX-heavy collateral construction.

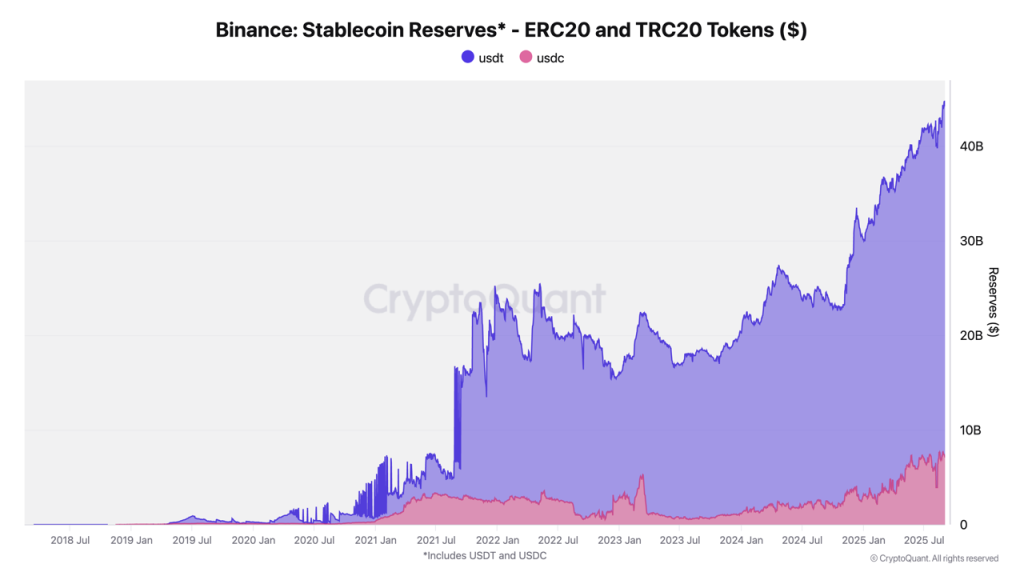

In the meantime, Binance at the moment instructions 67% of all alternate stablecoin reserves with $44.2 billion, together with $37.1 billion in USDT and $7.1 billion in USDC.

But the stablecoin sector reveals rising fragmentation as Chainalysis experiences $2.5 trillion in transaction quantity sector-wide, with specialised gamers focusing on particular niches.

Thus far, rising opponents embody MetaMask’s deliberate mUSD for pockets integration and Paxos’s USDH proposal providing 95% income sharing to token holders.

Smaller stablecoins have additionally demonstrated speedy progress trajectories, with EURC increasing from $47 million to $7.5 billion in euro-denominated transactions over the previous yr. Equally, PYUSD accelerated from $783 million to $3.95 billion over the identical interval.

Moreover, regulatory readability from the EU’s MiCA and the U.S. GENIUS Act creates alternatives for compliant alternate options to seize market share from established gamers going through ongoing scrutiny.

This regulatory atmosphere advantages main stablecoins like USDC, capturing institutional corridors, USDT dominating rising markets as digital money, and newer entrants focusing on specialised use instances.

Trade projections counsel the sector is ready to proceed rising and will attain $1 trillion in annual cost quantity by 2028, with Citigroup forecasting much more large enlargement to over $2 trillion market cap by 2030.

The put up Crypto Billionaire Justin Solar’s USDD Stablecoin Launches on Ethereum – Can it Overtake Tether? appeared first on Cryptonews.