Wednesday was a consequential day for Donald Trump’s presidency, and the repercussions may have an effect on Bitcoin.

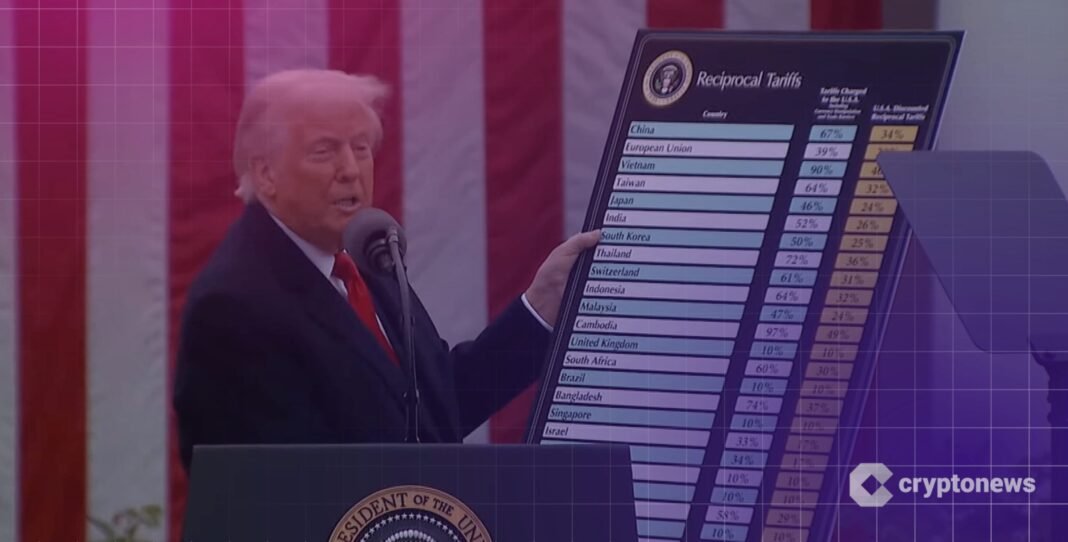

In a shock ruling, a little-known commerce courtroom blocked the president from rolling out his controversial “Liberation Day tariffs” — taxes on imports that induced inventory and crypto markets to tank once they have been unveiled in April.

And a little bit later within the night, it was confirmed that Elon Musk’s time as a “particular worker” within the Trump administration is over, that means the Division of Authorities Effectivity’s efforts to slash federal spending will fall to another person.

Response to the three-judge panel’s ruling on tariffs was fairly swift. As traders digested the influence, Asian equities have been on the rise, whereas S&P 500 futures witnessed an uptick.

However regardless of that correlation we’ve seen with BTC and equities up to now, the decision didn’t function rocket gas for this cryptocurrency’s value. On the time of writing it’s flat over the previous 24 hours and buying and selling at about $108,700 — lodging itself just under the earlier all-time excessive that was set in January.

24h7d30d1yAll time

Make no mistake: the Courtroom of Worldwide Commerce’s intervention is a giant deal. It dealt a hammer blow to the president’s financial agenda, and located that the president exceeded his authority with out searching for Congressional approval for these tariffs first. Trump argues he wanted to behave shortly as a result of it was a “nationwide emergency,” however critics say the U.S. has had commerce deficits with many different nations for the most effective a part of 50 years.

So: if Bitcoin tanked when the total scale of those tariffs turned clear — falling from $109,000 to $75,000 in three months — why isn’t it ripping increased now the Oval Workplace’s erratic commerce insurance policies have been nixed?

As you may anticipate, it’s not all that straightforward. First off, the U.S. greenback strengthened towards a number of main fiat currencies when the ruling emerged. This tends to be unhealthy information for riskier property like Bitcoin.

Second, it’s extremely doubtless that additional uncertainty for the markets lies forward, with the Trump administration already vowing to attraction the ruling. Senior White Home officers did little to hide their rage, with the president’s deputy chief of employees lambasting a “judicial coup that’s uncontrolled,” and a spokesperson decrying “unelected judges” meddling with the Oval Workplace’s agenda.

Companies throughout the nation — to not point out a few of America’s largest buying and selling companions — are actually scratching their heads and questioning what this ruling means for them… and how briskly it is going to be carried out. But when the decision stands, the federal government might want to carry the flat 10% tariffs imposed worldwide, in addition to the extra levies imposed on China, Mexico, and Canada since Trump’s second time period started.

In the long run, this has the potential to be excellent news for Bitcoin. The Federal Reserve and skilled economists have lengthy argued that these tariffs had the potential to be inflationary — with some U.S. banks fearing they may even improve the probability of a recession. Decrease inflation would give the Fed a freer hand to slash rates of interest, which helps make property like BTC extra enticing.

However Thursday’s value motion for BTC additionally reveals that merchants are retaining a detailed eye on the minutes from the Federal Open Markets Committee’s newest assembly, which have been launched a day earlier. It reveals officers raised fears that “inflation may show to be extra persistent than anticipated” — and there have been additionally fears for the greenback’s standing as a protected haven asset.

Musk’s (anticipated) departure from DOGE can be value a point out in the case of the long-term outlook for BTC. Following criticism that he hasn’t been spending sufficient time overseeing his companies, together with Tesla, the billionaire has now confirmed that he’s “again to spending 24/7 at work and sleeping in convention/server/manufacturing unit rooms.”

This may very well be excellent news for Tesla’s share value, and Bitcoin may gain advantage in flip, given how its strikes have been carefully correlated to tech shares.

4 months into Trump’s second time period, and the president is dealing with obstacles as he pursues his agenda. An enormous query mark now lingers over tariffs, and the Division of Authorities Effectivity has failed to attain the drastic cuts first hoped for. If the president doubles down, additional volatility will lie forward.

The submit Courtroom Blocks Trump’s Tariffs: What Shock Ruling Means for Bitcoin appeared first on Cryptonews.