Key Takeaways:

- Donald Trump plans to impose tariffs of 60% to 100% on all goods from China.

- The policy shift risks running afoul of the president-elect’s support for Bitcoin.

- The move will also make mining equipment more expensive for US-based operators.

U.S.-based Bitcoin (BTC) miners could face a sharp increase in mining hardware costs if Donald Trump makes good on his proposed new tariffs on key American foreign trade partners, according to market analysts.

The policy shift also risks contradicting the president-elect’s newly found support for Bitcoin and the cryptocurrency industry, they say. Trump has positioned himself as the “Crypto President“, making big promises to support the sector.

The billionaire has pledged that, on his first day in office in January, he would levy tariffs of between 60% to 100% on all goods from China in a bid to force the Asian country to crack down on the production of an addictive drug called fentanyl.

Trump also said he will impose tariffs of 25% on goods from Canada and Mexico, and 10% to 20% on goods from elsewhere. He’s demanding that those countries stop illegal immigration and drug smuggling into the U.S.

“All I want to do is to have a level, fast, but fair playing field,” Trump said on the campaign trail.

Analysts are worried that, if implemented, the tariffs—particularly those targeting China—could lead to higher prices for Bitcoin mining equipment in the United States compared to other regions like Russia.

“The proposed tariffs…could significantly impact the U.S. crypto mining sector, which relies heavily on imported mining equipment and semi-conductors,” said Phillip Lord, president of Bitcoin payments platform Oobit.

Speaking to Cryptonews, Lord said the higher duties on Chinese imports would result in a big increase in the “cost of establishing and upgrading mining operations in America.”

Tariffs Will Hit US Leadership in Bitcoin Mining

China is home to the biggest manufacturers of application-specific integrated circuits, or ASIC – purpose-built equipment used in BTC mining. Mining is the process of creating new coins using powerful computers to solve complex mathematical problems nonstop.

Miners help keep the Bitcoin network secure. ASIC miners are essential to BTC mining. The devices were made popular by the Chinese company Bitmain Technologies Ltd through its Antminer product range. Bitmain is the Google of Bitcoin mining hardware.

According to Bloomberg, the Beijing-based firm has a 90% share of the market for computers used to mine Bitcoin. Bitmain is so powerful that it can set global prices merely by adjusting the output of its mining devices, the report says.

But the company has been dogged by bitter shareholder disputes involving co-founders Jihan Wu and Micree Zhan. Wu was eventually forced to quit his role as Bitmain CEO and chairman in 2021.

Other notable Chinese crypto ASIC and mining hardware makers include Canaan, Ebang International Holdings, MicroBT, and ARM Group Holdings.

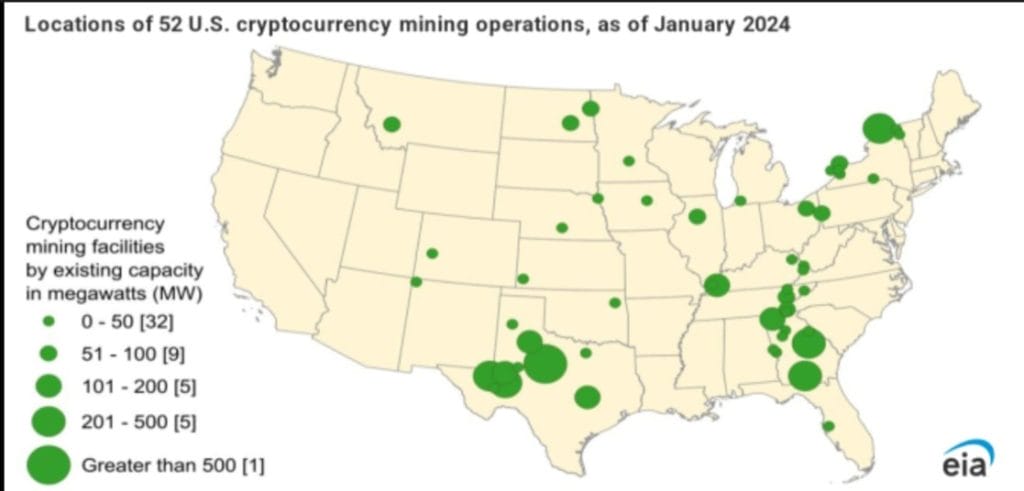

Meanwhile, the U.S. is the world’s biggest crypto mining hub, accounting for up to 38% of the Bitcoin network’s total “hash rate”—or processing power.

The country has overtaken China, which previously had over 75% of the hash rate before authorities cracked down on crypto in 2021.

According to Cambridge University data, China’s share of global Bitcoin mining capacity plunged to zero in July and August 2021 following a ban on crypto mining in the country.

As of Dec. 18, however, China made up about 21% of the total Bitcoin mining market, per The Chain Bulletin.

A Double-Edged Sword

General Kenobi, business development manager at Bitcoin mining pool Demand, told Cryptonews that Donald Trump’s proposed tariffs on China “will definitely increase the cost of all ASICs from all manufacturers.”

He said that’s because “there are currently no competitive US-based ASIC manufacturers.”

Kenobi said if tariffs make mining devices imported from China too expensive, American Bitcoin miners have the option to pivot to ASICs made by Bitmain in Thailand or Indonesia, where the company has other manufacturing plants.

He stated:

“Depending on how Trump’s administration implements the tariffs, and if any loopholes are left available to exploit, miners might be able to avoid the worst effects from the tariffs.”

The looming uncertainty surrounding Trump’s tariffs makes it difficult for any U.S.-based Bitcoin miner to predict their full impact. Lord, the Oobit president, noted that this unpredictability is a double-edged sword.

While tariffs inevitably raise costs for mining hardware, they also create major challenges for the industry’s growth, he said.

For example, higher costs could speed up the manufacture of mining rigs domestically, says Lord. But he admits that this “would take time and significant investment” to set up.

Secondly, increased costs could also lead to “consolidation” in the sector – something that favors “larger operators with established infrastructure” compared to “new entrants facing higher startup costs.”

Lord explained that such a scenario creates an “interesting dynamic,” one in which existing American miners “benefit from reduced competition, as higher equipment costs would raise barriers to entry,” adding:

“This could potentially strengthen the position of established American mining operations in the global hash rate distribution, although at the cost of reduced industry growth and innovation.”

Is Trump Contradicting Himself with Stiffer Tariffs?

Trump has gone from a crypto naysayer to a proponent in just three years. In June 2021, the former U.S. president criticized Bitcoin as a “scam against the dollar.” Today, he’s making huge promises about the digital asset.

One such promise is to double the supply of energy available to Bitcoin miners in the U.S., currently at 2.6% of the total electricity use every year, according to the Cambridge Centre for Alternative Finance.

“We’ll be releasing people from certain ridiculous requirements, and using fossil fuel to make electricity,” Trump said as he courted crypto investors at the Nashville Bitcoin conference in July.

“We’ll be using nuclear power [and] we’ll be doing it in an environmentally friendly way,” he added.

But analysts say his proposed new tariffs could make it even harder for local miners to buy advanced, energy-efficient mining rigs from abroad.

Kenobi, the Demand Bitcoin mining pool executive, said that given the pro-crypto administration that Trump is building, “it wouldn’t be outrageous to imagine certain exceptions to these new tariffs for the mining sector.”

He said such a move “would restore competitiveness” in the American Bitcoin mining market.

Kenobi believes that Trump could even offer miners subsidies to fend off threats from Russia and Iran – both of which appear to be actively supporting mining activities – in a “hash rate war.”

Coherent Strategy

Oobit’s Lord said the apparent contradiction between Trump’s backing of Bitcoin and his protectionist trade policies “reveals a coherent strategy aimed at reshaping the U.S. crypto industry.”

He said Trump appears to be pursuing a two-pronged approach. One strategy involves the use of tariffs to drive local manufacturing while at the same time “creating a more favorable regulatory environment for crypto operations and innovation.”

“This could lead to restructuring the global crypto industry, with more vertically integrated U.S.-based operations,” Lord tells Cryptonews.

The other strategy relates to the nomination of crypto-friendly officials like Paul Atkins as SEC Chair and David Sacks as AI and Crypto Czar.

Lord, a veteran investment banker who transitioned into Web3 and crypto, said the move suggests “a clear intention” by the president-elect to create “a comprehensive federal framework supportive of crypto development.”

He detailed:

“The regulatory clarity, combined with the potential establishment of a strategic U.S. Bitcoin reserve, could offset many of the short-term negative impacts of the tariffs… [It] could lead to a more resilient and self-sufficient American crypto sector in the long term.”

There’s still more than two million Bitcoins to be mined and American miners are ratcheting up investments in the sector.

For example, Jack Dorsey’s payments firm Block revealed plans to put more money into its Bitcoin mining initiative following Trump’s election victory.

Amid the US-China trade tensions, Bitmain recently announced the launch of its new production line in the United States.

The company described the move as “strategic,” aiming to provide “faster response times and more efficient services” to its North American customers.

The post Could Trump’s Tariffs Contradict His Pro-Bitcoin Stance? appeared first on Cryptonews.