Coinbase printed a complete information detailing its digital asset itemizing course of, emphasizing that purposes stay free and merit-based after dealing with earlier accusations of charging thousands and thousands in itemizing charges.

CEO Brian Armstrong introduced the transparency initiative amid ongoing disputes with initiatives claiming the alternate demanded substantial funds for token listings.

The information comes as Coinbase struggles with declining revenues and buying and selling volumes.

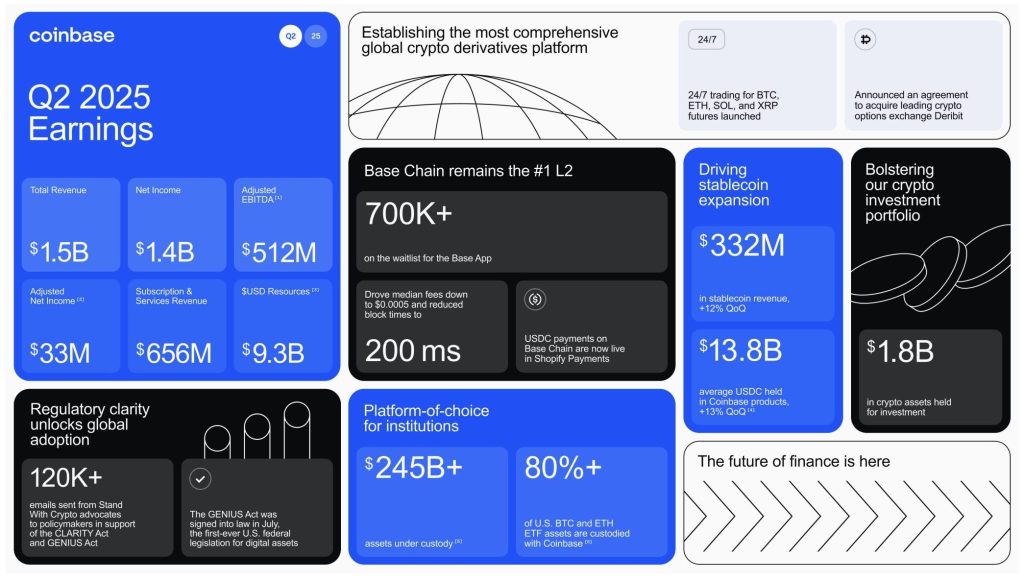

Second-quarter outcomes confirmed $1.5 billion in income, lacking analyst expectations of $1.59 billion, whereas shopper buying and selling quantity dropped 45% to $43 billion. Internet revenue plummeted to $33.2 million from $294.4 million in Q2 2024.

Coinbase inventory dropped 9.2% in after-hours buying and selling following Q2 outcomes, however has gained practically 50% year-to-date.

XRP emerged as an surprising income vibrant spot, producing 13% of shopper transaction income in comparison with Ethereum’s 12% for the second consecutive quarter.

Detailed Course of Addresses Payment Controversy

The itemizing information outlines a five-step analysis course of, together with software submission, enterprise evaluation, and core opinions protecting authorized, compliance, and technical safety components.

Coinbase emphasizes that listings join initiatives to deep liquidity and a world buyer base inside a trusted regulatory framework.

The alternate addresses frequent roadblocks, together with securities danger assessments based mostly on public statements and advertising and marketing supplies.

Based on the rule of thumb, initiatives highlighting token utility and governance rights face smoother opinions than these promising speculative returns or “moon” eventualities.

Common due diligence takes one week, with buying and selling enabled inside two weeks of approval, although timelines fluctuate considerably based mostly on asset complexity.

Tokens on supported networks, together with Ethereum, Base, Solana, Arbitrum, Optimism, Polygon, and Avalanche, obtain expedited processing in comparison with new blockchain integrations.

We get a ton of questions on how and why belongings get listed on Coinbase. To be extra clear we wrote a information on the way it all works.

TL;DR: listings are free and merit-based. Each asset is evaluated in opposition to the identical requirements.

Hyperlink in replies. pic.twitter.com/HmqQDt6085— Brian Armstrong (@brian_armstrong) September 12, 2025

The information coincides with Coinbase’s strategic pivot towards turning into an “every little thing alternate” supporting thousands and thousands of tokens by means of decentralized alternate integration.

Since then, Armstrong has introduced plans to eradicate intensive itemizing boundaries which have restricted asset additions.

As a part of the rule of thumb, the alternate’s phased market launch course of consists of transfer-only intervals, restrict order auctions, and full buying and selling states designed to guard market integrity throughout new asset introductions.

Notably, this new transparency guideline follows a number of allegations of misconduct.

Earlier in November 2024, TRON founder Justin Solar disputed Armstrong’s free itemizing claims, alleging that Coinbase requested 500 million TRX price $80 million plus a $250 million Bitcoin deposit in Coinbase Custody.

Solar famous that Binance listed TRON with out charges, whereas Sonic Labs co-founder Andre Cronje additionally reported related experiences with Coinbase demanding $30-300 million.

Income Pressures Drive New Monetization Methods Amid Market Challenges

Final month, Coinbase launched a 0.1% price on USDC-to-USD conversions exceeding $5 million inside 30-day intervals beginning August 13. This was the primary monetization of beforehand free stablecoin off-ramping providers.

The change addresses aggressive disadvantages from Tether’s present redemption charges that made USDC the most cost effective route for large-scale fiat conversions.

The price implementation triggered person backlash, evaluating Coinbase to conventional banking establishments.

CEO Armstrong defended the choice as vital to handle arbitrage alternatives the place customers swapped USDT to USDC earlier than changing to USD, decreasing USDC provide whereas sustaining USDT circulation.

@Coinbase is popping to the bond marketplace for assist after a disappointing second-quarter earnings report triggered a sell-off in its inventory. #Coinbase #Coinhttps://t.co/QAMu3x06KO

— Cryptonews.com (@cryptonews) August 5, 2025

Following disappointing Q2 outcomes, Coinbase additionally introduced a $2 billion convertible senior notes providing cut up between 2029 and 2032 maturities.

Proceeds will fund capped name transactions to restrict share dilution and assist company wants, together with working capital, acquisitions, and debt repurchases.

The corporate bought 2,509 Bitcoin price $222 million throughout Q2, bringing whole holdings to 11,776 BTC and putting it among the many prime 10 public holders forward of Tesla.

Nonetheless, Bitcoin accumulation couldn’t offset broader income declines affecting total efficiency.

Coinbase continues increasing income streams by means of prediction markets, tokenized shares, and derivatives for U.S. customers.

The alternate secured a European MiCA license by means of Luxembourg’s monetary regulator whereas pursuing partnerships, together with Chase Final Rewards level transfers to crypto wallets.

Regardless of monetary challenges, TIME additionally acknowledged Coinbase as certainly one of 2025’s 100 Most Influential Firms, labeling it a “disruptor” for shaping U.S. digital asset insurance policies and predicting it may develop into the central hub for American crypto buying and selling.

The regulatory panorama supporting Coinbase’s transparency push consists of the SEC’s Mission Crypto initiative, which goals to allow on-chain monetary markets, and the GENIUS Act, which creates frameworks for cost stablecoins.

The submit Coinbase Releases Public Information to Digital Asset Itemizing Course of Amid Transparency Push appeared first on Cryptonews.