Coinbase obtained 12,716 authorities and regulation enforcement info requests between October 2024 and September 2025, marking a 19% year-over-year improve and the very best quantity within the alternate’s historical past.

Worldwide requests accounted for 53% of the full, a brand new excessive, with France main jurisdictions outdoors the U.S. with a 111% surge in demand for buyer knowledge.

The surge comes as Coinbase expands operations throughout greater than 100 international locations amid heightened regulatory scrutiny following main compliance failures in Europe and a harmful cybersecurity breach earlier this 12 months.

The alternate’s seventh annual Transparency Report, revealed by Chief Authorized Officer Paul Grewal, factors out the rising world stress on crypto platforms to stability consumer privateness with authorized obligations.

France Drives Worldwide Demand, U.S. Nonetheless Dominates

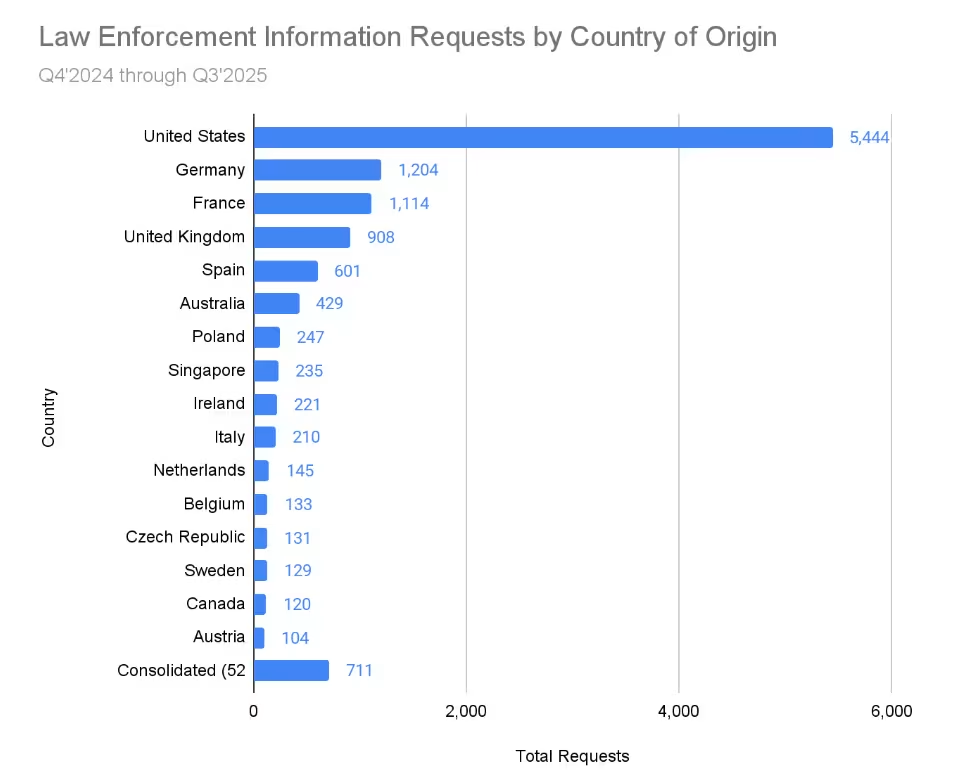

The USA remained the most important single supply of requests, adopted by Germany, the UK, France, Spain, and Australia.

These six international locations mixed accounted for roughly 80% of all regulation enforcement requests globally.

France noticed the sharpest improve amongst main jurisdictions, with requests leaping 111% from the prior reporting interval.

The U.Okay. and Spain additionally posted double-digit positive factors, rising 16% and 27% respectively. Germany, Sweden, and South Korea recorded decreases, with South Korea’s requests dropping 67%.

Requests from Moldova and Brazil elevated by components of 5.7 and a pair of.7, whereas Australia’s quantity remained almost flat with only a 1% uptick.

Regardless of fluctuations throughout completely different markets, complete request quantity has stayed inside the 10,000 to 13,000 vary yearly over the previous 4 years.

Compliance Underneath Hearth After Fines and Information Breach

The rising demand for consumer knowledge comes amid regulatory penalties and inner safety lapses which have broken Coinbase’s compliance fame.

In November, the alternate’s European arm agreed to pay €21.5 million to Eire’s Central Financial institution after coding errors left 31% of transactions, price greater than $202 billion, unscreened for cash laundering between 2021 and 2022.

The malfunction affected 5 of 21 transaction-monitoring situations, forcing Coinbase to reanalyze 185,000 transactions and file 2,700 suspicious transaction reviews.

Coinbase Europe was fined €21.5M after tech errors left 30M transactions unmonitored, breaching AML guidelines. #Eire #AML #Coinbasehttps://t.co/IdrCGSLhBp

— Cryptonews.com (@cryptonews) November 6, 2025

Simply final 12 months, Coinbase’s UK subsidiary was fined £3.5 million by the Monetary Conduct Authority for onboarding over 13,000 high-risk clients in violation of a voluntary restriction, facilitating almost $226 million in transfers.

In Might, the alternate disclosed a cyberattack compromising the private knowledge of no less than 69,461 clients, together with government-issued IDs and e mail addresses, after hackers bribed customer support workers.

The breach, which was not disclosed till weeks after discovery, triggered no less than six class-action lawsuits and a Justice Division investigation.

Shareholders later filed a separate go well with alleging that Coinbase and its CEO, Brian Armstrong, didn’t promptly disclose each the breach and the UK compliance violation, contributing to a 7.2% drop within the firm’s inventory.

Coinbase Expands Compliance as SEC Strain Eases

Coinbase emphasised in its newest report that it evaluations every request on a case-by-case foundation and seeks to slender overly broad calls for.

The alternate said that it seeks to offer anonymized or aggregated knowledge each time attainable, relatively than exposing particular person buyer info.

Requests obtained don’t all the time end in knowledge being produced, and the corporate maintains that it doesn’t grant governments direct entry to its methods.

The report arrives as Coinbase advantages from a dramatic shift in U.S. regulatory posture.

Nice information!

After years of litigation, thousands and thousands of your taxpayer {dollars} spent, and irreparable hurt performed to the nation, we reached an settlement with SEC workers to dismiss their litigation in opposition to Coinbase. As soon as accepted by the Fee (which we're advised to count on subsequent week)… pic.twitter.com/IlnoBs7N6n— Brian Armstrong (@brian_armstrong) February 21, 2025

In March, the Securities and Trade Fee agreed to drop its years-long enforcement motion in opposition to the alternate, which had accused Coinbase of working as an unregistered securities platform.

The dismissal adopted related strikes by the SEC to desert instances in opposition to Kraken, Robinhood, and Consensys after Paul Atkins changed Gary Gensler as chair in January.

Moreover, again in September, Atkins pledged to switch what he known as a “shoot first and ask questions later” method with advance notices and clearer steerage for crypto companies.

The put up Coinbase Hit With Document 12,716 Authorities Requests in 2025 appeared first on Cryptonews.