China has accused the US of covert involvement in what’s now thought of one of many largest Bitcoin thefts in historical past, a $4 billion hack courting again to 2020 that has advanced right into a geopolitical dispute over digital belongings.

The controversy facilities on the LuBian mining pool, a China-based Bitcoin collective that suffered a significant breach on December 29, 2020, shedding 127,272 BTC, then valued at roughly $3.5 billion.

The cash, owned by Chen Zhi of Cambodia’s Prince Group, remained dormant for almost 4 years till the U.S. Division of Justice (DOJ) introduced in October 2025 that it had seized 127,000 BTC and charged Chen.

A Lubian-linked pockets has moved 11,886 BTC (~$1.3B) inside a day of a DOJ submitting. @lookonchain and @ArkhamIntel have tracked flows as @TheJusticeDept particulars the Lubian Bitcoin transfers in a Forfeiture Case.#Bitcoin #CryptoLaw

https://t.co/Tz6XS1DxvB

— Cryptonews.com (@cryptonews) October 15, 2025

Did Washington Crack the LuBian Hack? Blockchain Forensics Trace at a Hidden Operation

Chinese language commentators and blockchain analysts argue that the seized Bitcoin stands out as the similar because the LuBian funds, implying American authorities might have accessed them years earlier via a covert operation.

Blockchain forensics from Arkham Intelligence and Elliptic present that pockets addresses within the DOJ’s indictment match these linked to the 2020 LuBian hack.

On-chain data point out that on the day of the assault, LuBian’s principal pockets transferred 127,272 BTC to an unknown handle, almost the identical quantity later seized by U.S. officers.

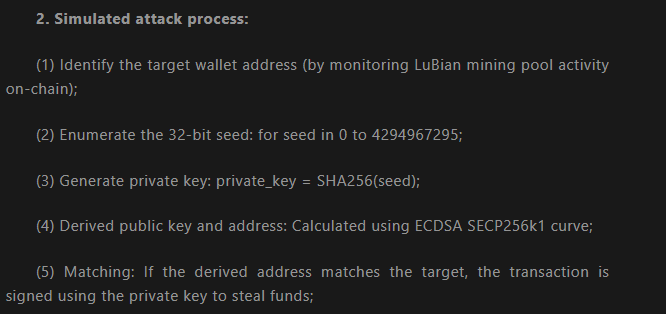

The 2020 breach exploited a flaw in LuBian’s 32-bit pseudo-random key generator, just like the “MilkSad” cryptographic flaw revealed in 2023.

The defect made it doable for attackers to brute-force hundreds of pockets keys inside hours, draining greater than 90% of LuBian’s holdings.

For years, the stolen Bitcoin remained unmoved. LuBian and Chen Zhi despatched over 1,500 messages through Bitcoin’s OP_RETURN perform in 2021 and 2022, pleading with the hackers to return the belongings and providing a ransom. No response was ever obtained.

In June 2024, blockchain trackers noticed renewed motion from the dormant wallets. About 127,000 BTC have been transferred to new addresses, later tagged by Arkham as belonging to the U.S. authorities.

The DOJ’s announcement of the seizure got here months later, a sequence that Chinese language observers say raises questions on when and the way the U.S. obtained entry to the non-public keys.

The DOJ has not disclosed its technical strategies however claims the belongings have been “linked to illicit operations and laundered via mining networks working in China and Iran.”

Nevertheless, on-chain information reviewed by analysts suggests the funds originated immediately from LuBian’s compromised wallets.

Dormant LuBian Wallets Transfer $3.1B in Bitcoin Amid U.S. Enforcement Strain

Including to the confusion, LuBian-linked wallets have proven new exercise because the DOJ’s announcement. On October 15, blockchain monitoring agency Lookonchain reported {that a} long-dormant handle moved 11,886 BTC (about $1.3 billion) to a number of new wallets.

Every week later, on October 22, one other 15,959 BTC (price $1.83 billion) was transferred to 4 further wallets, in accordance with OnChainLens.

LuBian-linked wallets transfer 15,959 BTC price $1.83B, marking the second switch in two weeks after the Oct 15 motion of 11,886 BTC price $1.3B following the DOJ case.#Bitcoin #Lubian #DOJhttps://t.co/SLHs8g9uJF

— Cryptonews.com (@cryptonews) October 22, 2025

Analysts debate whether or not the transfers are defensive strikes or reallocations forward of potential liquidation.

All associated wallets stay sanctioned, and Chen Zhi’s whereabouts are at the moment unknown. The LuBian case has change into a cautionary story for DeFi and crypto infrastructure safety, and the hack has change into a reference level for crypto’s early safety failures.

The incident exhibits the risks of weak random quantity technology, additionally affecting corporations like Wintermute, which misplaced $160 million in 2022 because of comparable vulnerabilities.

In the meantime, each the U.S. and the U.Ok. have been concerned in separate large-scale Bitcoin seizures tied to Chinese language-linked operations.

In a parallel case, British authorities are managing a £5 billion ($7.2 billion) Bitcoin trove confiscated in 2018 from Chinese language fraud suspects.

The U.Ok. Excessive Court docket is at the moment deciding whether or not to return the funds to 130,000 Chinese language traders or retain a lot of the proceeds for the federal government.

The publish China Accuses U.S. of Secret Function in $4B Bitcoin Hack – What’s Actually Going On? appeared first on Cryptonews.