ChatGPT’s AI mannequin processed 42 reside indicators, revealing bearish momentum as Dogecoin plunged 5.58% to $0.16241 amid political tensions between Elon Musk and Donald Trump, affecting DOGE company hypothesis.

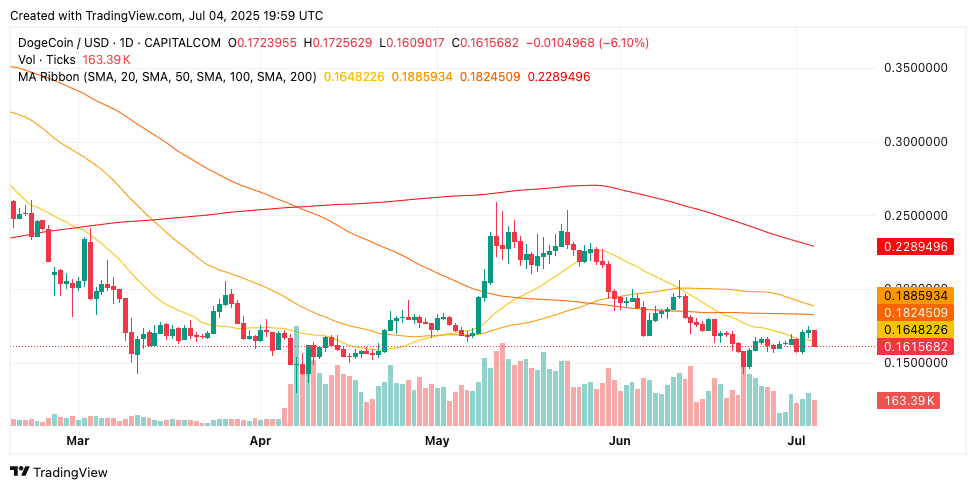

DOGE is buying and selling under all main EMAs with a large 636.62M quantity surge because it checks key assist on the $0.155–$0.160 zone.

Robust promoting strain emerges as the worth falls under the 20-day EMA ($0.16855), 50-day EMA ($0.17932), 100-day EMA ($0.19104), and 200-day EMA ($0.20457), amid heightened political drama, introducing volatility.

The market cap stands at $24.33 billion, with an explosive 42.16% quantity surge to $908.02 million, validating institutional repositioning during times of uncertainty.

The next evaluation synthesizes ChatGPT’s 42 real-time technical indicators, political developments, sentiment metrics, and technical patterns to evaluate DOGE’s 90-day trajectory amid escalating political tensions and chart sample formations.

Technical Breakdown: Bearish Construction Dominates All Timeframes

Dogecoin’s present worth of $0.16241 displays a significant 5.58% day by day decline from its opening worth of $0.17201, establishing a regarding buying and selling vary between $0.17296 (excessive) and $0.16128 (low).

This $0.01168 intraday unfold signifies excessive volatility during times of political uncertainty.

RSI at 43.57 approaches oversold territory with out reaching excessive ranges, indicating balanced momentum regardless of intense promoting strain. This positioning suggests DOGE stays weak to additional declines with out instant reversal alerts from technical indicators.

MACD indicators show conflicting readings with the MACD line at 0.00176, buying and selling barely above zero, which suggests underlying bullish momentum. Nonetheless, the adverse histogram at -0.00733 signifies robust bearish momentum divergence requiring cautious monitoring for breakdown cues.

Political Drama Affect: Musk-Trump Tensions Drive Volatility

The political feud between Elon Musk and Donald Trump has launched volatility to DOGE, with hypothesis surrounding the DOGE company creating uncertainty amongst buyers.

This political drama represents a departure from conventional meme-driven rallies, introducing systematic threat to DOGE’s worth motion.

Donald Trump on whether or not or not he’ll deport Elon Musk amid their feud:

“I don’t know. We’ll have to have a look. We could must put DOGE on Elon, what DOGE is? DOGE is the monster which may have to return and eat Elon.” pic.twitter.com/eO4FB0QTTh— Pop Base (@PopBase) July 1, 2025

Elon Musk’s hypothesis a few new American get together has generated elevated consideration for potential meme coin increase eventualities, though present political tensions have overshadowed these bullish narratives.

It’s apparent with the insane spending of this invoice, which will increase the debt ceiling by a file FIVE TRILLION DOLLARS that we reside in a one-party nation – the PORKY PIG PARTY!!

Time for a brand new political get together that truly cares in regards to the folks.— Elon Musk (@elonmusk) June 30, 2025

The timing of political developments coincides with technical breakdown patterns, amplifying downward strain.

Ascending Triangle Formation: Bulls Keep Hope Regardless of Breakdown

Technical analysts determine a big ascending triangle sample on weekly charts, representing a traditional bullish construction regardless of present worth weak point.

The sample reveals DOGE holding trendline assist round $0.17, although the latest breakdown challenges this bullish thesis.

$DOGE Weekly Chart Replace$DOGE is forming a big ascending triangle sample on the weekly — a traditional bullish construction!

Holding trendline assist round $0.17

Bounced twice off key assist zone

Eyes on breakout above $0.25–$0.29 resistance

Targets forward:… pic.twitter.com/ZeeiVdY9mL

— Fabri Crypto (@fabriwtfbro) July 4, 2025

The ascending triangle formation suggests accumulation at larger lows whereas dealing with constant resistance round $0.25–$0.29 ranges.

This sample sometimes resolves with upward breakouts, although present political tensions complicate conventional technical evaluation assumptions.

A number of bounces off key assist zones point out institutional curiosity in DOGE accumulation during times of weak point, though the latest breakdown under triangle assist raises questions in regards to the sample’s validity.

The following few weeks will probably be key in figuring out whether or not bulls can reclaim triangle assist or bears proceed driving costs decrease.

Historic Context: Sharp Correction from January Highs

DOGE’s 2025 efficiency displays excessive volatility following January’s robust shut at $0.33, representing the native excessive for the 12 months.

The next correction to February’s $0.20 and stabilization round $0.17 in March and April established the present buying and selling ranges.

Might’s modest restoration to $0.19, adopted by June’s decline to $0.16, demonstrates DOGE’s incapacity to maintain momentum with out main catalysts. Present worth motion represents the continuation of the correction cycle that started after January’s peak efficiency.

The 51% decline from January highs to present ranges displays DOGE’s high-beta nature and sensitivity to sentiment shifts.

This historic context gives perspective on present weaknesses whereas highlighting DOGE’s potential for dramatic reversals during times of optimistic catalysts.

Help & Resistance: Key Ranges Outline Subsequent Route

Rapid assist emerges at at this time’s low of round $0.16128, bolstered by the important thing assist zone at $0.15500-$0.16000.

This confluence represents essentially the most important technical stage for figuring out DOGE’s near-term path and potential for deeper correction.

Main assist zones lengthen from $0.14000 to $0.15000, representing historic accumulation ranges, adopted by robust assist from $0.12000 to $0.13000, similar to earlier cycle lows. These ranges present a number of security nets throughout prolonged correction eventualities.

#Dogecoin is on the third touchpoint of an ascending channel, making it the perfect purchase stage earlier than an enormous surge

$Doge/M1 pic.twitter.com/ZiYlzKPAaG

— Dealer Tardigrade (@TATrader_Alan) July 4, 2025

Resistance begins instantly on the 20-day EMA, situated at $0.16855, representing the primary hurdle for any potential restoration makes an attempt.

The important thing resistance cluster lies between the 50-day EMA ($0.17932) and the 100-day EMA ($0.19104), making a difficult overhead provide.

Market Metrics: Excessive Quantity Confirms Promoting Stress

DOGE maintains a $24.33 billion market capitalization with an distinctive 24-hour buying and selling quantity of $908.02 million, representing a large 42.16% surge. The quantity-to-market cap ratio of 3.74% suggests intense promoting strain during times of political uncertainty.

The excessive quantity surge to 636.62M DOGE confirms institutional repositioning throughout breakdown makes an attempt, validating technical evaluation quite than suggesting accumulation.

This quantity sample helps a bearish interpretation of present worth motion.

Present pricing represents a 78% low cost to the all-time highs achieved in 2021, though comparability to latest highs reveals a 51% decline from the January 2025 peaks.

This positioning gives long-term worth arguments whereas acknowledging important technical injury.

Social Sentiment: Group Optimism Fights Technical Actuality

LunarCrush knowledge reveals resilient group engagement with 83% optimistic sentiment regardless of latest worth weak point.

The social dominance of 2.95% with 2.71 million whole engagements demonstrates DOGE’s skill to take care of consideration throughout correction durations.

Latest social themes have targeted on ascending triangle formations, accumulation alternatives, and long-term bullish eventualities focusing on the $1 stage.

The prophecy: $1$DOGE pic.twitter.com/SESlJ33hMT

— Chimp of the North (@cryptochimpanz) July 4, 2025

Group discussions emphasize technical patterns whereas acknowledging the short-term political headwinds that have an effect on worth motion.

The disconnect between social sentiment (83% optimistic) and technical indicators (bearish) represents typical DOGE group habits throughout correction durations. This resilient sentiment gives basic assist for eventual restoration eventualities.

90-Day DOGE Value Forecast

Political Decision Rally (Bull Case – 30% Likelihood)

Decision of Musk-Trump political tensions, mixed with a breakout from an ascending triangle, may drive the restoration towards $0.25–$0.29, representing a 54–79% upside.

This state of affairs requires political readability and profitable protection of $0.155–$0.160 assist zone with quantity affirmation.

Technical targets embody $0.20, $0.25, and $0.29 primarily based on triangle sample measurements and historic resistance ranges. The meme coin narrative may resurface strongly if political uncertainties resolve favorably for DOGE-related hypothesis.

Prolonged Correction (Base Case – 50% Likelihood)

Continued political uncertainty and technical breakdown may drive DOGE towards $0.12–$0.14, representing a 14–26% draw back.

This state of affairs assumes ongoing political tensions and failure to carry key assist ranges throughout summer time buying and selling durations.

Help at $0.155–$0.160 would probably fail throughout an prolonged correction, with quantity normalizing round 400–500 million DOGE day by day. This sideways-to-downward motion gives higher accumulation alternatives for long-term holders searching for decrease entry factors.

Deep Correction (Bear Case – 20% Likelihood)

Extreme political escalation or broader market weak point may set off a correction towards $0.10–$0.12, representing a 26–38% draw back.

This state of affairs would require robust adverse catalysts past present political tensions.

The robust group sentiment and meme coin resilience restrict excessive draw back eventualities, with main assist at $0.12–$0.13 offering key long-term pattern assist for future restoration cycles.

DOGE Forecast: Political Drama Meets Technical Breakdown

DOGE’s present positioning displays the convergence of political uncertainty, technical breakdown, and group resilience.

The 42-signal evaluation reveals that the cryptocurrency is positioned at a key juncture between sample continuation and a significant correction.

Present consolidation round $0.16 with essential assist at $0.155–$0.160 creates a call level for DOGE’s trajectory. The mixture of political drama, technical weak point, and group optimism positions DOGE for unstable worth motion as catalysts develop all through Q3 2025.

The submit ChatGPT’s 42-Sign DOGE Evaluation Flags Key $0.155 Help Take a look at Amid Musk Drama appeared first on Cryptonews.