The U.S. Commodity Futures Buying and selling Fee has formally scrapped its 2020 “precise supply” steerage for Bitcoin and different digital currencies and set the stage for a broader shift in how the company oversees crypto markets.

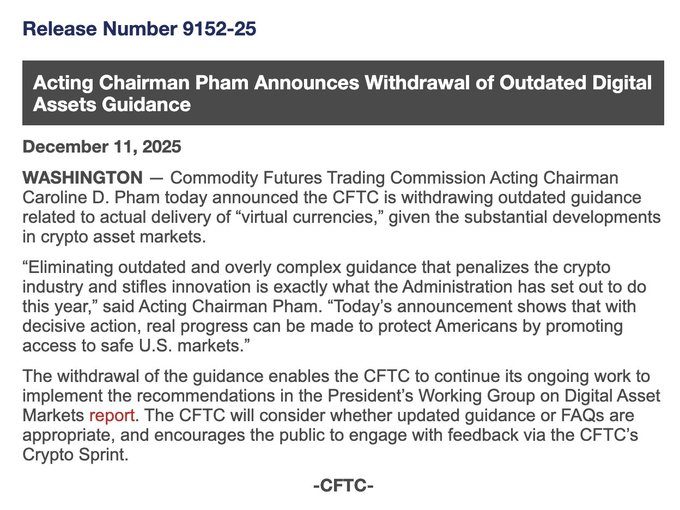

Appearing Chair Caroline Pham introduced the withdrawal on December 11, calling the previous framework outdated and inconsistent with the market’s stage of maturity.

Supply: CTFC

She mentioned the transfer displays the administration’s push this 12 months to take away guidelines that had turn out to be overly complicated and deterred crypto corporations from working throughout the U.S., including that eliminating such limitations exhibits “actual progress may be made to guard People by selling entry to secure U.S. markets.”

CFTC Withdraws 28-Day Crypto Supply Customary, Easing Path for New Merchandise

The steerage that has now been withdrawn outlined the situations below which a leveraged or margined crypto buy could possibly be thought-about “precise supply,” a regular constructed round a 28-day window that required the client to have full possession and management of the asset.

It was launched at a time when regulators have been nonetheless uncertain how digital forex markets would develop, and it positioned crypto in a class separate from different commodities.

Pham mentioned the company’s expertise with digital forex derivatives listings, together with years of market progress and the event of stronger custody practices, made the previous guidelines incompatible with how the business now operates.

The withdrawal permits digital belongings to be regulated below the CFTC’s basic, technology-neutral framework, a shift that reduces compliance burdens for exchanges searching for to checklist new merchandise.

It additionally marks a step towards normalizing Bitcoin and Ethereum alongside conventional commodities.

The replace lands at a time when U.S. regulators are shifting shortly on crypto coverage. Solely days earlier than scrapping the previous steerage, the CFTC cleared the way in which for spot crypto buying and selling to happen immediately on federally regulated futures exchanges, a primary for the business.

@ CFTC approves spot crypto buying and selling on U.S. futures exchanges, giving buyers secure, regulated entry to digital belongings. #SpotTrading #CFTC https://t.co/S30HuwWjGX

— Cryptonews.com (@cryptonews) December 4, 2025

Appearing Chair Caroline Pham known as the transfer a serious shift, saying it brings spot buying and selling onto platforms which have operated below federal guidelines for many years.

It additionally forces leveraged retail crypto trades, beforehand caught in a grey zone, onto exchanges that already observe strict market protections.

The transfer comes after months of coordination with different businesses, together with the SEC. Earlier this 12 months, each regulators confirmed that registered exchanges below both company might assist sure spot crypto merchandise.

Spot crypto buying and selling is shifting nearer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate sure spot merchandise.#SpotCrypto #SEC #CFTChttps://t.co/5C5uy800Ju

— Cryptonews.com (@cryptonews) September 3, 2025

CFTC Advances Crypto Dash With New Tokenized Collateral Pilot

These strikes are a part of a wider effort tied to the CFTC’s “Crypto Dash,” a program analyzing tokenized collateral, stablecoin use in derivatives markets, and methods to modernize clearing and settlement guidelines by way of blockchain techniques.

The company has already begun testing a few of these concepts in follow. On December 8, it launched a pilot program that permits Bitcoin, Ether, and USDC for use as collateral in derivatives markets, giving the company real-time perception into how tokenized belongings behave below regulated situations.

The US @CFTC has launched a pilot permitting Bitcoin, Ether and USDC to function collateral in derivatives markets, marking a serious step towards regulated crypto integration.#CFTC #Tokenization https://t.co/XrmdLTamP7

— Cryptonews.com (@cryptonews) December 9, 2025

For the primary three months of the pilot, futures fee retailers can solely settle for these three digital belongings and should submit weekly experiences on their holdings, a construction the company says will assist it monitor threat whereas nonetheless increasing entry to new instruments.

The CFTC’s divisions have additionally issued steerage confirming that tokenized real-world belongings, corresponding to U.S. Treasuries and cash market funds, may be evaluated throughout the present regulatory framework.

To ease the transition, the company granted no-action aid to corporations that wish to settle for sure non-securities digital belongings as buyer margin.

Pham has emphasised that the aim is to present U.S. merchants safer alternate options to offshore platforms after years of high-profile failures and losses.

The shift is unfolding because the company undergoes its personal management transition. Pham has been serving as performing chair since January and is predicted to step down as soon as the Senate confirms President Donald Trump’s nominee, Michael Selig.

The publish CFTC Scraps ‘Outdated’ Bitcoin Steering – What This Means for Future Regulation appeared first on Cryptonews.