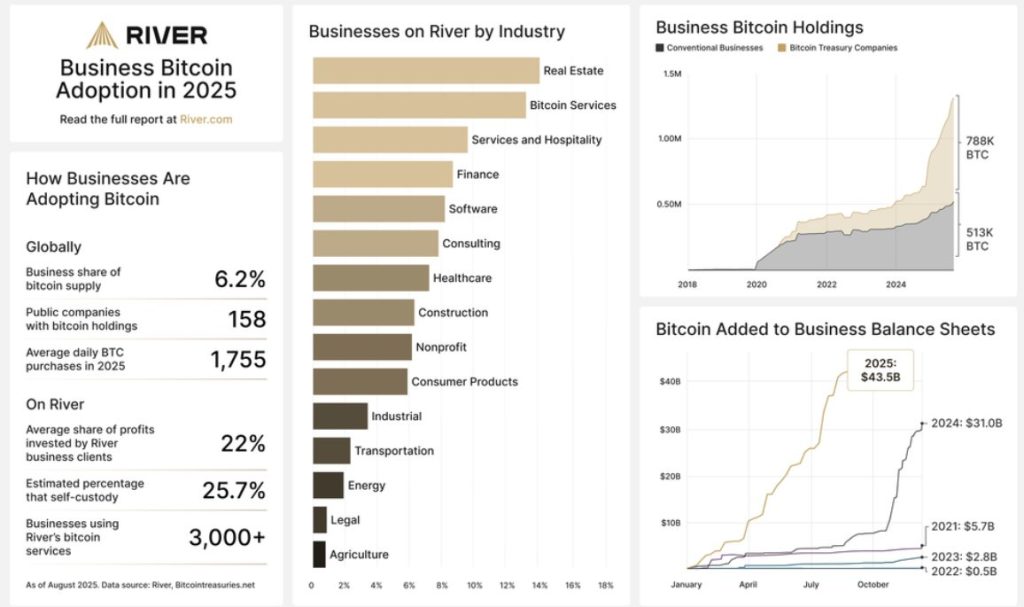

Companies throughout main industries have bought 1,755 Bitcoin day by day (value $195.2 million), contributing over $1.3 trillion to Bitcoin’s market cap throughout the previous 20 months.

Market analysts imagine that if this regular funding circulation continues, BTC transferring above $125K is the subsequent sensible goal.

River’s newest “Enterprise Bitcoin Adoption in 2025” research signifies that institutional Bitcoin acquisition has pushed company reserves from 510K BTC to 1.3 million BTC spanning January 2024 by way of August 2025, whereas publicly traded corporations proudly owning Bitcoin expanded from 39 to 158 entities on this interval.

22% Internet Revenue Allocation – Companies Go All-In on Bitcoin Technique

At present, companies now management greater than 6% of Bitcoin’s circulating provide, representing a twenty-one-fold growth since January 2020.

Bitcoin Treasury Firms drive a lot of this development in enterprise adoption, accounting for 76% of all enterprise purchases since January 2024 and 60% of publicly reported enterprise holdings.

These stock-listed entities give attention to amassing substantial Bitcoin reserves whereas offering shareholders who’re unable to buy Bitcoin immediately with equity-based publicity to its worth actions.

Michael Saylor launched the Bitcoin treasury mannequin when MicroStrategy (presently Technique) executed its inaugural $250 million Bitcoin acquisition in August 2020.

Technique’s Bitcoin portfolio now exceeds $70 billion in worth. This success story has impressed the launch of over 50 comparable Bitcoin treasury enterprises.

Previous to 2024, company Bitcoin adoption remained confined to pick out personal sector niches.

Mining operations had been preliminary adopters, with crypto companies and occasional unconventional individuals like Tesla from totally different sectors following go well with.

This mannequin reworked solely all through 2024.

River’s analysis signifies Bitcoin now delivers worth throughout enterprise classes and firm sizes, spanning actual property, software program growth, consulting providers, healthcare, logistics, shopper items, media corporations, and automotive sectors.

River’s findings present quite a few companies allocating properly past a theoretical 1% to Bitcoin holdings.

Present company allocations common 22% of internet earnings towards Bitcoin investments, primarily based on July 2025 survey information, whereas the median allocation reaches 10%.

Amongst these corporations, 63.6% deal with Bitcoin as a everlasting funding automobile, constantly accumulating positions with out speedy promoting or portfolio rebalancing intentions.

BTC Above $125K Inside Attain as Volatility Drops to Gold Ranges

Bitcoin’s climb above $125K now appears more and more attainable.

Earlier adoption boundaries, resembling authorities “ban” fears or company possession restrictions, have largely vanished.

A number of sovereign nations now preserve official Bitcoin investments, and March 2025 noticed america launch its Strategic Bitcoin Reserve program.

BINANCE FOUNDER CZ SAYS MANY COUNTRIES ARE BUYING #BITCOIN FOR THEIR RESERVES

“COUNTRIES ARE FORCED TO BUY BTC” pic.twitter.com/DxYIHFoG9N— Vivek Sen (@Vivek4real_) July 5, 2025

Bitcoin beforehand lacked ample liquidity for main institutional adoption. This constraint not exists.

However now Bitcoin presently ranks amongst international belongings with the best liquidity and operates constantly, contrasting with conventional treasury devices.

Current years have additionally witnessed stance reversals from outstanding figures, together with Federal Reserve Chair Jerome Powell, BlackRock Chief Government Larry Fink, and President Trump, concerning Bitcoin.

Analyst Zynweb3 observes that Bitcoin traditionally reaches lows on the 0.382 Fibonacci retracement, occurring in Q3 2024 and Q2 2025, with potential repetition forward.

$BTC often bottoms at 0.382 Fibonacci degree.

This occurred in Q3 2024, Q2 2025 and can in all probability occur once more.

For anybody questioning how low we are able to go, 0.382 Fibonacci degree is presently round $100K.

So the worst case state of affairs is a ten% drop earlier than a 50% rally above $150,000. pic.twitter.com/gdeLIe4RRF— ZYN (@Zynweb3) September 7, 2025

Present market weak spot has confined Bitcoin throughout the $113K-$107K vary, suggesting attainable additional decline towards the 0.382 Fibonacci degree close to $100K.

However, Bitcoin maintains long-term bullish prospects, with typical 10% corrections typically previous 50% advances that might drive Bitcoin previous $125K towards $150K throughout This fall.

Bitcoin Technical Evaluation: $114K Resistance Break Might Set off BTC Above $125K Breakout

Technically, the Bitcoin 4-hour chart reveals the value has bounced strongly from the correction zone round $108,000, forming a bullish engulfing construction that alerts renewed shopping for momentum.

The present transfer suggests a push towards speedy resistance close to $114,000, which would be the first check for bulls to substantiate energy.

If Bitcoin manages to interrupt and maintain above this degree, the chart initiatives an prolonged transfer towards key resistance at $120,000, marking the higher boundary of the present bullish construction.

Nevertheless, failure to clear $114,000 would threat one other pullback, doubtlessly retesting the correction zone.

The publish Companies Purchase 1,755 Bitcoin Day by day, Including $1.3 Trillion in 20 Months – BTC Above $125K Subsequent? appeared first on Cryptonews.