The previous week or so has gone with none main fireworks in both path, in contrast to the occasions from the earlier one, and BTC stays caught at round $84,000.

Nevertheless, the cryptocurrency doesn’t have a tendency to remain regular for lengthy, so this might be merely the calm earlier than the storm.

Whale Exercise Warning

As we’ve defined quite a few instances up to now, whales play a extremely necessary position within the cryptocurrency market as they management a big portion of BTC and most altcoins. Their choices on whether or not to purchase massive parts or promote them might change into a domino impact and result in substantial worth actions in both path.

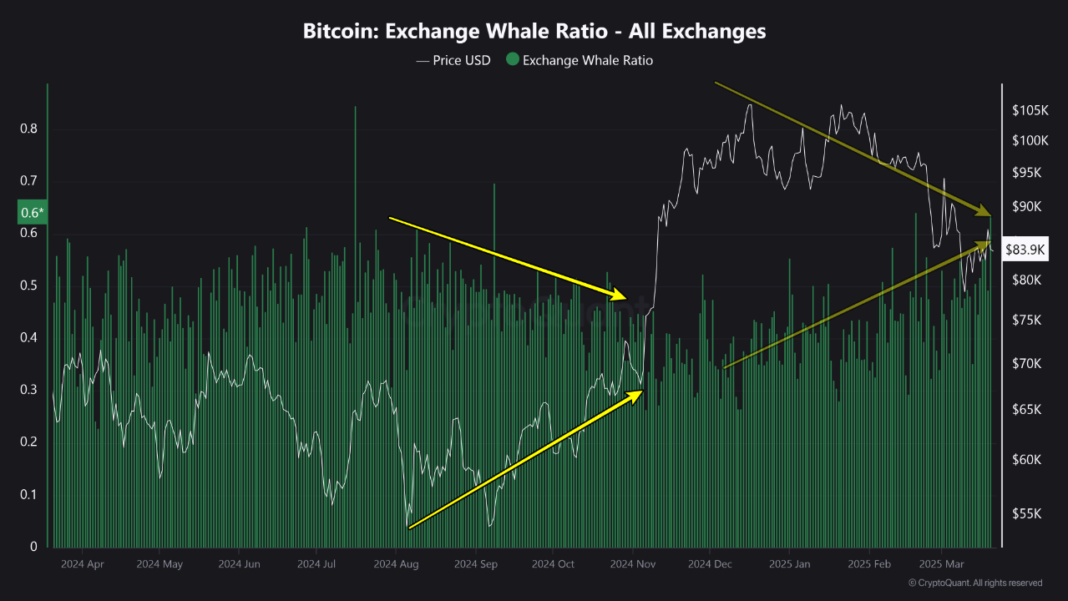

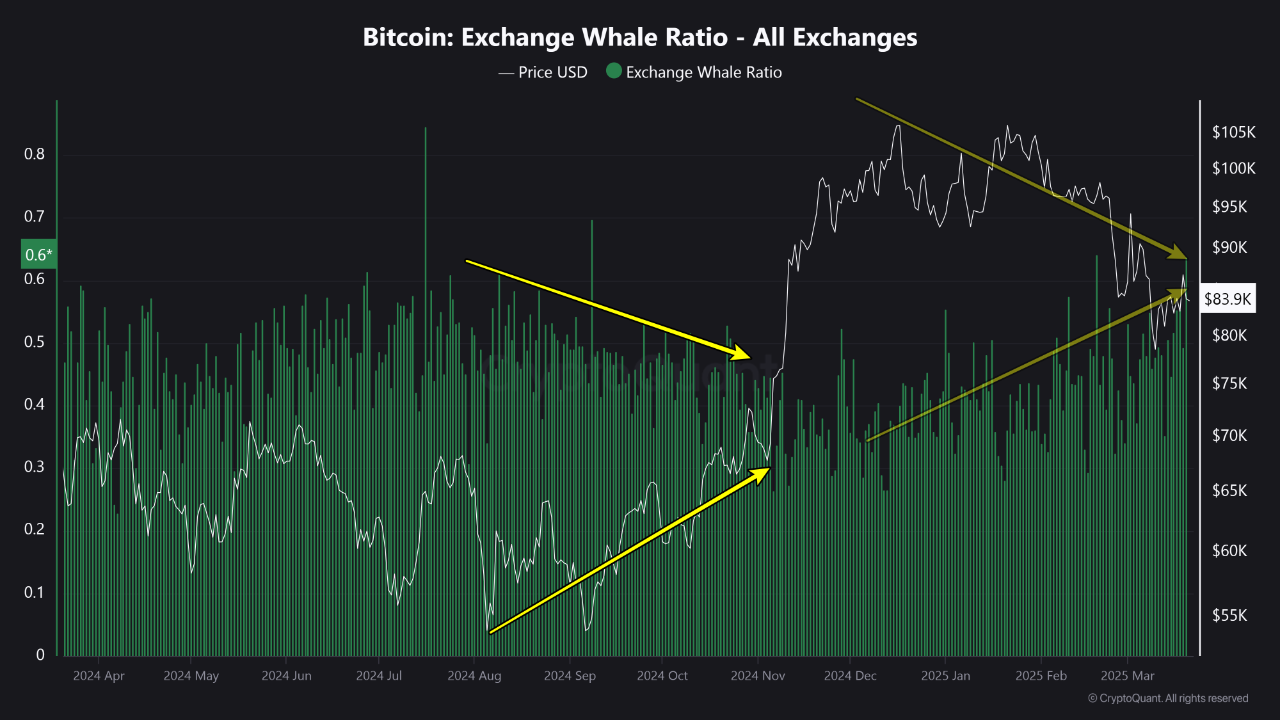

Information from CryptoQuant reveals some warning indicators with regard to bitcoin on that entrance. The BTC Change Whale Ratio, a metric calculated because the ratio of the highest 10 inflows to the whole inflows on crypto buying and selling platforms, has gone into “ranges not seen since final yr.”

The corporate’s evaluation suggests {that a} “substantial portion of Bitcoin deposits” into exchanges is “being pushed by giant holders or whales.” Consequently, the report indicated that this conduct is “typically interpreted as these massive gamers actively reallocating their property, doubtlessly signaling forthcoming promoting strain available in the market.”

STHs Underwater

The opposite considerably worrying information on the BTC worth entrance is the rising variety of Quick-Time period Holders (STHs) which can be sitting on substantial unrealized losses. Glassnode asserted that this cohort of traders has holdings price $7 billion, that are underwater.

That is the biggest sustained loss occasion of this cycle. Nevertheless, it stays inside “historic bull market bounds” and remains to be much less painful than these seen in the course of the Might 2021 sell-off. Throughout the finish of that bull cycle 4 years in the past and within the subsequent bear market, these losses skyrocketed to someplace between $19.8 billion and $20.7 billion.

STHs are usually the primary to exit the market when costs have a tendency to go south or stay in a consolidation section for some time, particularly when they’re underwater. As such, BTC might plunge additional in the event that they determine to get rid of some (or all) of their bitcoin holdings.

SPECIAL OFFER (Sponsored) Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this hyperlink to register and open a $500 FREE place on any coin!