Bitcoin spot exchange-traded funds (ETFs) noticed its second-highest file every day inflows of $1.18 billion on July 10, per Sosovalue information.

The numerous institutional exercise within the type of ETF inflows has pushed the token’s worth to a contemporary file of $116,664 on Thursday. Bitcoin is at the moment buying and selling at $118,140 at press time, briefly surpassing $118,450.

Moreover, the BTC spot ETFs have surpassed $51 billion in cumulative complete web inflows, marking the primary time and highlighting constant investor urge for food.

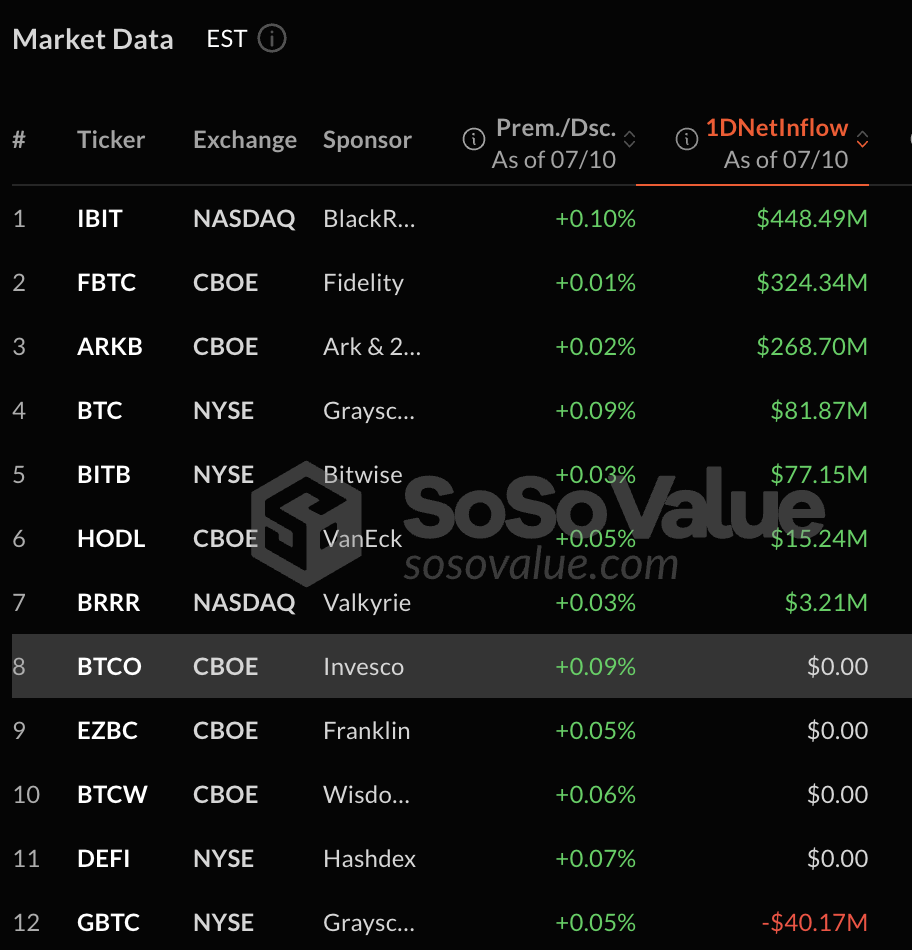

On Thursday, seven out of 12 Bitcoin funds reported web inflows, led by $448.49 million transferring into BlackRock’s IBIT. Following IBIT, Constancy dominates the move leaderboard with its Bitcoin fund (FBTC) witnessing $324.34 million constructive flows.

Ethereum Spot ETFs see $383M Complete Web Inflows, Alerts Sturdy Conviction

Ethereum spot ETFs additionally noticed a complete web influx of $383 million, marking the second-highest file. Ether ETFs have $5.10 billion in cumulative web inflows to date.

Fueled by ETF demand, Ether is up 8% with a clear push past $3,000. “It’s displaying extra power than Bitcoin this week, with contemporary institutional flows and BlackRock’s ETH ETF hitting file volumes,” wrote Rachael Lucas, crypto analyst at BTC Markets. Ether is at the moment buying and selling at $3,014 on the time of writing.

Ethereum’s up 7% with a clear push to US$3,000. It’s displaying extra power than Bitcoin this week, with contemporary institutional flows and BlackRock’s ETH ETF hitting file volumes. ETH maxis, benefit from the second.

— Rachael (@Rachael_M_Lucas) July 11, 2025

The Ether spot ETF every day web inflows of $300.93 million on July 10 is led by BlackShares iShares Ethereum Belief (ETHA), adopted by Grayscale’s ETHE fund.

Additional, ETHA noticed vital investor curiosity with over $1.2 billion collected since June, indicating bullish market sentiment.

Lucas famous that the optimism marks a “defining second” in each cryptos’ institutionalization.

“What we’re seeing shouldn’t be a retail-driven frenzy, however a gradual pipeline of capital from asset managers, company treasuries, and wealth platforms lastly entering into the market. Weeks of constant inflows verify that,” she added.

The submit Bitcoin Spot ETFs See $1.18B in Every day Inflows – Second-Highest Ever appeared first on Cryptonews.