Bitcoin steadied on Monday after a pointy weekend decline that pushed the world’s largest cryptocurrency to new native lows close to $93,000, in line with a Nov. 17 analysis be aware from Laser Digital’s Derivatives Buying and selling Desk.

The transfer decrease occurred with out an apparent catalyst, and with fairness markets opening modestly stronger on Monday, spot costs rapidly retraced again towards Friday’s shut.

Bitcoin plunges to $93,000 as Crypto Worry Index hits 10, lowest since July 2022, with $617M liquidated amid charge reduce uncertainty.#Bitcoin #RateCuthttps://t.co/uffTcVoV4Z

— Cryptonews.com (@cryptonews) November 17, 2025

Laser Digital, a part of the Nomura Group, stated the cooling of spot-driven promoting stress has given the market “some room to stabilise” after a unstable few periods. Nonetheless, derivatives positioning suggests the market stays fragile, and the subsequent main transfer might rely on whether or not bitcoin can reclaim key ranges within the days forward.

Perp Promoting Drove the Transfer; Brief Squeeze Setup in Play

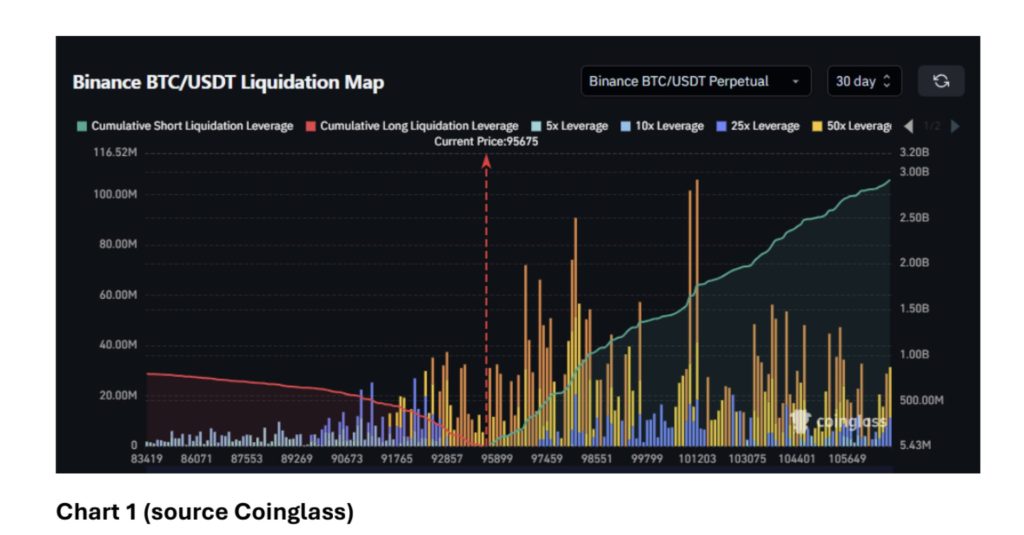

The desk highlighted {that a} “first rate quantity” of open curiosity was added throughout the selloff, pointing to perp-led stress fairly than spot liquidation as the first driver. That dynamic is seen within the liquidation heatmap, which reveals a heavy focus of short-side leverage at present ranges—creating circumstances ripe for a squeeze ought to costs push greater.

Chart 1 (Coinglass) illustrates this asymmetry clearly: cumulative short-side liquidation leverage continues to construct, whereas long-side leverage thins out above spot. In accordance with Laser Digital, “a sustained transfer again above 98.5k can be an vital affirmation for bulls and will set off significant brief protecting.”

Buying and selling volumes stay elevated, although barely under earlier highs, whereas threat reversals proceed to lean towards places. The choices time period construction additionally stays steep, reinforcing the defensive positioning that has characterised crypto markets via November.

Given this backdrop, Laser Digital stated merchants trying to specific a bullish view might discover the cleanest expression within the choices market. “Proudly owning front-end topside optionality is probably going a cleaner expression,” the desk wrote, noting that short-dated gamma might carry out nicely if compelled liquidations speed up, and that decision choices proceed to commerce at a relative low cost beneath present skew.

Macro Image Clouded by U.S. Information Delays

Past crypto-specific flows, the macro outlook stays unsure. The U.S. authorities shutdown has disrupted a number of official knowledge releases, together with the carefully watched nonfarm payrolls (NFP) and consumer-price index (CPI) reviews. The Bureau of Labor Statistics “has but to supply clear steering” on the timing of up to date releases, Laser Digital famous, leaving the market to function with incomplete data.

Broader sentiment took a flip after Meta’s Oct. 29 earnings, which strengthened investor considerations that AI-related capital expenditure might shift from being a progress engine to a possible drag on know-how margins. That shift has weighed on threat urge for food throughout equities and digital belongings.

This week brings one main catalyst: Nvidia’s earnings, due Wednesday. With the chipmaker more and more considered as a barometer for AI spending and enterprise know-how demand, Laser Digital stated the outcomes are prone to “form the subsequent transfer in macro,” with knock-on results for bitcoin’s momentum and volatility.

For now, merchants are watching whether or not bitcoin can reclaim the $98.5k stage and take up the build-up of leveraged shorts. If that’s the case, the setup described by Laser Digital implies that the subsequent important transfer may very well be sharply greater—not as a result of fundamentals have shifted, however as a result of positioning leaves bearish merchants susceptible.

The put up Bitcoin Rebounds After Weekend Selloff as Laser Digital Flags Brief-Squeeze Threat appeared first on Cryptonews.