Bitcoin (BTC/USD) is as soon as once more testing investor conviction because it trades close to $111,700, consolidating after a pointy 16% correction from latest highs. But in response to ARK Make investments’s Q3 2025 Bitcoin Quarterly, the inspiration beneath the market stays resilient, with bullish fundamentals, deep institutional involvement, and a macro backdrop that might set the stage for renewed upside into year-end.

Bitcoin Fundamentals Keep Sturdy Regardless of Volatility

ARK notes that Bitcoin closed Q3 2025 at $114,065, ending the quarter above its short-term holder price foundation of $111,933, a traditionally essential bullish threshold.

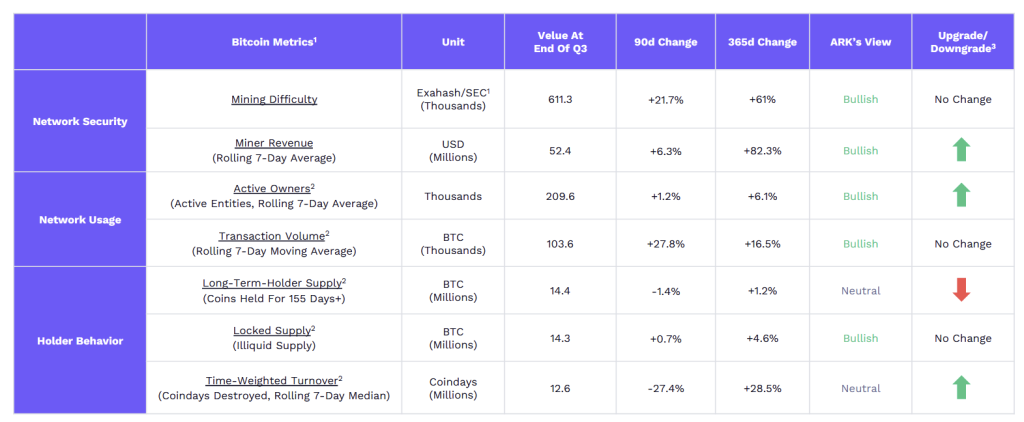

The community stays structurally sound:

- Mining issue rose 21.7% in Q3 and 61% year-on-year, reaching 611 EH/s, signaling record-high community safety.

- Miner income climbed 6.3% throughout the quarter to $52.4 million per day, up 82% year-over-year, confirming profitability restoration for the reason that halving.

- Transaction quantity surged 27.8% quarter-on-quarter to 103,600 BTC per day, whereas energetic entities elevated 6.1% YoY, proof of constant demand and utilization.

- Illiquid provide (cash unlikely to maneuver) reached 14.3 million BTC, up 4.6% YoY, suggesting rising conviction amongst holders.

Even after the newest pullback, 94.5% of provide stays in revenue, indicating that the majority holders aren’t underwater, a bullish on-chain construction hardly ever seen exterior mid-cycle consolidations.

Importantly, ARK highlights that Bitcoin’s “provide density” sits close to 30%, the best since 2020, that means a big share of cash final moved inside 15% of the present value. Such clustering usually precedes heightened volatility, setting the stage for sharp directional strikes as soon as sentiment shifts.

Institutional and ETF Demand Anchors the Market

Institutional involvement continues to broaden quickly. In response to ARK’s knowledge:

- Public corporations’ digital-asset treasuries (DATs) boosted holdings by 40% in 2025, reaching 1.1 million BTC or 5.6% of whole provide.

- U.S. spot Bitcoin ETFs now management 1.3 million BTC (6.6% of provide), a file excessive. Notably, each historic peak in ETF balances has preceded a brand new cycle value excessive.

- Mixed, ETFs and DATs maintain 12.2% of all Bitcoin, underscoring how institutional accumulation is tightening obtainable provide.

In the meantime, derivatives knowledge present a wholesome however not overheated market. Perpetual funding charges stand close to 2.1% and the three-month futures foundation is round 7.6%, far under the 43% and 17% extremes seen on the 2021 peak, proof that leverage stays contained and speculative extra is restricted.

Macro Tendencies: Inflation Eases, Productiveness Rises

ARK’s macro staff expects that fading inflation and weakening labor momentum will push the Federal Reserve towards a dovish stance. The U.S. labor differential has turned adverse for the primary time since 2020, the quits price has fallen to 1.9%, and common unemployment period has prolonged to 24.5 weeks.

Whereas labor softens, value pressures are muted: Truflation’s CPI exhibits a sub-3% year-on-year development, effectively under official readings. With tariffs having minimal inflation influence, ARK believes the Fed’s focus will pivot from inflation to employment, easing monetary situations, a backdrop traditionally favorable for Bitcoin.

Furthermore, deregulation and tax-driven funding incentives underneath the “One Huge Lovely Invoice” (OBBB) are anticipated to unleash a productiveness growth, with everlasting expensing for R&D, software program, and gear anticipated to elevate actual GDP development in 2026.

Such structural development, ARK argues, aligns with Bitcoin’s attraction as a technological and financial hedge. Expertise and new concepts. Due to this fact, Bitcoin may benefit as buyers seek for higher alternatives.

Bitcoin (BTC/USD) Technical Outlook: Bulls Defend $108K Help

From a technical lens, Bitcoin stays range-bound however secure. The $108,000–$110,000 zone aligns with the 200-day transferring common and on-chain imply assist at $104,772. The RSI (40.6) indicators gentle oversold situations, whereas contracting MACD histograms counsel waning bearish stress.

If BTC breaks above $117,000, it may set off a short-term rally towards $124,000–$126,000, retesting earlier highs. Failure to defend $108,000 could expose $103,000 and $98,200, in keeping with the 50% Fibonacci retracement from June’s rally.

For swing merchants, ARK’s data-supported construction factors to a buy-the-dip alternative close to $108K, with tight danger under $107.5K and targets close to $124K–$126K.

Outlook: Positioned for Progress, Poised for Volatility

ARK concludes that whereas Bitcoin’s cyclical timing suggests late-stage bull-market situations (about 18 months post-halving), structural fundamentals stay extremely constructive.

Community safety, institutional absorption, and moderating macro pressures present a sturdy ground, although elevated provide density warns of volatility spikes forward.

In brief: Bitcoin could wobble earlier than it surges, however its long-term trajectory stays upward, fueled by file institutional possession, tightening provide, and enhancing macro liquidity. As 2025 attracts to an in depth, the subsequent important transfer may outline the opening narrative for 2026.

Presale Bitcoin Hyper ($HYPER) Combines BTC Safety With Solana Velocity

Bitcoin Hyper ($HYPER) is positioning itself as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM). Its objective is to broaden the BTC ecosystem by enabling lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched safety with Solana’s high-performance framework, the undertaking opens the door to thoroughly new use instances, together with seamless BTC bridging and scalable dApp growth.

The staff has put robust emphasis on belief and scalability, with the undertaking audited by Seek the advice of to provide buyers confidence in its foundations.

Momentum is constructing rapidly. The presale has already crossed $23 million, leaving solely a restricted allocation nonetheless obtainable. At at this time’s stage, HYPER tokens are priced at simply $0.013095—however that determine will improve because the presale progresses.

You should buy HYPER tokens on the official Bitcoin Hyper web site utilizing crypto or a financial institution card.

Click on Right here to Take part within the Presale

The publish Bitcoin Value Prediction: What Onchain Indicators Recommend for BTC Value Route – Up or Down? appeared first on Cryptonews.