The Bitcoin value is buying and selling at round $111,000 after gaining assist close to the $109,500 mark. On the basics entrance, World authorities bond markets are beneath strain, with yields rising throughout the US, Europe, Japan, and the UK. The US 30-year Treasury is testing 5%, French lengthy bonds are above 4% for the primary time since 2011, and UK gilts are at 27-year highs.

In Japan, the 30-year yield has reached document ranges, sparking warnings of a “collapse in G7 bond markets,” based on The Kobeissi Letter.

This dramatic rise in yields displays a mixture of inflationary issues, hovering debt ranges, and provide pressures. For Bitcoin, the implications are far-reaching. Traditionally, BTC has acted as each a danger asset and a hedge relying on the drivers behind yield spikes.

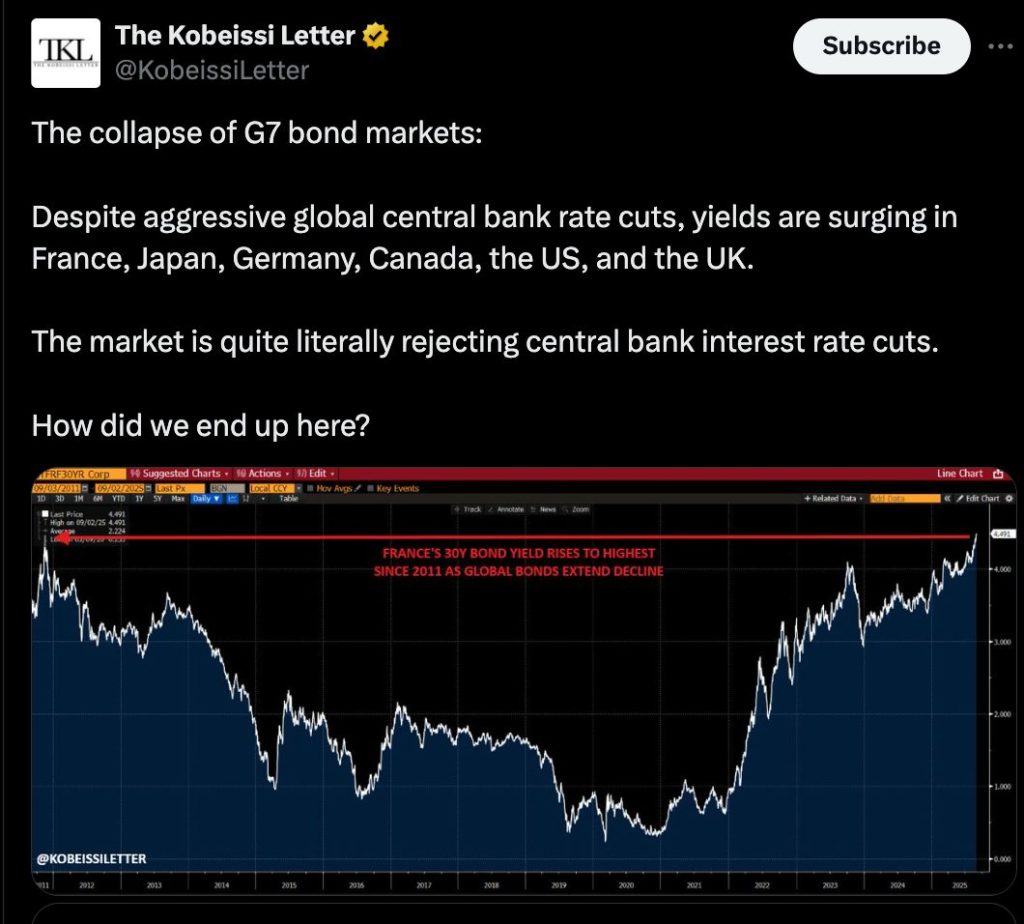

The collapse of G7 bond markets:

Regardless of aggressive international central financial institution charge cuts, yields are surging in France, Japan, Germany, Canada, the US, and the UK.

The market is kind of actually rejecting central financial institution rate of interest cuts.

How did we find yourself right here? https://t.co/cA7UCGuokD pic.twitter.com/0CndO3fQ5l— The Kobeissi Letter (@KobeissiLetter) September 2, 2025

Bitcoin’s Historic Playbook

Previous yield surges supply clues. Throughout the 2013 taper tantrum, Bitcoin’s worth surged from beneath $100 to over $1,000 as buyers fled authorities debt. The same sample emerged in 2021, when yields rose amid inflation fears and Bitcoin surged to $65,000.

Nevertheless, the story differs when central banks drive yields increased by way of aggressive tightening. In 2018, rising actual bond returns drew capital away from Bitcoin, inflicting its worth to fall by greater than 80%.

The present cycle seems nearer to 2013 and 2021. U.S. debt has ballooned by greater than $1 trillion in simply two months, reaching $37.3 trillion. On the similar time, Glassnode knowledge exhibits Bitcoin’s holder retention charge climbing, signaling confidence in BTC as a hedge in opposition to forex debasement.

- U.S. debt rose to $37.3 trillion in September, up from $36.2 trillion in July.

- Bitcoin gained 4.2% over the previous three days, mirroring the most recent surge within the bond market.

- Holder retention charges level to a stronger “HODL” development amongst long-term buyers.

Bitcoin (BTC/USD) Brief-Time period Technical Evaluation

Bitcoin has damaged free from its descending channel, gaining momentum after weeks of sideways buying and selling. At present close to $110,819, BTC is consolidating above its pivot at $110,181. The 50-EMA now serves as assist, whereas the 200-EMA at $112,663 is the speedy ceiling to look at.

Momentum is bettering, with the RSI at 56, indicating renewed demand with out overextension. A decisive transfer above $112,600 might gas rallies towards $115,600 and $117,500. On the draw back, helps are positioned at $107,407 and $105,215, providing merchants outlined danger ranges.

Bitcoin (BTC/USD) Lengthy-Time period Technical Outlook

The larger image is bullish inside Bitcoin’s rising channel from the 2022 lows. Value is consolidating at $110,587, the 50-week SMA is at $95,922 and powerful assist.

The RSI is 62, leaving room to run. If BTC breaks $134,487, Fibonacci extensions challenge to $171,055 and $231,241, with a stretch aim at $290,000.

Key long-term assist is at $104,379, $89,096 and $74,732. So long as Bitcoin is above $95,000 the supercycle construction stays intact and we will see six determine milestones.

Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Safety With Solana Pace

Bitcoin Hyper ($HYPER) is positioning itself as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM). Its aim is to broaden the Bitcoin ecosystem by enabling lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation.

By combining Bitcoin’s unmatched safety with Solana’s high-performance framework, the challenge opens the door to completely new use instances, together with seamless BTC bridging and scalable dApp growth.

The workforce has put robust emphasis on belief and scalability, with the challenge audited by Seek the advice of to offer buyers confidence in its foundations.

Momentum is constructing shortly. The presale has already crossed $13.7 million, leaving solely a restricted allocation nonetheless obtainable. At right now’s stage, HYPER tokens are priced at simply $0.012855—however that determine will enhance because the presale progresses.

You should buy HYPER tokens on the official Bitcoin Hyper web site utilizing crypto or a financial institution card.

Click on Right here to Take part within the Presale

The publish Bitcoin Value Prediction: World Bond Markets Are Collapsing – Is $150K BTC Now a Matter of When, Not If? appeared first on Cryptonews.