Bitcoin is attempting to stabilise after a pointy $4,000 sell-off on December 17, buying and selling close to $87,000. The rapid query for market members is simple: can BTC get well sufficient floor to reclaim $90,000 earlier than Christmas, or has the current drop shifted momentum decisively decrease?

The timing issues. Markets are coming into a interval of thinner liquidity, and US CPI knowledge due at present might decide whether or not threat urge for food stabilises or fades additional. With inflation expectations shaping interest-rate outlooks, Bitcoin is responding much less to crypto-specific developments and extra to macro indicators.

Sentiment Weakens as Threat Urge for food Fades

Investor positioning has turned defensive following final week’s decline. The Crypto Worry and Greed Index has fallen to 22, inserting sentiment firmly in worry territory. This displays decreased risk-taking somewhat than pressured promoting, with merchants scaling again publicity whereas ready for clearer affirmation.

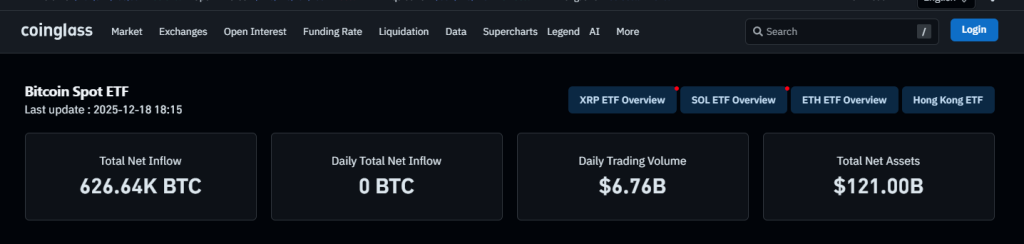

ETF exercise helps this view. US spot Bitcoin ETFs recorded a web influx of roughly 5,210 BTC on December 17, in response to CoinGlass knowledge. Nonetheless, inflows stalled in subsequent classes. Whereas cumulative web inflows stay substantial at round 626,600 BTC, the shortage of constant every day additions factors to hesitation somewhat than renewed demand.

Buying and selling exercise additionally stays contained. Every day spot ETF buying and selling quantity stood close to $6.76 billion, with complete web belongings holding near $121 billion, indicating stability however restricted urge for food for aggressive positioning.

Fundamentals Maintain, however Macro Units the Tempo; US CPI In Focus

Bitcoin’s longer-term fundamentals stay intact. Circulating provide stands close to 19.96 million BTC, persevering with its gradual transfer towards the mounted 21 million coin cap. Community safety stays secure, and whereas institutional exercise has slowed, there isn’t a signal of a broad exit from the market.

Within the close to time period, macro circumstances are driving value motion. Markets are centered on US CPI knowledge due at 13:30 UTC, which carries added weight after October’s report was cancelled and November knowledge have been partially incomplete because of the federal authorities shutdown.

In accordance with the US Bureau of Labor Statistics, the latest full knowledge confirmed headline CPI at 3.0% 12 months on 12 months, with core inflation slowing to three.0%.

Consensus forecasts now level to headline CPI at 3.1% and core inflation at 3.0%, each above the Federal Reserve’s 2% goal.

With every day Bitcoin buying and selling quantity close to 44 billion {dollars}, participation seems regular however cautious. A stronger CPI studying might weigh on threat belongings, whereas a softer print might give Bitcoin room to stabilise.

Bear Flag Breakdown Retains Stress On

Technically, Bitcoin stays beneath stress. The every day chart confirms a bear flag breakdown, signaling continuation of the prior downtrend somewhat than a pause. BTC is buying and selling under the 50-day EMA close to $94,500 and the 100-day EMA round $100,100, each of which proceed to cap upside makes an attempt.

Momentum indicators align with this view. The RSI within the low-40s exhibits persistent bearish stress with out reaching oversold ranges. Current candles mirror weak follow-through on rallies, suggesting consumers are hesitant forward of macro threat.

Key assist sits within the $85,000–$84,000 zone. A every day shut under this space would expose $80,600. On the upside, Bitcoin must reclaim $90,200 decisively to problem the bearish construction.

Bitcoin Value Prediction Forward of Christmas

Within the close to time period, Bitcoin’s path hinges on US CPI and follow-through value motion. A transfer above $90,000 earlier than Christmas is feasible, however it possible requires a softer inflation print and a fast reclaim of damaged assist. With out that, rallies might battle and stay susceptible to promoting stress.

For now, Bitcoin seems caught between macro uncertainty and technical resistance. Whether or not the following transfer is a restoration towards $96,800 or a deeper check towards $80,000 will rely much less on sentiment and extra on how markets digest inflation knowledge and threat heading into year-end.

Whereas Bitcoin reacts to macro stress, some traders are additionally watching early-stage crypto initiatives nearing crucial presale deadlines.

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Shut

PEPENODE is gaining momentum as a next-generation meme coin that blends viral tradition with interactive gameplay. With over $2.36 mn raised and the presale approaching its cap, curiosity is constructing quick because the countdown enters its remaining stretch.

What makes PEPENODE stand out is its mine-to-earn digital ecosystem. As an alternative of passive holding, customers can construct digital server rooms utilizing Miner Nodes and services, incomes simulated rewards via a visible dashboard. The idea brings gamification and competitors into the meme coin house, giving holders one thing to do earlier than launch.

The challenge additionally affords presale staking, permitting early members to earn boosted rewards forward of the token technology occasion. Leaderboards and bonus incentives are deliberate post-launch to maintain engagement excessive.

With 1 $PEPENODE priced at $0.0012016 and restricted allocation remaining, the presale is coming into its remaining alternative window for early consumers.

Click on Right here to Take part within the Presale

The publish Bitcoin Value Prediction: Can the BTC Value Push Above $90,000 Earlier than Christmas After the $4K Dump on Dec.17? appeared first on Cryptonews.