Bitcoin is holding at $107,911 down 1.10% within the final 24 hours with $46.17B in buying and selling quantity. As we head into the Memorial Day weekend all eyes are on whether or not decreased liquidity will result in massive strikes to $115,000.

Bitcoin ETF Inflows Sign Renewed Institutional Confidence

Spot Bitcoin ETFs noticed important inflows between Could 17 and Could 23, totaling $2.75 billion, a 4.5× improve from the earlier week, in keeping with Farside Buyers. BlackRock’s iShares Bitcoin Belief (IBIT) stood out, persevering with its eight-day streak of inflows.

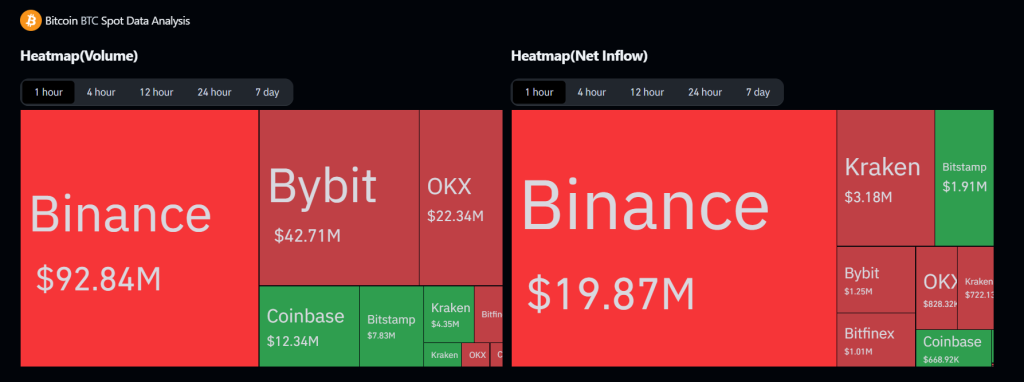

Supporting this, Coinglass information reveals heightened spot alternate exercise. On Could 23, the BTC spot alternate web influx heatmap exhibits Binance main with $19.87 million in web inflows over a 1-hour window, whereas Bybit, OKX, Kraken, and Bitstamp noticed smaller inflows.

Spot alternate quantity heatmaps affirm Binance’s dominance with $92.84 million, adopted by Bybit’s $42.71 million.

Key highlights:

- Spot ETF inflows: $2.75B between Could 17–23; $5.39B whole for Could

- Spot alternate inflows: Binance $19.87M web influx, Bitstamp $1.91M

- Change quantity: Binance $92.84M, Bybit $42.71M, OKX $22.34M

This information aligns with Bitcoin’s current rally to $111,970 on Could 22 and suggests renewed institutional and exchange-driven curiosity. The Crypto Worry & Greed Index cooled from 78 (“Excessive Greed”) to 66 (“Greed”), reflecting a slight pullback in sentiment.

Bitcoin Technical Evaluation: Key Ranges for the Weekend

On the two hour chart Bitcoin is testing helps because it’s under the 50 interval EMA at $108,315. Value is urgent towards the ascending trendline at $107,000 and the Fibonacci retracement ranges from the $102,190 low to the $111,958 excessive have $107,074 as a key pivot.

- Helps: $107,074, $105,905, $104,289

- Resistance: $108,315, $109,637

- Indicators: Bearish MACD crossover, indecision candles, trendline strain

If BTC goes under $107,000 count on drops to $105,905 or $104,289. But when it goes above $108,315 it may regain bullish momentum and goal $109,637 and above.

Therefore, Bitcoin value prediction stays bearish below $107,.000 and vice versa.

Will Skinny Liquidity Trigger a Weekend Spike?

With the lengthy weekend forward decreased liquidity will amplify value actions. If ETF inflows proceed and technicals get better BTC may go to $115,000. But when indecision and low quantity persists BTC may transfer massive in both route.

BTC Bull Token Nears $7.33M Cap as 65% APY Staking Attracts Curiosity

With BTC/USD falling under $108,000, consideration is shifting to altcoins like BTC Bull Token ($BTCBULL). To this point, $6.33 million has been raised out of a $7.33 million cap. The presale is closing in on its restrict, subsequent presale value leap closes in quick.

Bitcoin Rewards and Provide Reductions

BTC Bull Token operates with a built-in system: the upper Bitcoin’s value, the extra BTC airdrops are distributed to token holders. Notably, presale members obtain precedence. The system additionally options:

- Token burns each $50K BTC improve, decreasing provide.

- Present token value at $0.00253 earlier than the subsequent bump.

This method aligns token worth with Bitcoin’s value strikes whereas sustaining shortage by programmed burns.

Staking Phrases for Passive Returns

BTCBULL’s staking pool holds 1.62 billion tokens providing 65% APY, with:

- No lockup durations or charges.

- Full entry to funds at any time.

This construction appeals to holders on the lookout for yield with out complicated necessities or danger of illiquidity.

Momentum Earlier than the Cap Fills

With simply over $1 million remaining within the presale, patrons are positioning early. The token’s mechanics of Bitcoin-tied rewards, provide changes, and staking choices are driving participation.

Key figures:

- USDT raised: $6,329,314.26 / $7,332,195

- Token value: $0.00253

BTCBULL provides a whopping ~65% APY on its Ethereum-based staking pool (at present holding 1.61B BTCBULL), with no lockups or withdrawal charges. Which means passive yield — with full liquidity.

The put up Bitcoin Value Prediction: BTC at $107,911 After Huge Week — Will Decrease Quantity Drive Volatility to $115K? appeared first on Cryptonews.